If you’re struggling with poor credit or have no credit history at all, Arro is the perfect way to start building credit. Unlike traditional credit cards that require good credit for approval, Arro gives you the opportunity to establish or rebuild your credit without requiring a deposit or hard credit check.

How Does Credit Building Actually Work?

Credit Building VS. Secured Card

Why Credit Building Is Worth It

Who Can Benefit From Credit Building?

Who Can Benefit From Credit Building?

How To Get The Most From Your Credit Building?

Timeline: How Long Does It Take To Build Credit?

How To Choose The Right Credit Building Card

Build Credit The Smart Way With Arro

FAQs

What Exactly Is Credit Building? Credit building is all about creating or improving your credit history over time. Instead of focusing on perks and rewards, credit cards like Arro enable you to build a solid credit foundation. Instead of chasing points or cash-back rewards, its real value is in helping you build a strong credit foundation.

These cards are easier to qualify for than traditional credit cards and are made to help you prove your reliability. Each payment you make is reported to the three major credit bureaus,

such as Experian, Equifax, and TransUnion. Which means your good habits actually count toward improving your score.

In this article, we’ll break down how credit cards like Arro work, who they’re best for, and how they can help you build lasting credit habits. We’ll also touch on common questions like how many credit cards should I have and how many credit cards is too many, so you can make smart choices as you grow your credit.

Key Takeaways

Start building credit with credit cards like Arro, a no-deposit, no-hard-check option.

Use your card responsibly and keep spending under 30% and pay on time to improve your score.

Track your progress with tools like Arro’s free score monitoring.

Credit-building options are easier to qualify for and help you prove credit responsibility.

Good financial habits lead to better credit scores and more opportunities.

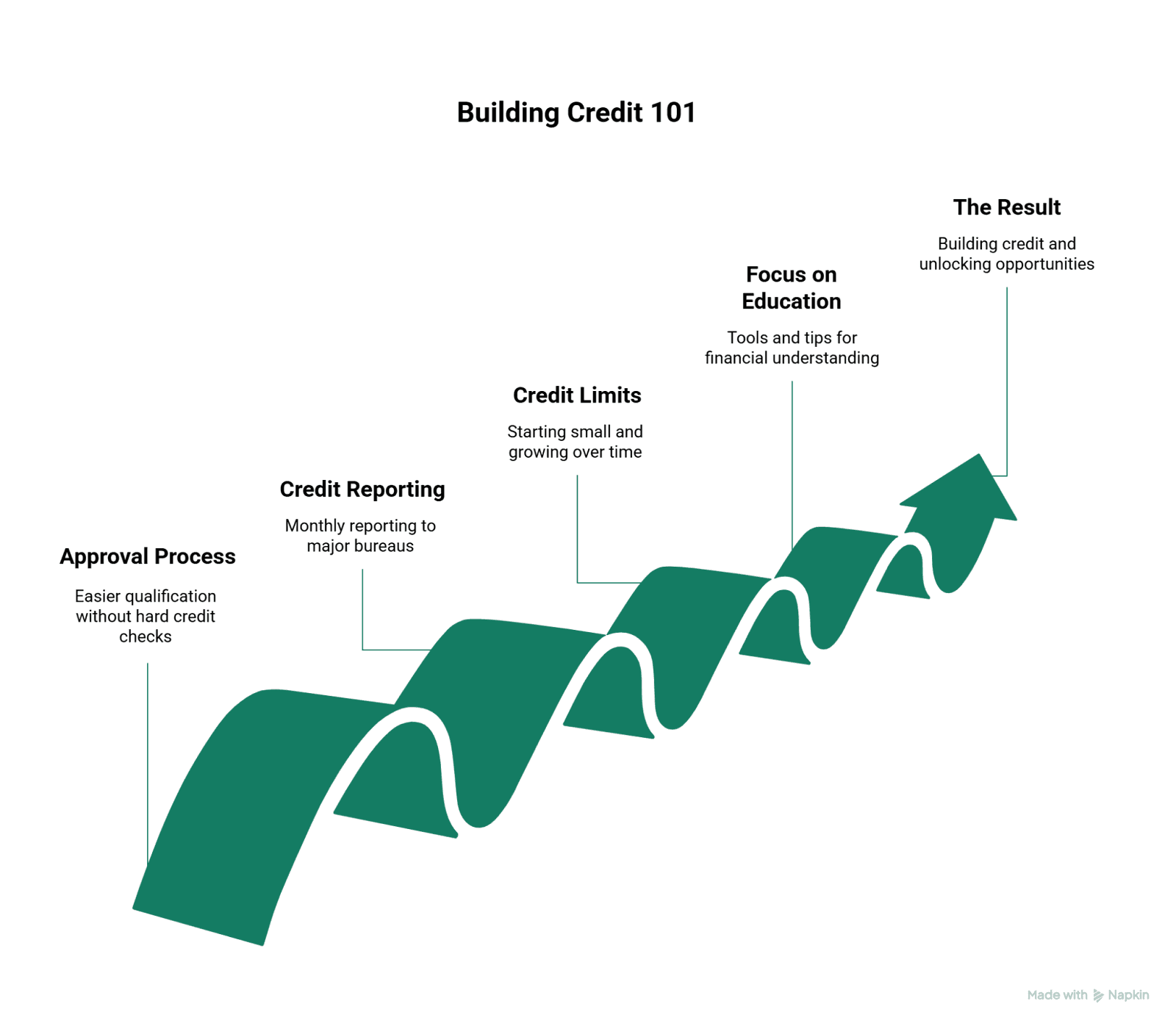

How Does Credit Building Actually Work?

Credit building works much like using a regular credit card. It’s designed for people who are just starting out or working to rebuild their credit. The goal is to help you show lenders that you can handle credit responsibly.

What can you expect when you start building credit?

Approval Process

Most credit-building options are easier to get approved for, and they often skip the hard credit check. This means even if your credit history isn’t perfect or you’re just getting started, you still have a good shot at approval.

Credit Limits

When you begin building credit, you'll usually start with a small limit, typically between $200 and $1,000. As long as you use your card responsibly and make payments on time, your limit can grow. It’s an easy way to show lenders that you’re reliable and building good financial habits.

Focus On Education

Many credit-building tools come with useful resources and tips to help you understand how credit works. These can make it easier to get a handle on your credit and manage it more effectively.

As you continue making steady progress, you’ll see the results. You’ll build a strong credit history and move closer to reaching your bigger financial goals.

Credit Building VS. Secured Card

Both types of cards can help you build credit, but they work a little differently. With a secured card, you need to put down a cash deposit, like $500, and that deposit becomes your credit limit. The deposit acts as the bank’s safety net, and you'll get it back when you close the account in good standing.

On the other hand, a credit-building card doesn’t require a deposit. Instead, lenders consider things like your income and spending habits. This makes it a good option for starting to build credit without tying up money you might need for day-to-day expenses.

To sum it up, a secured card relies on your cash as a backup, while a credit-building card lets you prove you can manage credit responsibly without needing to put up any money upfront.

Why Credit Building Is Worth It

A credit-building card can do more for you than you might expect. Your payment history and how much credit you use make up about 65% of your FICO score, so building good habits really sets you up for stronger credit in the long run.

No Deposit Needed

Unlike a secured card, credit cards like Arro don’t require you to lock up your money with a deposit. That means you can hang on to your cash for things that matter, like rent, bills, or savings, while still working on building your credit.

Helps You Build Credit History

Every time you pay on time, it gets reported to the credit bureaus. Those consistent payments help show lenders you’re dependable and serious about improving your credit.

Learn While You Build

Many credit-building cards come with simple tools and tips to help you understand how credit works. It’s a great way to learn as you go and get more confident with your finances.

Grows Over Time

When you use your card responsibly, your credit limit can go up. It’s proof that your good habits are paying off and that lenders trust you more.

Leads To Better Opportunities

As your credit improves, you’ll qualify for better cards, loans, and rates, saving you money and giving you more financial freedom.

With the right approach, credit building is about opening doors to better financial opportunities and a brighter future.

Who Can Benefit From Credit Building?

Whether you’re just starting out or trying to bounce back from some financial challenges, credit building is a great way to get your credit back on track. It gives you the chance to show you can handle credit responsibly.

Who might benefit most:

Students or young adults: It’s a simple way to start building credit and get a feel for managing it early in life.

Newcomers to the U.S.: If you’re new here, credit building helps you establish a credit history so you can qualify for things like an apartment or car loan.

People who’ve had financial setbacks: Whether it’s late payments or even bankruptcy, credit building helps you get back on your feet and show lenders you’ve learned from the past.

If your credit score isn’t great: This is your chance to rebuild, one on-time payment at a time.

No matter your starting point, credit cards like Arro give you the opportunity to build credit safely, learn as you go, and move closer to your financial goals.

How To Get The Most From Your Credit Building?

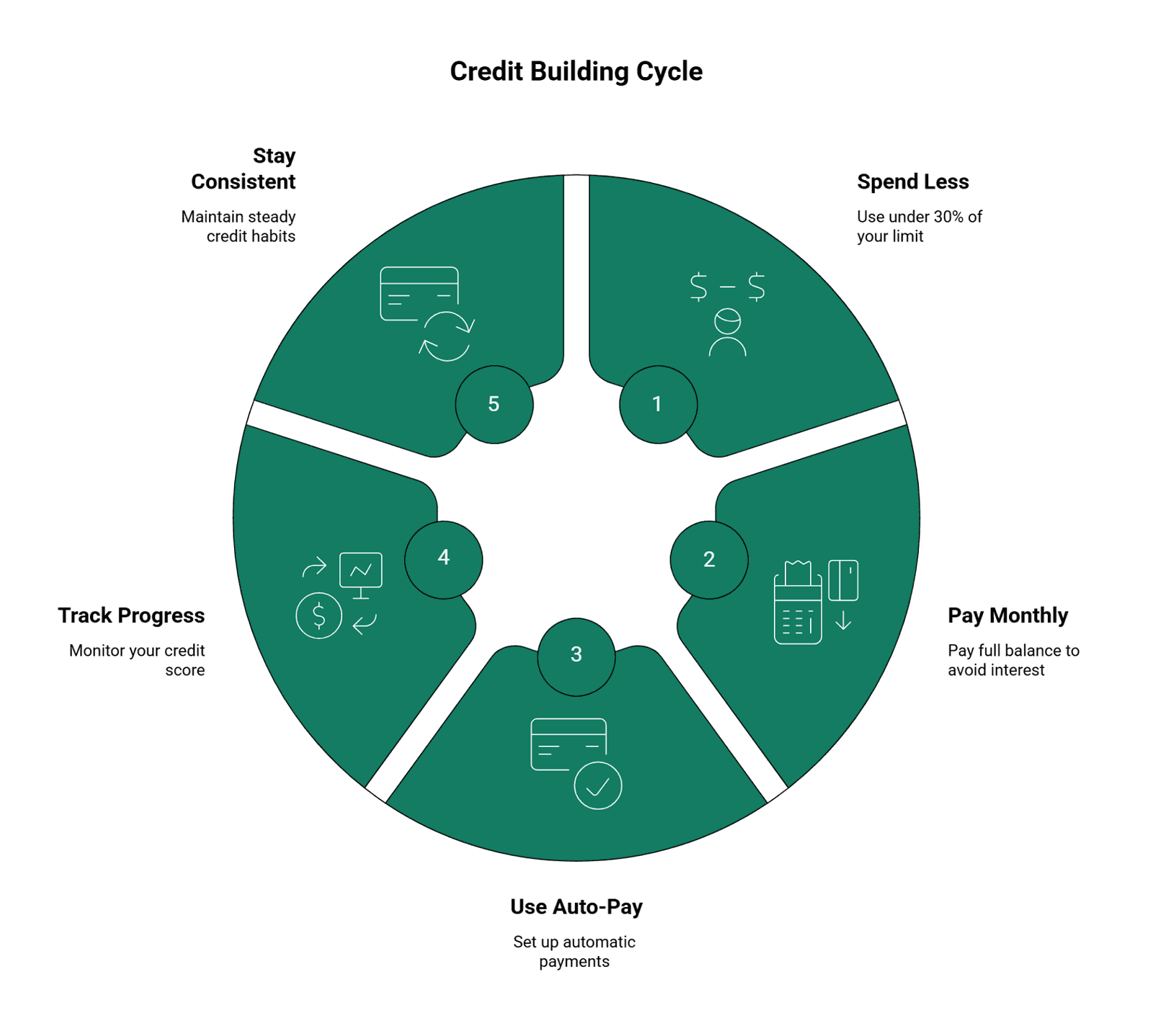

Getting approved is just the beginning. What really matters is how you use your card day to day.

1. Keep Your Spending Low

Try not to use too much of your card’s limit. Staying under about 30% is a good target, and keeping it closer to 10% is even better. People who use less of their available credit tend to have higher scores, it shows lenders you’re being smart and responsible with your money.

2. Pay Off What You Owe Each Month

Paying your balance in full by the due date shows lenders that you can manage credit responsibly. It also saves you from paying interest and keeps your score moving in the right direction.

3. Turn On Auto-Pay

Life gets busy sometimes, and missing a payment can hurt your score. Setting up automatic payments is an easy way to make sure you’re always on time. Since payment history is a big part of your credit score, it really matters.

4. Keep An Eye On Your Progress

Check your credit score regularly to see how you’re improving. Many credit cards like Arro, offer free score tracking, which can help you stay motivated and catch any errors early.

By following these habits, you can turn a small credit line from credit cards like Arro into a strong foundation for your financial future.

Also read:

Is it bad to pay your credit card early?

How to Build Credit Without a Credit Card: Steps to Get Started

Aim High: What an 800 Credit Score Means and How to Get There

Timeline: How Long Does It Take To Build Credit?

As long as you’re paying on time and keeping your balance low, you'll start to see small wins add up. Building credit takes time, but sticking with good habits each month will make a real difference.

What does the process usually look like?

Months 1–3

Your new account shows up on your credit report, and you start building a payment history.

Months 3–6

As you keep making payments on time, you might notice that your score begins to go up.

Months 6–12

With steady use and no missed payments, your score can improve even more, showing lenders you can actually be trusted.

After 12 Months

At this point, you may qualify for credit cards or loans with better rates and perks which is a clear sign that your consistency is paying off.

Keep at it. Good credit isn’t built in a day, but if you stay steady, the progress will come and it’ll be worth it.

How To Choose The Right Credit Building Card

Choosing the right card is the first step, but how you use it is just as important. The best card for you will make it easy to keep track of payments.

Here’s what to look for and what to avoid:

What To Look For?

Low or No Fees: You shouldn’t have to pay a lot just to build your credit.

Reports To All Three Bureaus: Make sure the card reports to Experian, Equifax, and TransUnion. That's how your score actually grows.

Fair Interest Rates: Look for something manageable, so you’re not losing money while trying to build credit.

Room To Grow: Choose a card that can increase your credit limit as you build a positive history.

Helpful Tools And Guidance: Some cards, like Arro, offer credit tips and progress tracking to help you stay on course

Good Customer Support: A straightforward app and a quick-to-respond team can really help when questions pop up.

Picking a card with these features gives you a solid start. It makes building credit easier and helps you stay confident along the way.

Mistakes To Avoid

Missing Payments: Even one late payment will harm your progress, so set up auto-pay and make sure you never miss one.

Using Too Much Credit: Holding your credit under 30% of your limit will show you’re in control

Closing Your Card Too Soon: Maintaining your account is essential for building a longer and stronger credit history

Not Checking Your Progress: Review your credit report every now and then and make sure everything’s accurate.

Stay consistent, be patient, and before long, you’ll start seeing real results. The right card and a few good habits can go a long way.

Build Credit The Smart Way With Arro

A credit-building card is one of the easiest ways to take control of your credit and start moving in the right direction. When you use it the right way, cards like Arro help you build good habits, improve your score, and open the door to better financial opportunities.

At Arro, we’ve made building credit simple. There’s no hard credit check, no deposit, and you’ll even earn 1% cash back on gas and groceries. Everything you need to track your progress and learn how credit works is built right into the app.

You’ll also have Artie, your personal AI Money Coach, to help you along the way: answering questions, celebrating wins, and keeping you on track. Every payment and every small step adds up, helping you unlock higher limits and a stronger credit score.

Thousands of people are already building better credit with Arro and you can too.

Download the Arro app today and start building credit with confidence

FAQs

1. How long should I keep a credit-building card before upgrading to a traditional card?

You’ll want to keep your credit-building card open for at least a year. This gives you enough time to build a solid payment history and form good habits. Even after qualifying for a traditional card, keeping your first account open will help maintain your credit age and support your overall credit score.

2. Will using a credit-building card hurt my credit score?

Using your card responsibly won’t hurt your score. In fact, it’s a good idea to make small purchases each month and pay them off on time. This shows lenders you can manage credit. But if you stop using your card altogether, it could slow down progress, so it’s important to keep it active.

3. What happens if I stop using my credit-building card?

If your card goes unused for a while, the lender might close the account. This can shorten your credit history and hurt your credit score. To avoid this, make small purchases and pay them off regularly to keep your account active.

4. Does applying for a credit-building card affect my credit score?

Most credit-building cards, including Arro, don’t require a hard credit check, so applying won’t negatively affect your score. This makes them a great choice for beginners or anyone rebuilding credit. It’s an easy way to start fresh without worrying about hurting your score.

5. Can a credit-building card help me qualify for bigger financial goals like buying a car or renting an apartment?Yes, over time, it can make a real difference. By paying on time and keeping your balance low, you’ll build trust with lenders and improve your score. A stronger score makes it easier to qualify for car loans, apartments, and better credit cards with improved terms and rates.