Abby Butkus

So, What Exactly Is A Negative Balance?

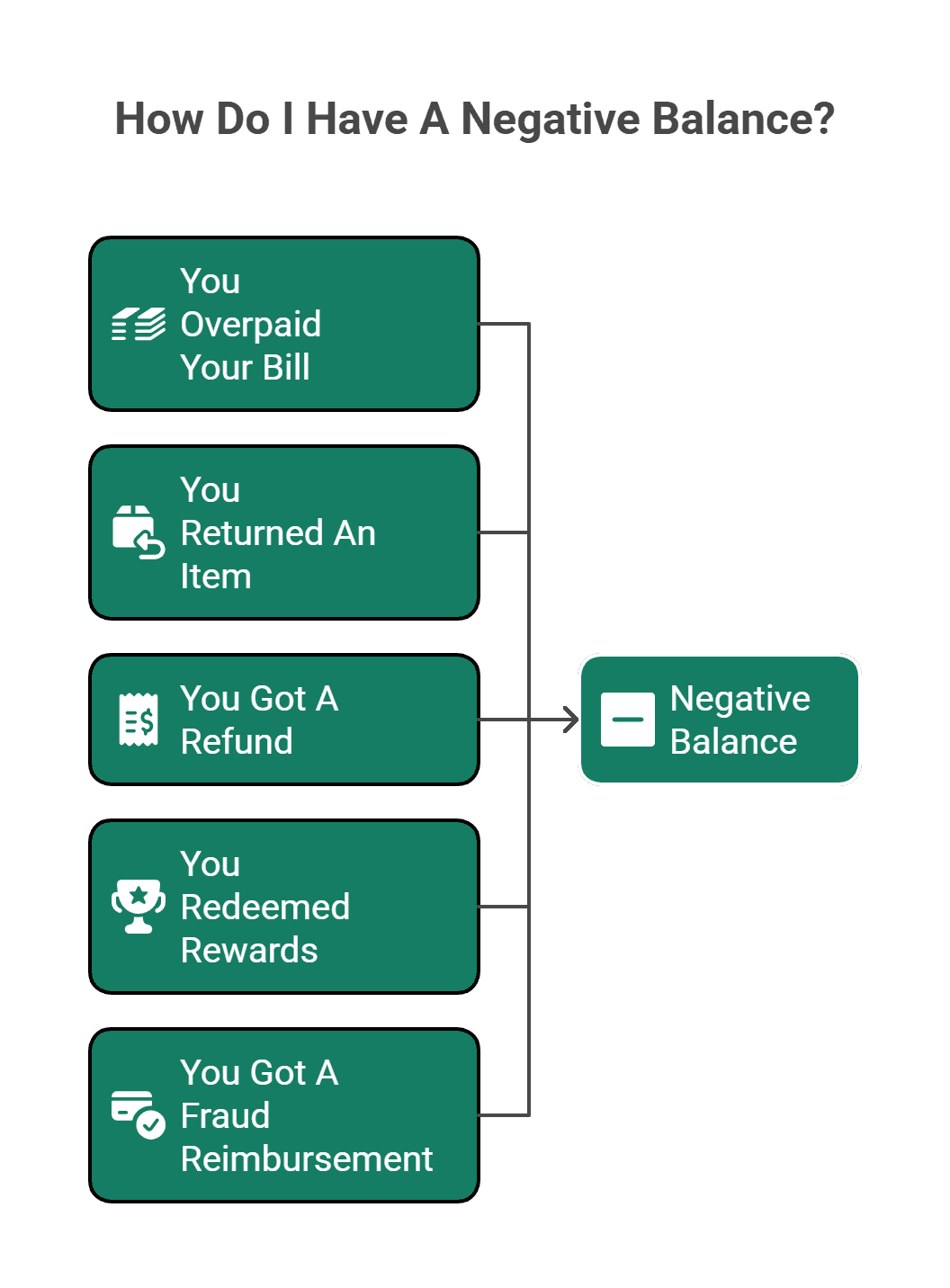

How Did The Negative Balance Happen?

What Occurs Once You Have A Negative Balance?

Should You Keep A Negative Balance?

You’ve Got This

FAQs

What does it mean to have a negative balance on your credit card? While it may initially seem daunting, it can be an opportunity for understanding and growth.

You just opened your credit card statement (and oops), there’s a minus sign next to your balance. Don’t worry!

A negative balance on a credit card might look weird, but it’s actually not a bad thing. In fact, it means the credit card company owes you money. Let’s unpack what’s going on and how you can make it work for you.

In this article, we’ll break down what it really means when your current balance on credit card is negative and how it differs from your statement balance on credit card.

You’ll learn why this can happen, what it says about your account, and how to handle it confidently, no stress, no confusion, just clear answers from Arro.

Key Takeaways

A negative balance means your card issuer owes you money.

It can happen if you overpay, get a refund, or redeem rewards.

You can spend the negative balance or request a refund anytime.

No need to keep it sitting there, you won’t earn interest on it.

So, What Exactly Is A Negative Balance?

Negative balance on a credit card simply means you’ve paid more than you owe or received a refund or reward that puts your account below zero.

In other words, you’re temporarily ahead.

Example: Let’s say your credit limit is $5,000 and your statement shows –$1,000. That means your available credit is now $6,000. You could spend that extra $1,000 without needing to make a payment. Not bad, right?

How Did The Negative Balance Happen?

Here are the common reasons for a negative balance on a credit card:

You Overpaid Your Bill: If you paid more than you owed or accidentally paid twice, you’ll have a negative balance.

You Returned An Item: If you returned an item you bought with your card, the refund may create a negative balance.

You Got A Refund: A refund from a merchant (such as a canceled event or a deposit) can result in a negative balance.

You Redeemed Rewards: Sometimes, rewards or bonuses are credited to your card, leaving a negative balance.

You Got A Fraud Reimbursement: If you reported fraud and got reimbursed, you might see a negative balance.

Also read:

How to Build Credit: Your Complete Guide to Building Credit from Scratch

A Beginner’s Guide to Managing Credit Cards Like the Pros

Credit Cards 101: Here’s What Happens if You Go Over Your Credit Limit

What Occurs Once You Have A Negative Balance?

If you see a negative balance on a credit card, here’s what you need to know:

No impact on your credit score: A negative balance is reported as $0 to the credit bureaus, so it won’t hurt your score.

Temporary extra spending power: If you have a negative balance, your available credit is temporarily boosted by that amount.

No interest earned: You don’t earn interest on a negative balance, so there’s no benefit to leaving it there.

A negative balance indicates that you have paid more than you needed to. This is not an issue. Your future purchases will use this excess credit until your balance is reduced to zero.

Should You Keep A Negative Balance?

It’s not harmful, but there’s no reason to leave a negative balance on the card:

You’re not earning interest on it.

You can spend it or get a refund whenever you prefer.

So, if you see a negative balance, take it as a tiny win, your account’s in good standing, and your card issuer actually owes you this time.

How To Clear A Negative Balance On A Credit Card?

To get your balance back to zero, you can:

Use Your Credit Card and spend money with it, and the negative balance will start decreasing with each purchase.

If you don’t want to spend, you can ask the card issuer for a refund of the negative balance.

Getting your balance back to zero is easy. Just make a purchase or ask for a refund, and you’ll be back on track in no time.

You’ve Got This

Now, you’ve got the tools to handle a negative balance on a credit card with confidence. Whether you choose to spend or request a refund, you’re in control. Keep building your credit with Arro, we’ve got your back!

At Arro, we’re sure that building credit should be easy, affordable, and available to everyone. That's why we've created a credit card that helps you learn, earn, and grow, all from the convenience of one app.

Arro simplifies improving your credit while rewarding everyday spending with no hard credit checks or deposits, and you get 1% cashback on gas and groceries. Adding up, you have 24/7 access to Artie, your AI Money Coach, guiding you every step of the way.

Every on-time payment and lesson brings you closer to higher limits and stronger credit. Thousands are already growing their credit with Arro, and now it’s your turn.

Download the Arro app today and start building credit the smarter way.

You’ve got this, and we’ve got you

Start building your credit with Arro today!

FAQs

1. Can a negative balance on my credit card expire?

Actually, no. The thing is, your negative balance will remain in your account indefinitely and certainly will not expire or disappear over time. Don't be afraid to use it for future purchases or, if you prefer, request a refund from your card issuer at any time.

2. Can I transfer my negative balance to another credit card?

Unfortunately, you can’t transfer a negative balance between cards. Credit card companies don’t process transfers for money they owe you. The best option is to ask your issuer for a refund.

3. Will a negative balance lower my credit utilization?

Yes, temporarily! A negative balance can temporarily lower how much of your available credit you’re using, which might give your score a small boost, but it’s not a long-term way to build credit health.

4. Can I get cashback for my negative balance?

Credit card companies don’t usually pay interest or cashback when you have a negative balance. If that happens and you want your money back, just contact your card issuer; they’ll help process the refund and get those funds back to you quickly.