Learn how credit inquiries work and what you can do to minimize their impact on your credit score.

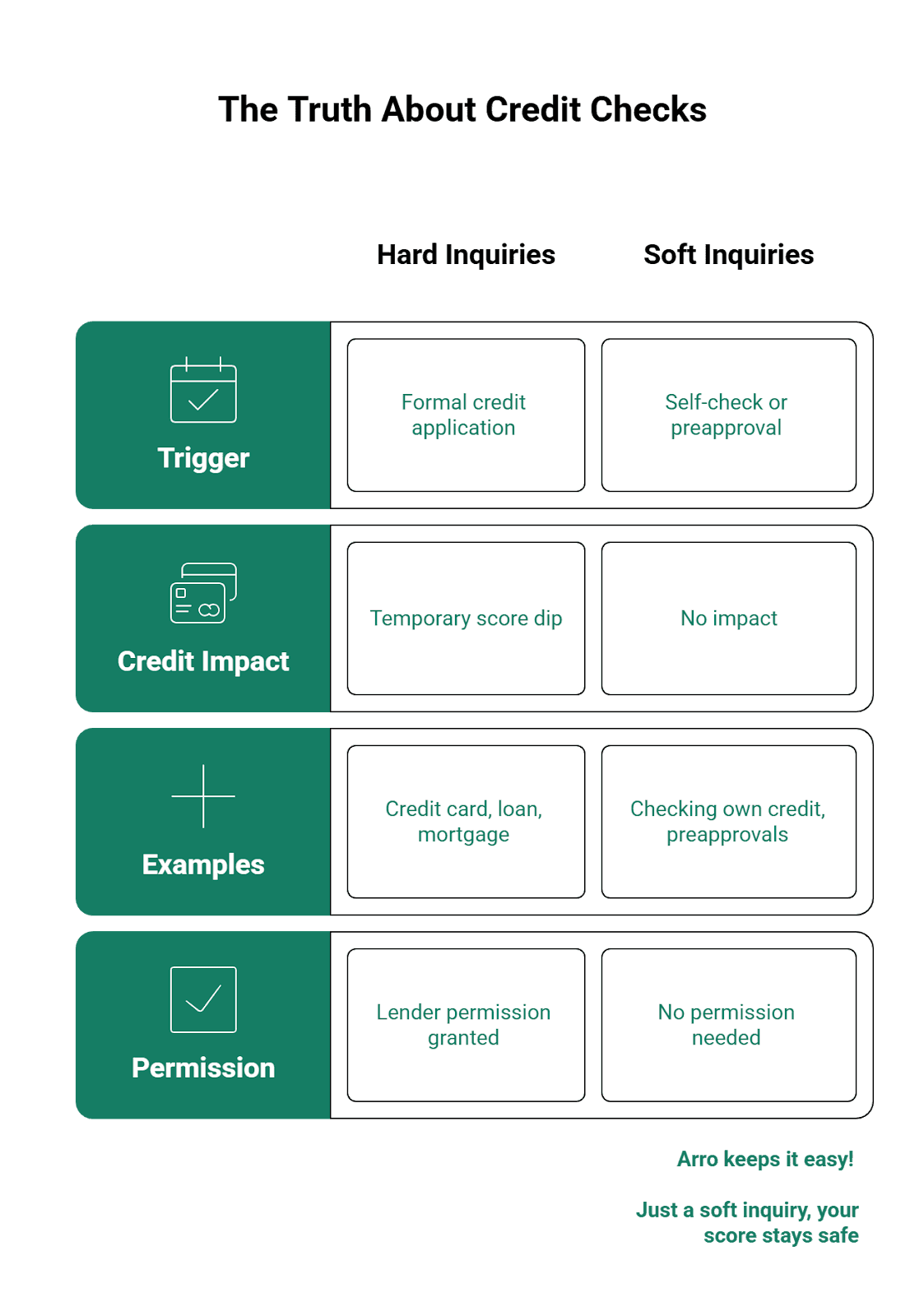

The Truth About Credit Checks

The Real Impact Of Hard Inquiries On Your Credit Score

Is There Such A Thing As Too Many Credit Pulls?

Smart Ways To Keep Credit Checks From Hurting Your Score

Keeping Your Score Steady After A Credit Check

A Better Way To Build Credit

FAQs

Have you ever received promotional mail from credit card companies or big retailers? They often advertise zero interest for 12 to 15 months or cashback on a purchase if you open their credit card.

If you’re planning a large purchase, those offers can sometimes be worth it. But before you start applying for every card that comes your way, there’s something to keep in mind: when you apply for credit, lenders usually check your credit history through what’s called a hard inquiry, and each one can cause a small, temporary dip in your score.

Credit inquiries are a routine part of applying for credit, but having several in a short period can work against you. In this article, we’ll explain how many credit inquiries is too many, how they affect your score, and simple ways to prevent them from dragging your credit score low.

Key Takeaways

A few credit inquiries won’t hurt your score much, but several close together can make a difference.

Hard inquiries can cause a small, temporary dip, usually fewer than five points.

Soft inquiries, like checking your own credit, don’t affect your score at all.

Spacing out applications helps protect your credit and shows lenders you borrow responsibly.

Keeping utilization low and paying on time helps your score bounce back faster after inquiries.

Arro makes credit building easier with no hard checks, no deposit, and tools to track your progress.

The Truth About Credit Checks

A credit inquiry simply means a lender or another authorized company has asked to see your credit report. There are two types: hard inquiries and soft inquiries.

Hard Inquiries

Happens when you formally apply for credit, such as a new credit card, auto loan, or mortgage.

They can also come up when you apply for certain cell phone plans or utilities.

By applying, you’re giving the lender permission to review your credit history with one of the three major credit bureaus.

Lenders use that information to decide whether to approve your application and what terms or interest rate to offer.

A hard inquiry can cause a small, temporary dip in your score, but if you’re careful about how often you apply, your credit will stay on track.

Soft Inquiries

Occurs when you check your own credit or when a lender reviews your report for marketing or preapproval purposes.

For instance, a furniture store might send you a pre-approved credit card offer with a low introductory rate.

These checks don’t affect your credit score at all.

However, if you decide to go ahead and apply for that offer, it will then show up as a hard inquiry.

Knowing how hard and soft inquiries work makes it easier to plan when to apply for credit and understand how many credit inquiries is too many for your situation.

The Real Impact Of Hard Inquiries On Your Credit Score

When you apply for credit, the lender runs what’s called a hard inquiry, which can cause a small, temporary dip in your score. Most of the time, it’s only a few points, usually fewer than five, and your score tends to bounce back within a few months once you show you can handle the new account responsibly.

If you’re newer to credit or don’t have many accounts, the drop might be a bit more noticeable. A few things to remember:

Hard inquiries make up about 10% of your FICO Score.

They stay on your report for two years

Only those from the past 12 months actually affect your score.

Overall, hard inquiries are a normal part of building credit. As long as you’re applying thoughtfully and keeping up with payments, your score will recover and keep moving in the right direction. Understanding this helps answer the common question of how many hard credit inquiries is too many before your score starts to drop.

Is There Such A Thing As Too Many Credit Pulls?

There’s no strict rule for how many credit inquiries is too many. How much it affects you really depends on a few things: the type of credit you’re applying for, how long you’ve had credit, and how much of it you’re currently using.

Limit How Often You Apply

It’s generally best to keep hard inquiries to one or two per year. Submitting several credit applications within a short time can raise a red flag to lenders, since it may suggest you’re a higher credit risk or having trouble managing your current accounts. Limiting applications shows that you’re borrowing thoughtfully and keeping control of your credit.

If you’re wondering how many credit inquiries is too many in a year, one or two is a good rule of thumb. Beyond that, lenders may start seeing you as someone taking on too much new credit at once.

Space Out Your Credit Requests

Don’t rush to open another credit line right after the last one. Use the account you already have for a while and keep making your payments on time. That consistency shows lenders you can manage credit responsibly and gives your score time to recover. When you’ve built up a solid record, you’ll have a better chance of qualifying for new credit with lower rates and better terms.

When Multiple Inquiries Count As One

There are exceptions to this guideline. Mortgage and auto loan inquiries are treated differently. If you submit several applications within a short window, typically about 14 to 15 days, they count as a single inquiry as long as they’re for the same type of credit. This gives you the chance to shop around and compare rates without being penalized for multiple checks.

Also read:

Where Do I Start? How to Build Credit if You Don’t Have a Credit Score

Ask the Experts: How to start your side hustle and earn extra income

Your Must-Read Guide to Understanding a Negative Balance on Your Credit Card

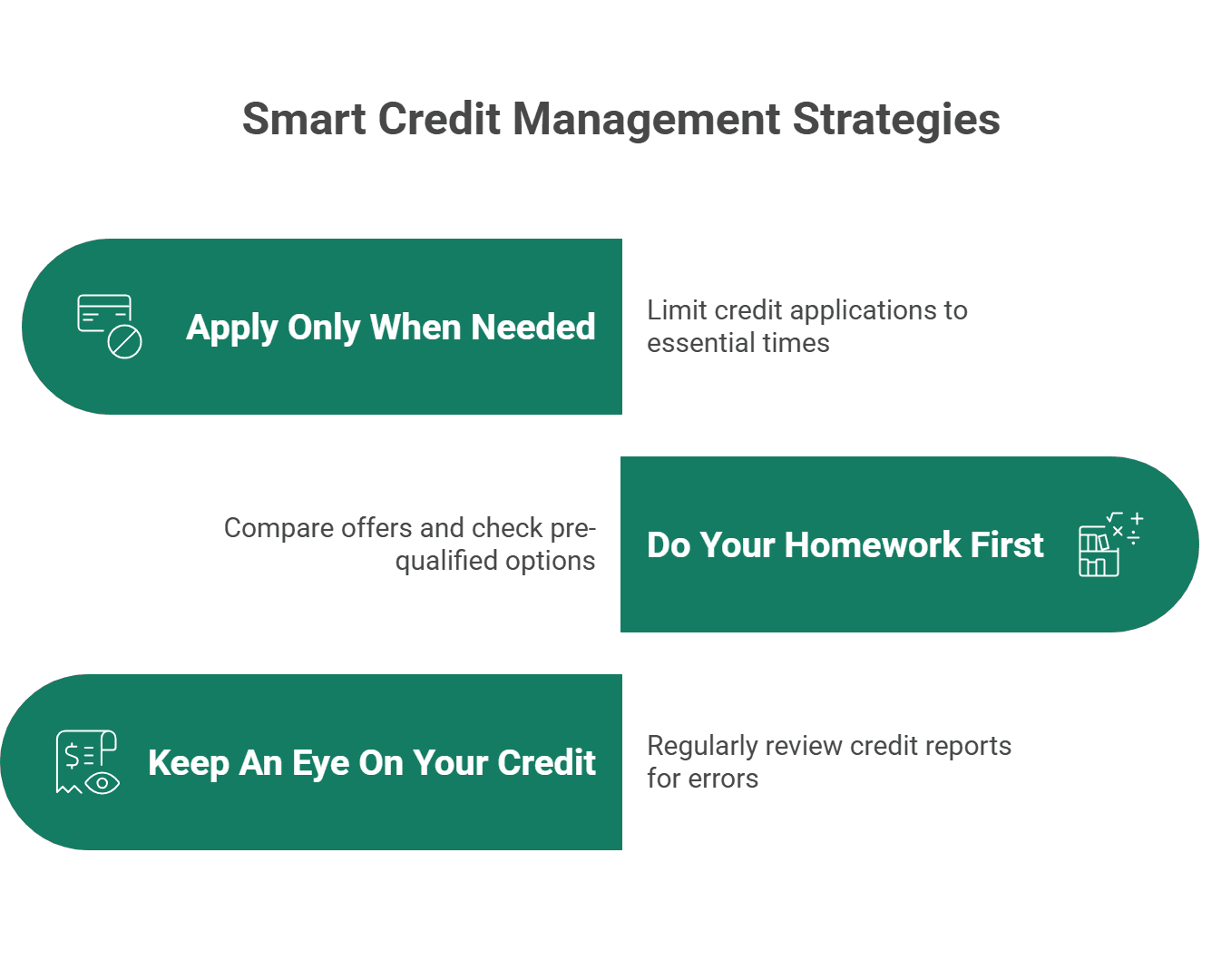

Smart Ways To Keep Credit Checks From Hurting Your Score

Worried about how many credit inquiries is too many? A few small habits can make a big difference in keeping your credit strong.

Apply Only When It Counts

Try to apply for new credit only when you truly need it. Limiting applications to once or twice a year shows lenders you’re thoughtful about taking on new accounts.

Do Your Homework First

If you’re shopping for a car loan, mortgage, or credit card, take time to compare offers before you apply. Look at pre-qualified options so you know what rates to expect before moving forward. This can help you avoid unnecessary hard checks.

Keep An Eye On Your Credit

Make it a habit to review your credit report for mistakes or signs of fraud. Arro makes this easy, members can check their credit anytime through the app, track their score, and stay on top of their progress as they build healthy credit habits.

Building good credit takes a little awareness and consistency. When you’re careful about when you apply, do your research, and keep an eye on your credit, you’ll protect your score and keep moving forward with confidence.

Keeping Your Score Steady After A Credit Check

A hard inquiry might cause your score to dip slightly, but it’s rarely a long-term setback, especially if you already have good credit habits. In most cases, your score rebounds within a few months.

The best way to soften the impact is to keep your credit in good shape. Make payments on time, use less than 30% of your available credit, and take care of any overdue accounts. It also helps to keep older credit lines open, since a longer history works in your favor.

With steady habits like these, your score will recover naturally and continue to improve over time. If you’ve ever thought about how many credit inquiries is too many, remember that the number itself matters less than how you manage your credit afterward. With steady habits like these, your score will recover naturally and continue to improve over time.

A Better Way To Build Credit

Every time you apply for a new credit card or loan, the lender runs a hard inquiry to see how you’ve managed credit in the past. It’s a normal step, but too many at once can weigh down your score. The best way to keep your credit strong is to stay on top of it, check your score often, understand what’s in your report, and apply only for offers that truly make sense for you.

That’s where Arro makes things easier. We built the Arro Card for people who want to grow their credit without all the roadblocks. There’s no hard credit check, no deposit, and you’ll even earn 1% cashback on everyday essentials like gas and groceries.

Inside the Arro app, you’ll find Artie, your personal AI money coach, ready to answer questions and cheer you on. As you keep making on-time payments and learning through the app, your credit grows, and so does your confidence.

Ready to start?

Download the Arro app and take the first step toward building credit the smart, stress-free way.

FAQs

1. How long should I wait before reapplying after being denied credit?

If your credit application was denied, wait a few months before trying again. This gives your score time to recover from the hard inquiry and lets you work on areas that need improvement, like paying down balances or making on-time payments. When you reapply with stronger credit habits, your approval chances improve significantly.

2. Can closing a credit card reduce the impact of inquiries?

Closing an old credit card won’t remove inquiries and can sometimes hurt your score. When you close an account, you lower your total available credit and shorten your credit history, two factors that affect your score. Keeping older accounts open helps balance out the effects of new inquiries and shows long-term credit stability.

3. Do credit inquiries affect all credit scores the same way?

Different credit scoring models, like FICO and VantageScore, weigh inquiries a bit differently. Most only consider hard inquiries from the past 12 months, but the effect may vary depending on the model and your overall profile. Either way, inquiries make up a small part of your score, and strong payment habits matter much more over time.

4. Can being an authorized user help offset hard inquiries?

Yes. In fact, being added as an authorized user on someone else’s well-managed credit account can strengthen your credit profile without requiring a new hard inquiry. You’ll benefit from their positive payment history, which helps balance the temporary impact of past inquiries and shows lenders you can manage shared credit responsibly.

5. What should I do if I already have too many recent inquiries?

Too many credit applications close together can weigh your score down for a bit, but it’s easy to turn things around. Focus on paying bills when they’re due, chip away at existing balances, and hold off on opening anything new. Give it some time, and after a few months, those inquiries will matter less, and your score will start to climb again.