Abby Butkus

Lenders: Getting a small line of credit will help you build your credit history.

Also, Lenders: You don't have enough credit history for us to give you a line of credit.

Heard that one before? It's an unfortunate truth that in order to build credit, you must have credit. As a newbie, this can be frustrating. According to the Consumer Financial Protection Bureau (CFPB), about 2.7% of U.S. adults (roughly 7 million people) lacked any credit record in 2020, meaning they were “credit invisible.

As you reach new milestones in life, such as buying a house or upgrading to a nicer car, it's a reality that credit, and good credit at that, is essential. But, there's good news! You've got plenty of options to start building your credit early so you're prepared for those bigger money moves down the road.

In this article, we'll walk you through practical ways to start how to build credit with no credit today, what to watch out for when managing your credit score, and why starting now matters for your financial future.

Key Takeaways

Building credit with no credit is possible with the right approach – no existing credit required.

Multiple paths exist to establish credit history, including utility reporting, authorized user status, and no-deposit credit cards.

Paying balances in full and on time each month is the most important habit for credit success.

Keeping credit utilization under 30% helps boost your score faster.

Starting your credit journey today means you'll be ready for major life purchases tomorrow.

Ways To Start Building Credit Today

Why bother? As of 2020, in addition to the 2.7% of “credit invisible” adults, an additional ≈ 9.8% (about 25 million adults) had a credit file but insufficient activity to be scored, often due to limited or outdated credit use. Learning how to build credit with no credit can be the solution, especially if you take advantage of alternative methods.

Start Counting Your Utility, Rent & Cell Phone Bills

Are you paying for your cell phone bill, utilities, and rent on time? Great! Take advantage of your good track record and apply it to your credit report. In many cases, you can request that your landlord or your utilities company report your on-time payments to the credit bureaus. There are also some third-party apps and services that can offer this.

Become An Authorized User

Another option to start building credit is to become an authorized user on a family member, friend, or significant other's credit card. Jump on your favorite person's bandwagon and, as a result, establish your own credit card history… but be careful of the risks. You need to be 100% confident that the account holder is a responsible credit card user, meaning they consistently pay on time and maintain responsible spending habits. If the account holder doesn't pay on time, that could actually tank your credit score – ouch. We want you to come out of this as two peas in a pod, not two peas in debt.

Open A Store Card

Opt-in for the credit card of a store you shop at frequently and make one purchase per month on the card – and pay it off immediately. Store cards are generally easier to qualify for than traditional credit cards, especially if you don't have a long credit history. It's important to note that these cards typically charge higher interest rates, so ensure this store aligns with your financial goals and that you pay off the balance each month to avoid negative repercussions.

Get A Secured Credit Card

Secured credit cards could be a good way to start building credit. They are called "secured" for the initial deposit you pay upfront to "secure" the credit line. Typically, the amount you deposit equals the credit limit, so if you deposit $300 to open the account, your credit limit is $300. Bonus: once you establish a positive payment history, you can receive your deposit back (but check the fine print before you open the card!) and have the option to increase your limit or upgrade to an unsecured, traditional credit card.

Apply For The Arro Card

We recognize that there may still be barriers to building credit with these options, which is why we offer our members a traditional credit card (no security deposit!) without a hard inquiry on their credit report.

Arro uses alternative data, such as income and bank account transactions, to assess eligibility in order to uphold a more inclusive and fair vetting process. All you need to apply is a Social Security Number or ITIN, a valid checking account with a US bank for at least 3 months, income, and to be at least 18 years old. Not bad, huh?

Things To Watch Out For When Building Your Credit Score

As you work to build your credit, it's important to be aware of factors that could negatively affect your credit score. Here are some key things to watch out for:

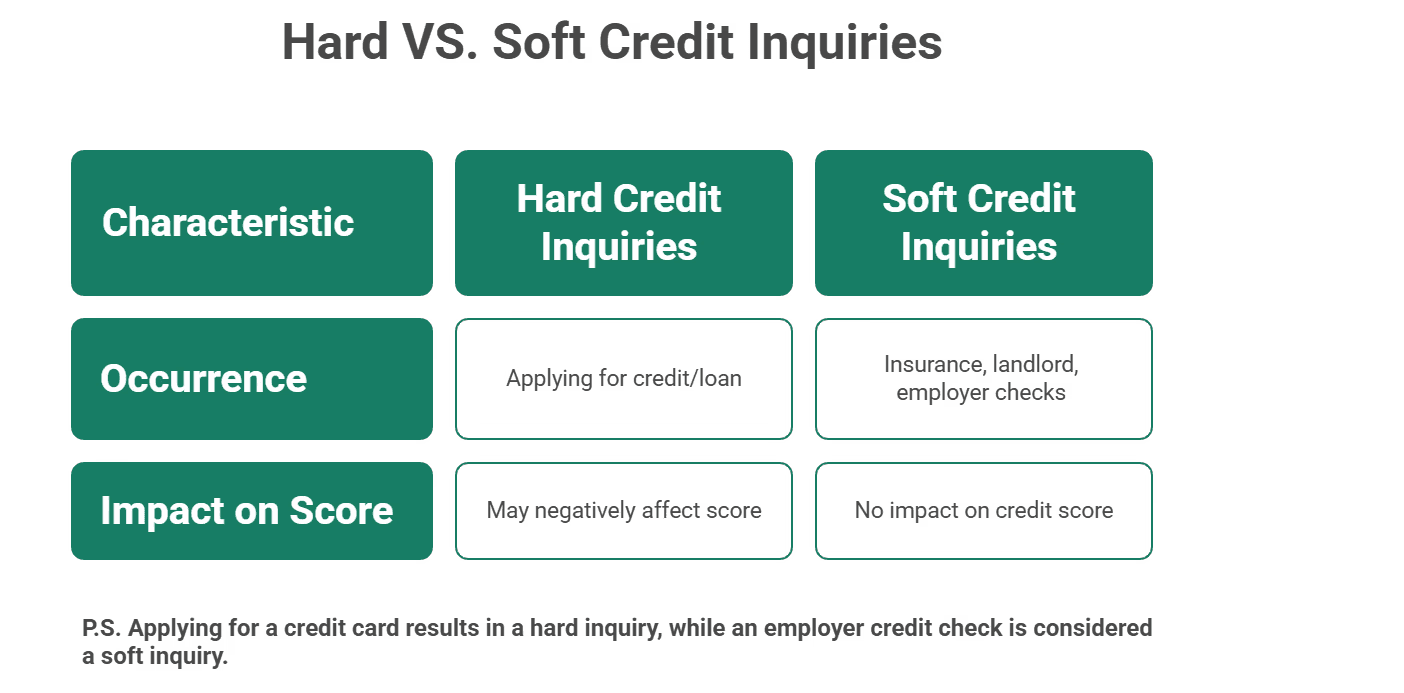

Hard VS. Soft Credit Inquiries

As you work on building your credit, it's crucial to understand how different types of credit inquiries can impact your score.

Here are the key distinctions:

Hard Credit Card Inquiries occur when you apply for a credit card or a loan. Creditors request to look at your credit file, and these inquiries are recorded on your report. Too many inquiries may negatively affect your credit score.

Soft Credit Card Inquiries happen when insurance companies, landlords, or employers check your credit. These do not impact your credit score. Arro uses only soft credit inquiries, so applying for the Arro Card won’t hurt your score.

In summary, understanding the difference between hard and soft credit inquiries can help you avoid unnecessary dips in your credit score and stay on track as you build credit for the first time.

Paying Off Your Balance

The top priority once you receive your line of credit is to pay off your balance in full and on time each month. If you carry a balance from month to month, interest charges will compound and can leave you in a bind. Consider setting up automated payments or alerts to ensure you don't forget to pay it off each month.

Credit Card Utilization

When it comes to credit card utilization, the lower the better. You might be wondering why the bureaus care. Well, utilization refers to the amount of credit you have available in relation to how much you're using each month. If you are maxing out your credit limit each month, it can look risky to the bureau.

Therefore, a good rule of thumb is 30%; following this will help you build credit with no credit history.

For example, if you have a $1,000 credit limit and use about $300 each month, that is roughly a 30% utilization rate. Credit card utilization can also be a handy tool to increase your credit score quickly, too – pay down any balances on your credit card regularly and watch your score grow.

Free Annual Credit Report

Ignorance is not bliss when it comes to your credit. You can utilize free tools to monitor your credit report's health and dispute any potential errors that could negatively impact your score (and it also allows you to keep an eye out for fraudulent activity).

All three Credit Reporting Agencies grant one free credit report a year. Therefore, if you are strategic about it, you can space out your credit report requests throughout the year to avoid paying to check your score.

Also Read:

But, Do I Really Need To Start Building Credit Now?

The reality is that many major life moments require a credit report: landlords will run a soft credit inquiry to determine your eligibility for leasing and the amount of the security deposit (it goes up without it, or you cannot lease at all!).

Also, lenders will run a credit check if you need an auto loan, and without a credit score, you’ll likely face higher interest rates or fewer options.

That’s why starting to build credit sooner rather than later matters. So, do you need more reasons to keep exploring how to build credit with no credit? Let’s break down why starting now puts you in a stronger financial position.

And once you do get started, remember: building credit from scratch takes time, so be patient and just keep doing the right things:

Pay off your balance each month

Don't apply for credit you don't need

Keep your credit utilization low

Check your credit score on a regular basis

That's it! Do those four things and consider yourself well on your way to achieving your financial goals as well as a healthy credit score.

Take The First Step: Start Building Credit Today, Even With No Credit History

Building credit doesn't have to feel overwhelming or out of reach. Whether you're starting from zero or rebuilding after setbacks, the key is taking that first step and staying consistent with good habits.

At Arro, we believe building credit shouldn't be confusing, expensive, or out of reach. That's why we've created a credit card that supports you in learning, earning, and growing – all in one app. With no hard credit checks, no deposit, and 1% cashback on gas and groceries, Arro makes it simple to start improving your credit while rewarding your everyday spending.

You'll also get access to Artie, your personal AI Money Coach, who's there 24/7 to answer questions, celebrate wins, and help you make smart financial moves.

Every on-time payment, every lesson, every small step forward enables you to unlock higher credit limits and better credit health. Thousands of people are already building stronger credit with Arro and enjoying the process.

Ready to build credit with no history? See how easy it can be to build credit with confidence.

FAQs

1. What are the potential risks of starting to build credit with a secured credit card?

Secured credit cards can be a good tool for building credit, but there are some risks to be aware of. The primary concern is that failing to make payments on time could result in losing your deposit, and late payments can damage your credit score. Additionally, secured cards typically have lower credit limits, and if your utilization is too high, it could negatively affect your score. Always ensure you can commit to the payments before applying for a secured card.

2. How can building credit impact my chances of renting an apartment?

Many landlords perform a credit check to assess your reliability as a tenant. If you have a strong credit score, you’re more likely to be approved for rental applications, and you may even secure a lower security deposit. Building credit helps establish your financial credibility, and even a small credit history can demonstrate your ability to manage finances responsibly.

3. Can building credit from scratch help me qualify for better loan terms in the future?

Yes! A solid credit history not only helps you qualify for loans but can also significantly improve the terms of those loans, meaning lower cost to you. With a higher credit score, you are more likely to secure lower interest rates on mortgages, car loans, or personal loans. This can save you a substantial amount of money over time, making it easier to afford big-ticket items like homes or cars.

4. What’s the difference between a soft and hard inquiry, and why should I care?

A hard inquiry occurs when you apply for credit, such as a loan or credit card, and can slightly affect your credit score. A soft inquiry occurs when someone checks your credit for non-lending purposes, such as a background check for renting an apartment. Soft inquiries do not affect your credit score. It’s crucial to manage hard inquiries wisely, as too many in a short period can lower your score and make it harder to qualify for future credit.

5. How does using the Arro Card help me build credit without the typical risks associated with traditional credit cards?

The Arro Card is designed to help people build credit without the usual risks of traditional credit cards. Unlike many cards that require a security deposit or a high credit score, the Arro Card uses alternative data, such as income, to assess eligibility, so even those with no credit history or a low score can qualify. Arro also uses soft credit inquiries, so applying for the card won’t impact your credit score. Plus, you can track your progress through the app and receive personalized tips from the AI Money Coach to guide you toward better credit health.