What to Like (and Hate) about Secured Credit Cards

More and more banks have started offering secured credit cards as a credit option, particularly for people just getting started on their credit journey or trying to rebuild their credit. But what is a secured credit card and does it make sense for you?

Author: Gabe Kahn

November 17, 2022|Blog

What is a secured credit card?

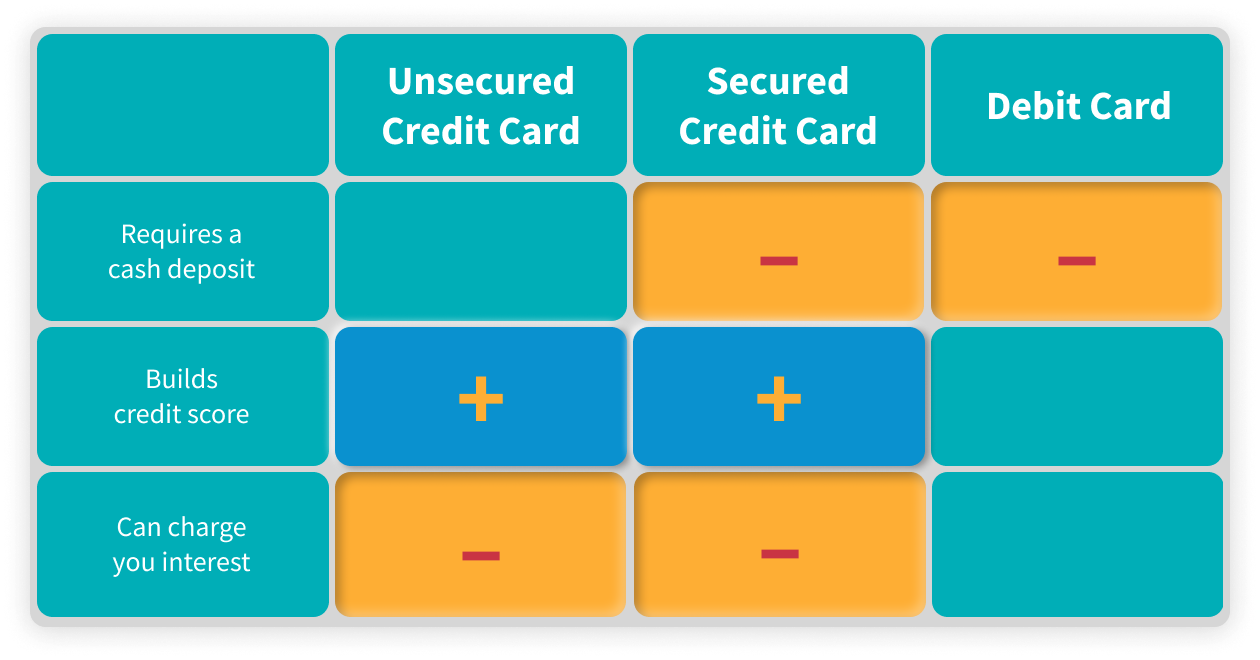

The main difference between secured and unsecured credit cards is that secured cards require a cash deposit up-front in order to open an account. If you’re approved for a secured credit card, the card issuer will ask you to send money equal to either part or all of the credit card’s initial credit limit to fund your account. If you choose not to send the money then you won’t be able to open the account.

Most secured credit cards require you to put down a $200 deposit to get a $200 credit limit, and you can typically raise your credit limit by depositing more money. The deposit acts as collateral for the loan, meaning that the bank will take your deposit if you don’t pay back your balance, but you can’t use the deposit to make your monthly payment. Think of this like a security deposit you put down for your current or prior apartment – if you take care of the apartment, you get the deposit back when you move out, but if the apartment is damaged, you might lose some or all of your deposit. Secured credit cards work in much the same way – make your payments and you can get your deposit back, but miss too many and the lender could take your deposit.

Besides this, secured cards operate similarly to standard credit cards. You can use them to make purchases in stores or online, you still need to make payments towards your monthly balance, and (warning!) you can be charged interest and late fees. Some issuers will “unsecure” your credit card by sending you back your deposit if you make enough on-time payments. Or you can recoup your deposit at any time by closing your account. Remember, the issuer may take your security deposit if you miss too many consecutive payments.

Can a secured credit card help you increase your credit score?

Secured credit cards are often used as an entry ticket into the credit arena if you’re having trouble getting approved in other places. Issuers generally have a high approval rate for secured card applications - even if you don’t have credit or your credit score is low - because of the deposit. This is helpful if you’re trying to build your credit for the first time or to rebuild your credit.

Opening any credit card and moving some of the purchases you typically make using a debit card or cash to the card is a great way to start building your credit, especially since payment history is the most important factor affecting your FICO Score. People with a credit score under 650 can often see a large improvement in their credit score in 6-12 months by making consistent, on-time payments on a credit card. In this way, a secured credit card helps you build your credit in the same way that an unsecured card does. Just be careful because missed payments may also be reported to the credit bureaus which will hurt your score.

Are there better options than an unsecured credit card?

The biggest downside to using a secured credit card is that you need to hand over your hard earned cash before you ever see a benefit of using the card. This will tie-up a chunk of your money in the bank’s hands and, in many cases, defeats the purpose of applying for access to credit in the first place. While the bank may give you your money back if you make enough on-time payments, they’re not required to do so unless you close your account. In this way, a secured credit card is not too different from a debit card - except it charges you interest and late fees for lending you your own money.

Arro was created to give you a better way to build your credit AND have access to a credit line in case of emergencies at the same time. We use alternative data to help people qualify so we can approve you at an even higher rate than secured card companies without asking you to put down any money up front. You shouldn’t be required to put down up to $200 of your hard earned money up front just to get access to credit and you should expect to be told exactly how you can grow your credit line, decrease your interest rate, and use your card to achieve your goals. We don’t think it’s too aspirational when we say:

No more listening to someone tell you that you need credit in order to get credit.

No more charging you interest to lend you back your own money.

No more hearing that you’re ‘being evaluated’ for interest rate decreases without any follow-through.

At Arro, we’re changing credit cards for good.