Ian Quetglas

I'm a CFP Professional, and in this blog, I'm addressing 5 budgeting strategy tips that can help you start 2023 on the right foot.

For starters, forget previous financial planning strategies that you have used that have not worked. You have the opportunity to finish this holiday season with the proper budget and start 2023 with a fresh perspective on approaching your financial situation strategically. Don’t be intimidated by a budget – all the information you need is in your head, bank account, or credit card statements. As a starting point, download this template to save you the step of having to design your own table. In the template you will find common line items, but you should add and delete line items to personalize your budget.

Budgeting is not complicated. It's all about understanding the money coming in and out of your accounts and planning to meet your goals. It's a money plan for a period of your choosing.

Here we go! The plan is divided into 5 steps that will help you think strategically about budgeting for the new year.

Be the CEO of your finances

Before doing anything, you must assess your situation. It helps me think about my financial situation the way I would look at a business. That helps me ask tough questions and separate emotions from the exercise. One of the main reasons people don’t create a budget is because they are afraid of what they might see under the hood. However, to properly create a path forward, it will be important to ask the tough questions and face reality with a solid plan. Let’s rip that bandaid!

Ask yourself some questions to get you going. Some that help me are: have I made any spending mistakes during the holidays? How did my financial situation look for the whole year? Was I able to cover all my expenses without needing debt? What do I want to improve next year? You can summarize it to, most importantly, how much did you spend during the past year, and how can I improve next year?

You will need a summary of your financial activity for the year. You can find this information in your bank or credit card statements, or maybe you know it by memory. This will help you understand where you stand and let you come up with an effective plan to get to where you want to be. Like a business, list your income, expenses, and things you own and owe. What you own might be more than what you think, so include anything you can sell! Think about your car, clothes, jewelry, savings, etc. Use our template as a starting point.

Once you have a clear picture of your financial situation this year, you can understand where you might find some hitches and where you will need to make adjustments.

Set your short-term and long-term goals

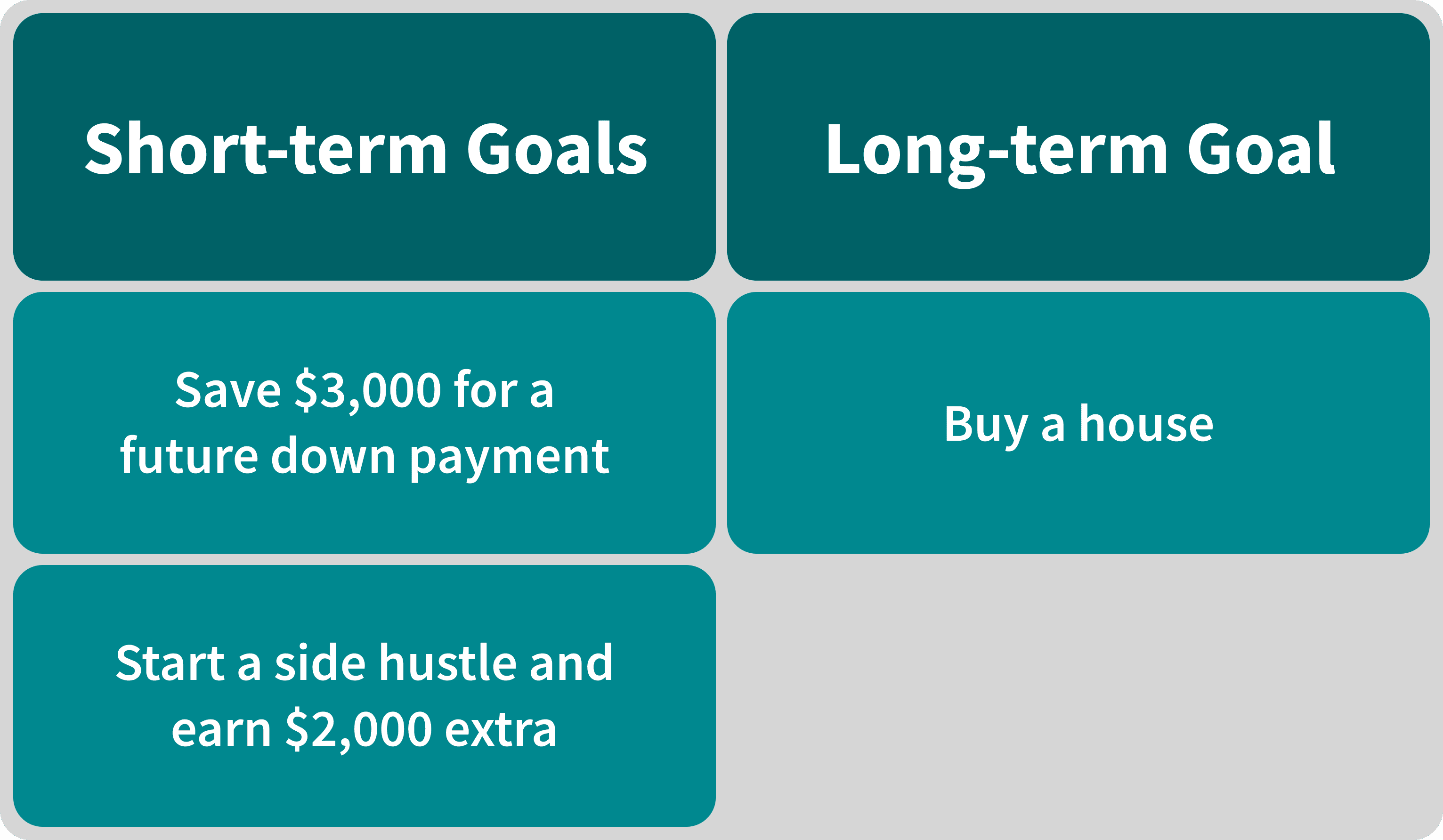

Once you have a good idea of where you stand, you need to consider where you want to be. You should divide your goals into short and long term. Your short-term goals should be achievable in 1 year, and position yourself for successfully achieving the long-term goals, which should be your aspirations. Additionally, short-term goals should aim to fix anything that might prevent you from reaching your long term goals, such as debt pay down or credit score repair.

After assessing your situation you will have enough ammunition to develop impactful goals. For example, this can be a short list of goals of someone looking to save more to buy a house in the future:

Understanding your goals as the starting point will give you a purpose and measurable metrics to evaluate your progress. To help plan for 2023, we’ll focus on short-term goals and how your financial planning strategy can help you achieve them.

Consider multiple budget scenarios

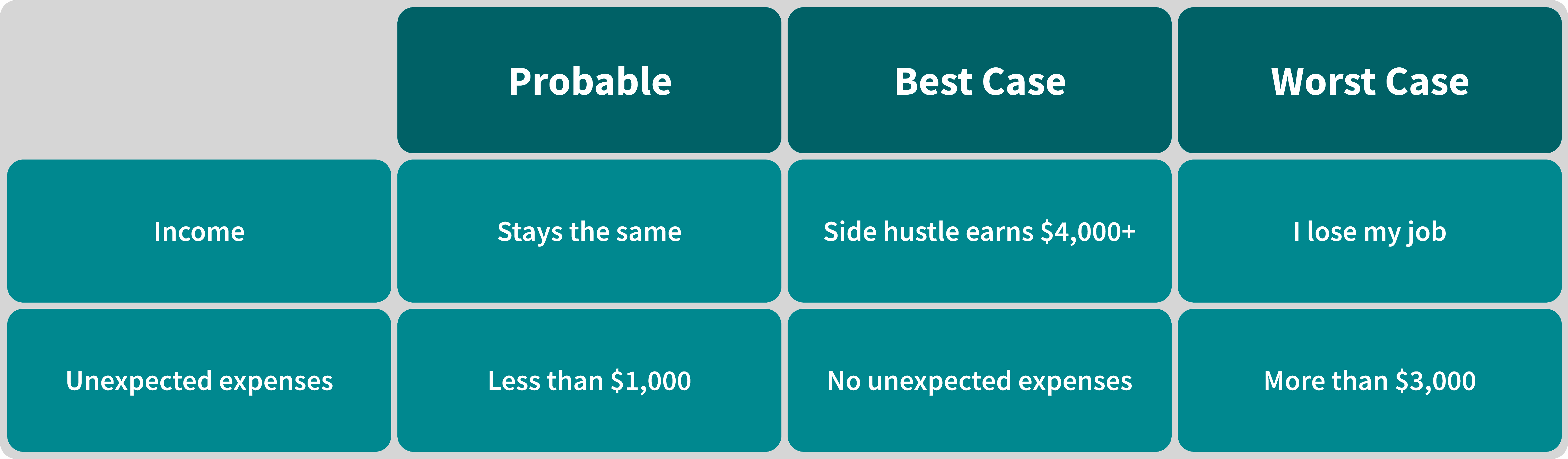

It's okay to be pessimistic for a second! Think about the best-case, worst-case, and most probable scenarios as you try to understand how everything will play out in the future. This will help you understand how much room you have to deviate from the plan and how quickly you can get back on track. During this activity, consider how the economy is doing and how it might look next year. For example, many people are less optimistic about the economy right now than they were this time last year. Having all the answers is impossible, but scenario planning can help you prepare for any situation. For example, it might be important to have extra savings just in case you can no longer rely upon your income from other activities if the economic downturn makes it harder for that second job to provide you with that opportunity. Think about what line items in your personal assessment can change and by how much. By doing this, you will know what actions move you towards achieving your goals. It would be ideal if you had a case where everything that can go wrong does and for you to have a safety plan to address it.

After understanding how your most important line items can vary and by how much, you can summarize it:

Assessing how the most important drivers of your budget could change will help you create a most realistic budget. These are the metrics you can then track when implementing your budget.

Create a realistic budget that reflects your current situation and future goals

Congratulations! You can now create a realistic budget because you have thought about your current financial situation, understand where you want to be, and have accounted for multiple scenarios. Now it’s time to create your 2023 budget!

Laying out and visualizing your budget in whatever format works for you (time to download the template!) will be the most work in creating your plan, but having done all the previous work makes it much easier. Using the template, add all the expenses from 2022 that you expect you’ll still have, and think about what can change in the future based on your situation and your goals.

This might take a little bit of time, but you’re almost there!

Go out and live your financially planned life!

The great thing about having your budget is that you’ll start seeing how all your finances evolve and where you need to focus your attention. But for now, you’ve done the hard work, so time to execute on your plan! George Patton, a great general, once said he would always choose a good plan perfectly executed today rather than a perfect plan executed next week. Most people will stay in the planning stage and never completely execute the plan, but the only way you’re going to meet your financial goals is by taking action.

Stay tuned for another blog on the best ways to track and monitor your budget. If you’re interested in more financial insights and learning personal finance tips, sign up for the Arro waitlist today.