Can You Build Credit Without A Credit Card?

Building Credit Without A Credit Card

What Is A Good Credit Score?

How Credit Score Ranges

Checking Your Credit Report

Start Building Your Credit History With Arro

FAQs

Whether you are new to credit or looking to improve your credit score, follow these tips to learn how to build credit without using a credit card.

Building good credit opens doors to better financial opportunities, like qualifying for lower interest rates on loans. On the flip side, poor credit can limit your options, often making things like renting an apartment more expensive due to higher security deposits.

You need credit to build a history, but you need a history to get credit. It’s like needing experience for a job, but how can you get that experience if you’re never given the chance?

In this article, we will explore practical steps to build credit without a credit card, including using alternatives like credit-builder loans, becoming an authorized user, and even rent reporting, and how Arro Credit Card helps improve your credit history.

Key Takeaways

You can build credit without a credit card using credit-builder loans, rent reporting, or becoming an authorized user.

Rent payments can help boost your credit with tools like Experian Boost.

Credit-builder loans let you build credit while saving money.

Becoming an authorized user on someone else's card can help, as long as they pay on time.

Secured credit cards are a solid way to build or rebuild your credit.

Can You Build Credit Without A Credit Card?

It is absolutely possible to build a credit score without a credit card! Many people don’t realize that their credit history may already be shaping their score.

Your credit score is calculated based on various factors, including more than just credit card usage. For example, rent payments, utility bills, auto loans, and student loans can all contribute to your credit history. If you’ve been consistently paying these bills on time, you’re likely already building a credit profile.

Services like Experian Boost allow you to add these payments to your credit file, helping improve your score. However, it’s essential to know that debit card transactions don’t help build your credit. Since you’re spending your own money, there’s no borrowing involved, which is what’s necessary for credit to grow. To build credit, you’ll need a credit product that reports to the bureaus, like a credit card, loan, or credit-builder service.

Building Credit Without A Credit Card

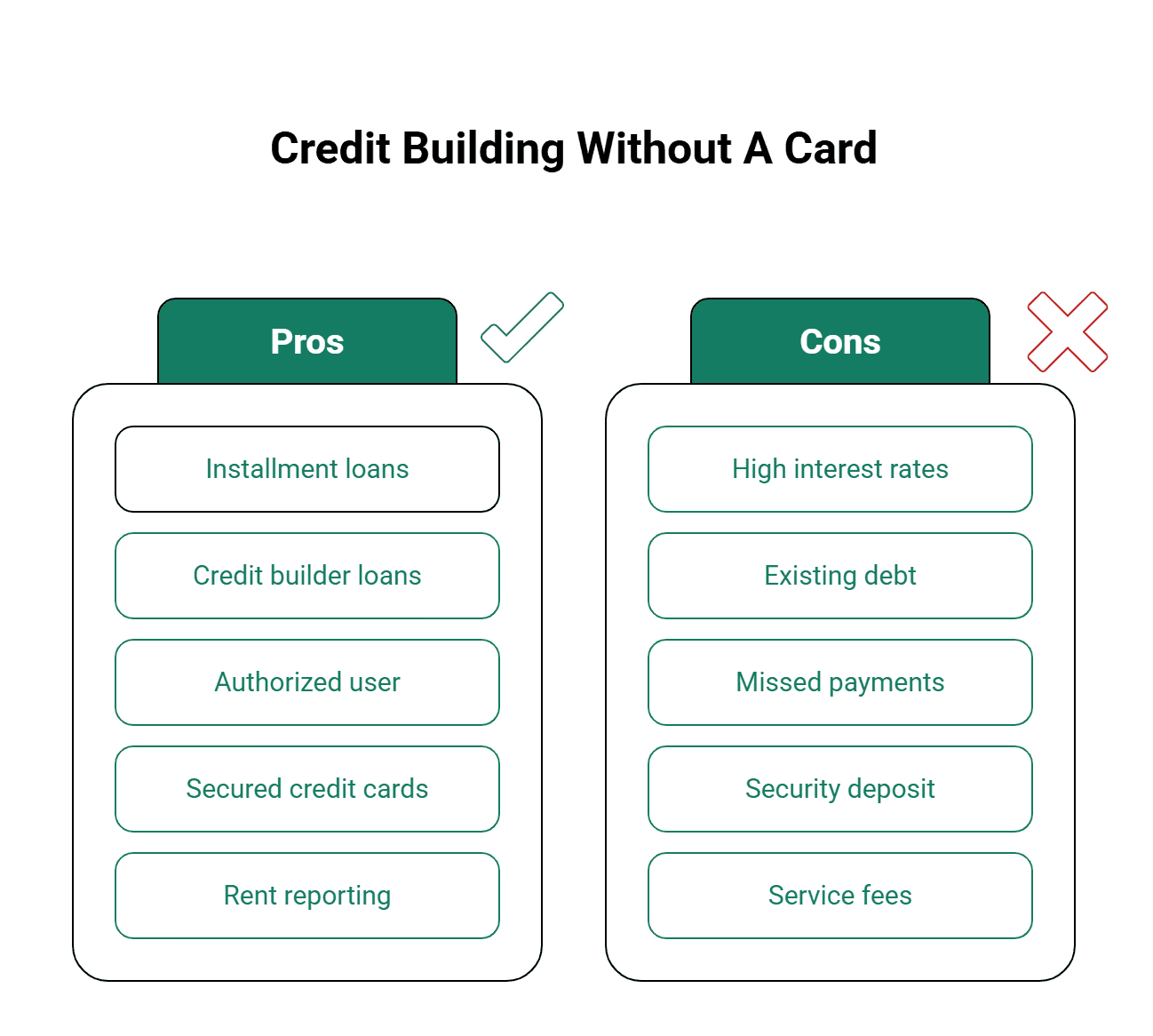

Whether you're just starting to build your credit or looking to improve your poor credit score, there are effective strategies you can employ without needing a credit card.

Lenders appreciate a well-rounded credit history that includes a variety of loan types, even if you don’t have a credit card. They want to see that you can handle different kinds of debt responsibly. Ultimately, the key is to showcase your ability to manage credit wisely. What are the most effective methods to enhance your credit?

Installment Loans

It lets you borrow a set amount of money and pay it back in monthly installments. Each payment covers both what you borrowed and the interest.

The loan term is fixed, so you’ll know exactly how much you owe and when your payments are due. This makes it easier to manage your budget and stay on track with your finances.

Installment loans include:

Car loans

Student loans

Personal loans

Mortgages

The advantage of installment loans is that they allow you to finance large purchases, making it easier to manage bigger expenses. However, the downside is that these loans can come with a high interest rate, which could increase the total cost over time.

Credit Builder Loans

It is a type of installment loan specifically designed to help you establish or improve your credit history. Here’s how it works: The lender deposits the loan amount into a savings account, and you make monthly payments, which include both the loan principal and interest.

At the end of the loan term, you receive the total balance you’ve paid, making it a great way to build both savings and credit simultaneously. Once the loan is paid off, you’ll have a savings nest egg, but credit builder loans may not be suitable if you already have significant existing debt.

Becoming An Authorized User

It is one of the quickest ways to build credit without a credit card. Essentially, you’re added to someone else’s credit card account, typically a trusted family member or friend. You can make purchases on the account, but the primary cardholder is responsible for paying the bill. As an authorized user, the account's payment history is reported on your credit report. This can help you build your credit.

This arrangement works best when there is mutual trust, as young people often rely on their parents or family members to add them as authorized users. It’s important to note that an authorized user is different from a cosigner. A co-signer is legally responsible for the debt if the primary cardholder doesn’t make payments.

Being an authorized user can be a hands-off way to build credit, but it can also hurt your score if the primary cardholder misses payments or doesn’t pay on time.

Building Credit With Secured Credit Cards

A secured credit card is a great way to build or rebuild your credit, especially for beginners or those with poor credit. Unlike an unsecured credit card (which doesn’t require collateral), a secured card requires you to make a refundable security deposit. This deposit acts as your credit limit, meaning if you don’t make your payments, the bank uses the deposit to cover your debt.

Most financial institutions offer secured credit cards, and you can often find better deals at credit unions. While some secured cards may charge an annual fee, others do not, so it’s important to shop around for the best option.

Secured cards can also offer rewards, like cash back, but remember you’ll need a lump-sum deposit upfront.

Rent Reporting

Rent reporting lets you add your rent payments to your credit report, which can help boost your credit score. However, landlords don’t have to report rent payments to credit bureaus, so you’ll need to ask if they’re willing to do it. If not, you can use rent reporting services to get it added yourself.

You can build your credit by reporting your rent payments. This can help you while paying your rent each month. Keep in mind, that some rent reporting services charge fees. It’s a good idea to compare options to find the best one for you.

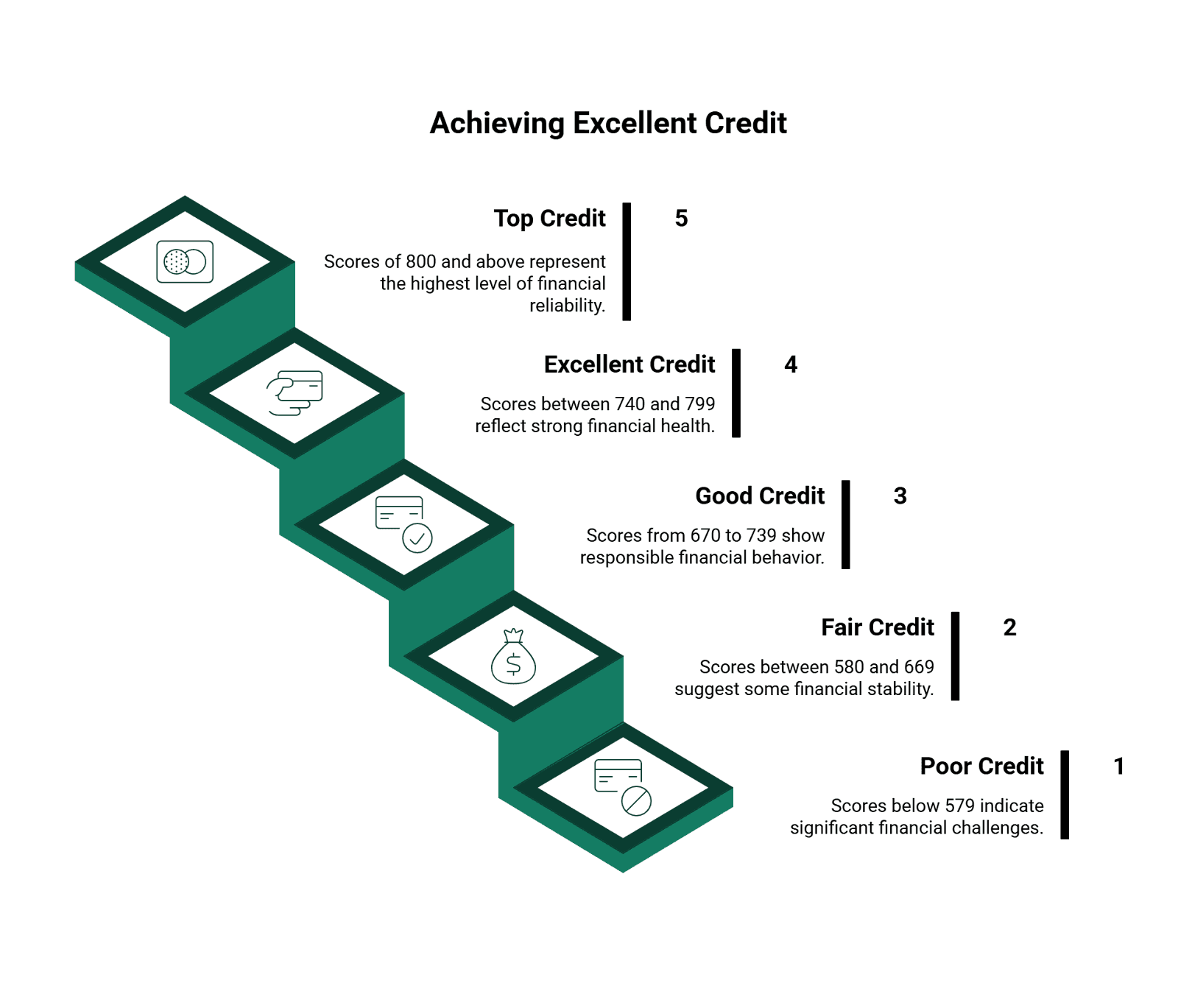

What Is A Good Credit Score?

A good credit score shows that you manage credit responsibly. Scores range from 300 to 850, with higher scores indicating better creditworthiness. Generally, a score between 670 and 739 is considered good, while anything above 740 is excellent.

Lenders look at your credit score to determine how risky it is to lend you money. A higher score can help you qualify for lower interest rates on loans and credit cards.

Improving your score takes time and requires consistent, responsible financial habits like paying bills on time, reducing debt, and keeping your credit usage low. Regularly checking your score and taking steps to improve it can save you money and open up better financial opportunities. Luckily, with the Arro credit card, you can begin building your credit on your own terms.

How Credit Score Ranges

Your credit score is basically a three-digit number that reflects how well you manage credit. A high score indicates you’re good at managing debt, while a low score can signal repayment issues. The FICO score, which ranges from 300 to 850, is commonly used by lenders to evaluate your creditworthiness. Here’s how credit scores are typically ranked:

Scores below 579: Poor credit

580 to 669: Fair credit

670 to 739: Good credit

740 to 799: Excellent credit

800 and above: Excellent credit

The good news is, even if your credit score is less than stellar or nonexistent, you can use the strategies mentioned earlier to improve it. Understanding your credit score range and working to raise it can open up better financial opportunities, such as qualifying for lower interest rates and gaining easier access to loans.

Checking Your Credit Report

Staying on top of your credit is an important part of managing your finances. You’re entitled to a free credit report once a year from the three major credit bureaus: Equifax, Experian, and TransUnion. It’s a good idea to make checking it a regular habit.

Your credit report gives you a snapshot of your financial picture, showing things like your payment history, how much credit you're using, and any public records like tax liens or bankruptcies. Negative marks usually stay on your report for seven years, though bankruptcies can stick around for up to ten.

It’s also smart to check for any mistakes. Errors can happen, so if you notice something wrong, contact both the credit bureau and the creditor to fix it. Here are some things to look out for:

Similar names listed on your accounts

Mistakes in personal details like your name, address, or phone number

Accounts marked as late when they shouldn’t be

Wrong balances or credit limits

Accounts that are marked as open when they’ve been closed

Duplicate debts

Regularly checking your credit report ensures your credit history is up to date and accurate, making it easier to work toward your financial goals.

Also read:

How to Build Credit Without a Credit Card: Steps to Get Started

Want to Conquer your Debt? Arro Can Help

Credit Cards 101: Here’s What Happens if You Go Over Your Credit Limit

Start Building Your Credit History With Arro

You can effectively build your credit without relying on a credit card; now is the time to take charge and make it happen. If you’re already paying student loans, rent, or utility bills, you’ve been building your credit history without even knowing it.

You can decide whether becoming an authorized user, getting a credit-building loan, or putting down a deposit for a secured card is the best route for you. The great thing is, all of these options can help you establish credit. Just be sure to stay disciplined with your finances missed or late payments can quickly set you back and hurt your credit score.

At Arro, we believe building credit should be simple and available to everyone. We’ve designed the Arro credit card that lets you learn, earn, and grow: all from one app.

With no hard credit checks, no deposit needed, and 1% cashback on gas and groceries, you can start improving your credit score while earning rewards at the same time.

When you're starting out, the Arro credit card limit can be as low as $50, but as you make on-time payments, it will gradually increase, helping you grow your credit line over time.

Plus, with Artie, your personal AI Money Coach, you get 24/7 support to make smarter financial decisions. Every on-time payment and lesson helps you unlock better credit health.

Thousands are already building stronger credit with the Arro credit card, which offers great features and easy-to-understand terms.

Don't just take our word for it, check out Arro credit card reviews to see how others are benefiting!

FAQs

1. How does rent reporting impact my credit score?

Rent reporting can help improve your credit score by adding your rent payments to your credit report. However, landlords aren’t required to report rent payments, so you’ll need to ask if they’re willing to do so or use rent reporting services that can add this information.

2. Can I improve my credit score without taking on debt?

Yes, you can improve your credit score without adding new debt. Consistently paying your bills on time, including rent and utilities, can help build your credit history. Services like Experian Boost allow you to add these payments to your credit report.

3. How can I tell if a credit-builder loan is right for me?

Credit-builder loans are great for people with little to no credit history. They help establish credit by locking your loan amount in a savings account and allowing you to make regular payments. If you're not already in significant debt, a credit-builder loan might be a good way to get started.

4. What are the advantages of being an authorized user on someone else's credit card?

Adding yourself as an authorized user on a family member or friend's credit card can be a quick way to boost your credit. You get the benefit of their good payment history without being responsible for the bill. Just be sure you trust them, because missed payments can affect your credit score.