Arro Team

A common question for credit cardholders is, “I accidentally went over my credit limit, what now?” Learn more about the most essential aspects of using a credit card.

Can You Exceed Your Credit Card Limit?

What Happens If You Go Over Your Credit Limit?

So, What Can Happen Next?

How Does Going Over The Limit Impact Your Credit Score?

Some Tips To Avoid Exceeding Your Limit

What To Do If You Go Over Your Limit?

How Arro Can Help?

FAQs

If you've ever found yourself near your credit card limit and had an unexpected expense pop up, you might have wondered what happens when you go over your credit limit. It's a valid concern.

In this article, Arro will walk you through what happens if you exceed your credit limit and give you some practical tips to help keep your spending in check.

Key Takeaways

Exceeding your limit can result in fees, interest hikes, and penalties.

Over-limit protection allows purchases beyond your limit, but with extra fees.

Temporary holds (e.g., at gas stations) can cause accidental overages.

Set spending alerts to avoid going over your limit.

Pay off your balance quickly to minimize negative impacts on your credit.

Can You Exceed Your Credit Card Limit?

Yes and no. Not all credit card companies allow the option of intentionally going over your limit. The ones that do and charge a fee for it must abide by the CARD Act regulations and require you, as the cardholder, to opt into their over-limit protection before letting you exceed your limit.

To add some confusion to the mix, it’s also possible to exceed your limit indirectly, even if you didn’t opt in.

How can that happen? Pre-authorizations and holds are the culprits.

When you use your card, a dollar amount is charged (pre-authorized) against your available balance (ever seen that italicized pending transaction on your online account?). That amount is temporarily placed on hold for anywhere from a few minutes to a few days. In most cases, the hold is removed when your purchase clears your account. However, holds may fall off (expire) beforehand, resulting in the purchase amount being added back into your available balance.

Now, let’s take a look at the ways you can go over your limit:

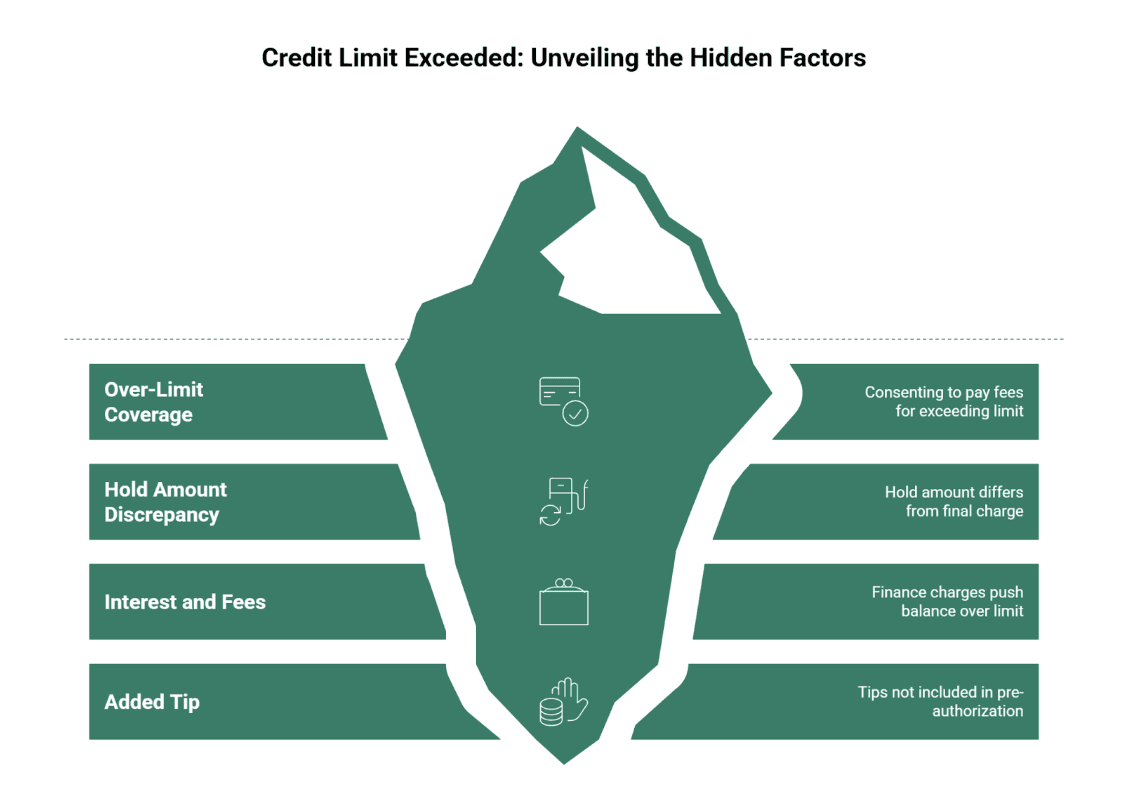

You Opted Into Over-Limit Transactions

This one’s pretty cut-and-dried; you can use your card to make purchases that push you over your limit. Basically, you consented to paying a fee for exceeding your limit by enrolling in your card issuer's over-the-limit coverage.

By opting in, you're telling the credit card company that you're okay with them approving transactions and letting you continue using your card.

Here's what that might look like: Suppose you only have $5 left to spend on your card but need to replace a blown-out tire. Because you opted in, your $100 new tire purchase can be approved, “protecting” you from being stranded. Keep in mind your credit card issuer isn’t obligated to approve purchases over your limit, even if you opt in.

The Hold Amount Was Less Than The Actual Charge

Sometimes, the hold on your card isn’t the same as the final charge. For example, you might see a $1 hold when you start pumping gas, but if your fill-up costs $50, that small hold can throw off your available balance.

‘I accidentally went over my credit limit’...Your card issuer can't charge you an over-limit fee for a temporary hold, but it’s still a good idea to keep an eye on pending charges.

You Were Charged Interest Or Fees

If you don’t pay your credit card bill in full each month and carry a balance instead, you’ll be charged interest. If your balance is already close to the limit, that finance charge can push you over the top. The same goes for things like foreign transaction fees or late payment fees.

You Added A Tip

Adding a tip to your bill instead of using cash can throw your available balance off. That’s because tips aren’t included in the pre-authorization that’s placed on your card. The hold will be for the meal or service, and the tip will show in the final amount that clears your account.

What Happens If You Go Over Your Credit Limit?

‘I accidentally went over my credit limit’...Well, the outcome will depend on whether or not you’ve opted into over-limit protection.

When you go over your limit, the outcome will depend on whether or not you’ve opted into over-limit protection.

If you do opt in, you’re subject to a fee for exceeding your limit if your transaction is approved. However, even if you’ve opted in, it doesn’t guarantee that your over-limit purchase will be approved. This is because your credit card issuer might have specific guidelines for the service, such as a maximum dollar amount or payment history.

If you don't opt into over-limit protection, it can get a little complicated. Here's why: If you try to actively use your card for purchases that would exceed your limit, your card will likely be declined. But any previously approved charges will get paid when they come through, even if they push you over your limit.

Example: you have $50 left on your card and pump $45 in gas. But the gas station only holds $1 (held or pre-authorized amounts vary by merchants), making it look like you have more available than you do. Because you're not watching your balance, you stop at the grocery store that evening and buy $45 worth of groceries. Two days later, your $45 gas purchase hits your account. The credit card company has to pay it because it was approved at the time of your purchase.

So, What Can Happen Next?

It might be tempting to max out your credit card, especially when money’s tight, but it’s essential to understand the consequences.

Your Card Could Be Declined

As mentioned above, even if you’ve opted in to exceed your limit, the card issuer doesn’t have to approve those transactions. Aside from the awkward moment when you’re denied while trying to grab a cup of coffee, you could be put in a difficult situation if you’re counting on the charge being approved and you have no other way to pay.

You’ll Be Charged Over-Limit Fees

Not all card issuers hit you with over-limit fees, but some do. If you're already struggling financially, those extra fees only make it harder to pay down your balance. And the worst part? Over-limit fees can pile up every billing cycle you're over your limit. But remember, issuers can only charge you if you’ve opted into over-limit protection.

Your Interest Rate Can Go Up

In your credit card agreement, you’ll find details about any penalties for breaking the rules. And those penalty APRs? They can be steep sometimes, up to 30%. Carrying a balance with a rate like that means more of your payment goes toward interest, making it even harder to pay down your debt. If your card issuer raises your rate, the penalty APR only applies to new purchases, not to your existing balance.

Your Minimum Payment Will Increase

On top of your regular minimum payment, you’ll also need to cover the amount you’ve gone over your limit. So, if you exceed your credit line by $150, you'll pay that $150 plus your usual minimum and possibly a fee in the next billing cycle. That can sting.

Harder To Get Approved For Future Loans

If you’re maxed out on your credit cards, lenders will notice you're stretched thin when they look at your credit report. They may think you’re struggling to keep up with your finances and could be at higher risk of missing payments, making it harder to get approved for new credit or loans.

By opting out of over-limit protection, you’re avoiding a long list of potential financial headaches and the frustration that comes with them. It’s a smart move for your wallet.

Your Credit Limit Could Decrease

Your credit card company may lower your credit line to reduce its risk. Although this most likely won’t happen after one occurrence, they might reduce your credit limit to prevent you from spending more and getting deeper into credit card debt.

Your Credit Card Could Be Closed

Your card issuer could temporarily freeze or permanently close your account if you violate its terms. If they close your card, it will shorten your credit history, which can affect your credit score, as the length of your credit history is a key factor in the calculation.

How Does Going Over The Limit Impact Your Credit Score?

Your credit card activity and balances are reported to all major credit bureaus. Exceeding your card limit is unhealthy for your credit and will definitely lower your score. Here’s why:

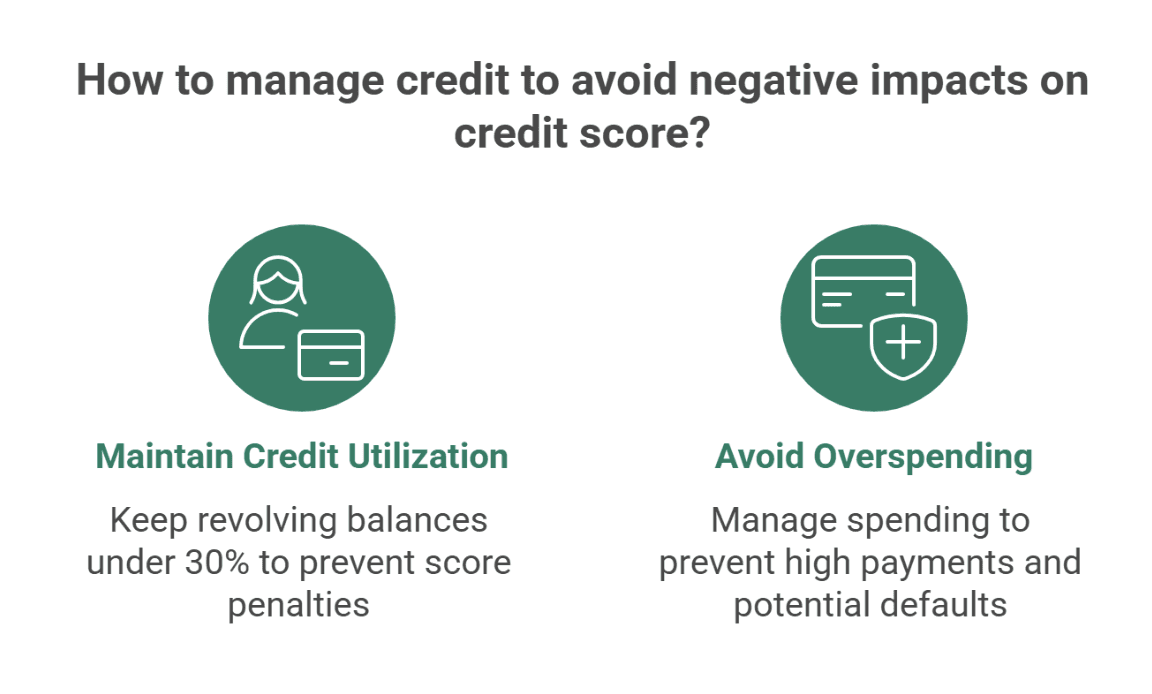

It Raises Your Credit Utilization Ratio

Going over your credit limit hurts your credit score because it raises your credit utilization ratio on revolving accounts. Simply put, you’re using a higher percentage of your available credit. Try keeping your revolving balances under 30% of your available credit to prevent your score from being penalized.

It Can Cause You To Default On Your Payments

Exceeding your limit directly impacts your required payment amount. You still owe your regular minimum payment, but you also have to pay the total amount over your limit on your next bill.

Depending on how much you overspent, that can make your payment too high for you to handle, causing you to miss payments.

Some Tips To Avoid Exceeding Your Limit

To effectively avoid exceeding your credit limit, it's essential to take charge of your finances. These are some tips on how you can prevent overspending today:

Opt out of over-limit protection. This will help you avoid fees, protect your credit score, and reduce the temptation to overspend.

Know your credit limit. Always check your credit limit before using your card to avoid exceeding it.

Set up balance notifications. You can receive alerts when your balance hits a set amount.

Build an emergency fund. Your credit card isn’t for emergencies. Save money for unexpected expenses instead of relying on your card.

Set a personal spending limit. Set a monthly budget for your credit card to keep your spending in check and protect your credit score.

Adjust your spending habits. Be mindful of your purchases and take the time to understand how your credit card works.

By staying proactive and making smart choices, you'll be able to manage your credit responsibly and avoid the stress of overspending.

Also read:

Want to Conquer your Debt? Arro Can Help

Ultimate Guide to FAFSA and Student Loans: Making sense of it all

A Beginner’s Guide to Managing Credit Cards Like the Pros

What To Do If You Go Over Your Limit?

If the thought ‘I accidentally went over my credit limit’ still haunts you here and you find yourself over your credit limit, don’t stress, just take action right away to minimize any negative effects.

Here’s what you can do if you go over your credit limit:

Pay down the balance: The sooner you pay off the amount that pushed you over your limit, the less time you'll spend in the red. This can help prevent extra fees or interest from piling up.

Request a credit limit increase: If you often find yourself nearing your limit, ask your card issuer for a higher limit. This will give you more breathing room and reduce the chances of going over in the future.

Ask about a payment plan: If you’ve gone over by a large amount, contact your card issuer to see if they can offer a payment plan. Just remember, you'll need to cover the amount over your limit along with your regular payment and possibly a fee if you've gone over by too much.

The key is to act quickly and stay on top of your spending. Taking these steps can help you avoid further complications and maintain good credit.

How Much Can You Spend Over Your Limit?

If you've signed up for over-limit protection, how much you can spend beyond your credit limit depends on your card issuer. They’ll review several factors before approving any purchases that exceed your limit, so there’s no set amount you can count on.

What if You Accidentally Exceed Your Card Limit?

If you accidentally go over your credit limit, what happens next depends on whether you’ve signed up for over-limit protection:

With over-limit protection, You’ll probably get hit with an over-limit fee. However, it’s worth reaching out to your card issuer to ask if they can waive it, some issuers may be willing to do that as a one-time courtesy.

Without over-limit protection: You won’t be charged a fee, but your transaction could get declined. You’ll need to adjust your spending to stay within your limit moving forward.

Just remember, staying aware of your spending and knowing your card’s terms can help you avoid these situations and keep your finances on track.

Should You Exceed Your Limit?

Now that you know what happens if you go over your limit, you might be wondering: Is it ever okay to exceed it? The short answer is: just because you can, doesn’t mean you should. It’s generally a good idea to opt out of over-limit protection to avoid the temptation.

The consequences of going over your credit limit are too severe to overlook. Maxing out your card can raise your interest rate, hurt your credit score, and lead to over-limit fees. So, unless it’s an absolute emergency, it’s best to stay within your limit.

How Arro Can Help?

At Arro, we think building credit should be simple and rewarding, not stressful. With no hard credit checks, no deposit required, and 1% cashback on gas and groceries, we make it easy to start improving your credit while getting something back for your everyday spending.

And with Artie, your personal AI Money Coach, you’ll get help whenever you need it, whether it’s celebrating a win or guiding you through smart financial choices. So you won’t worry that ‘I accidentally went over my credit limit’.

Each on-time payment, every lesson, and small step forward helps you unlock better credit health and higher limits. Thousands of people are already building stronger credit with Arro and having fun doing it.

Ready to take control of your credit?

Download the Arro app now and start building your credit today!

FAQs

1. Can exceeding my credit limit affect my ability to earn rewards on my credit card?

Some credit card issuers might pause your ability to earn rewards if you go over your credit limit. To keep earning rewards, it’s important to stay within your limit.

2. I accidentally went over my credit limit. How long do I have to pay it off before facing penalties?

If you exceed your credit limit, you typically need to pay the over-limit balance off by your next statement due date. Failing to do so could result in over-limit fees, interest rate hikes, and a negative impact on your credit score.

3. How can I set up a spending limit to avoid exceeding my credit card limit?

Many credit card companies let you set up spending alerts or limits through their mobile app or website. These features let you know when you're nearing your credit limit, so you can adjust your spending on the spot and avoid going over.

4. Can an over-limit fee be waived if it's my first time going over the limit?

Some credit card companies might offer a one-time waiver on an over-limit fee, especially if it’s your first time exceeding your limit. It really depends on their policies.