Team Arro

Set A Realistic Holiday Budget

Get Creative With Gift-Giving

Shop Smart: Timing And Tools Matter

DIY Decorations That Wow

Plan Budget-Friendly Celebrations

Focus On Experiences Over Things

Start A Year-Round Holiday Fund

Track Your Spending In Real Time

Your Partner In Building Financial Confidence

FAQ

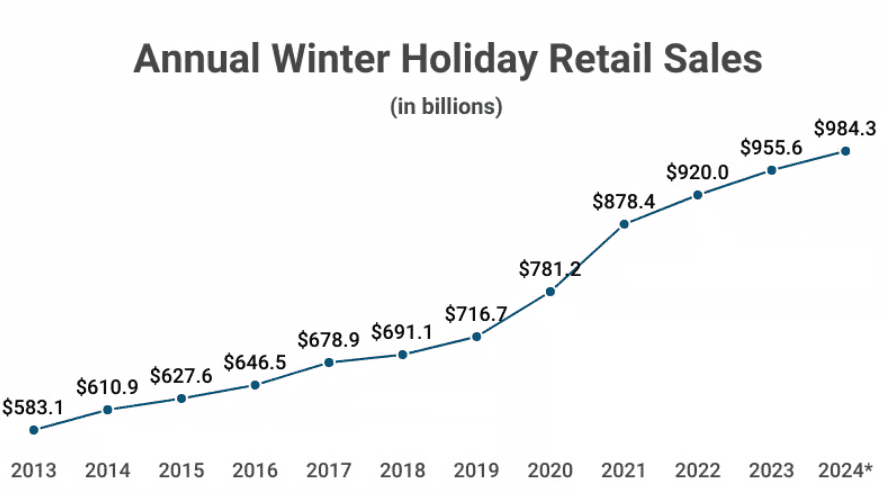

The holiday season brings joy, connection, and yes, expenses. But you don’t need to drain your bank account to create meaningful memories. With smart planning, you can fully celebratewhile keeping your finances healthy. Especially when average U.S. holiday expenditures are expected to exceed $1 trillion this year.

This guide shares practical money-saving tips for holidays that actually work. In this article, we’ll cover simple ways to budget smarter, give thoughtfully, and enjoy the season without financial stress, so you can make the most of every dollar.

Key Takeaways

Plan your holiday spending with intention; about 1% of your annual income is a solid starting point.

Meaningful gifts don’t have to be expensive; experiences, homemade ideas, and exchanges often mean more.

Holiday sales work best when you shop with a plan and skip impulse buys.

Saving a little throughout the year takes the pressure off December.

Tracking spending in real time helps you stay in control and adjust early.

Simple, shared celebrations create just as many memories as big, expensive ones.

Set A Realistic Holiday Budget

Before the holiday rush hits, take a moment to assess what you can actually afford. Your budget should reflect your financial reality, not societal pressure. In fact, consumers plan to spend around $890 per person on holiday gifts, food, and décor in 2025.

A practical approach to money-saving tips for holidays starts with allocating about 1% of your annual income toward all holiday expenses. Break this down into categories:

Gifts: 50%

Food & gatherings: 30%

Decorations: 10%

Miscellaneous: 10%

Review last year's spending if possible. Where did you splurge unnecessarily? Which purchases brought genuine joy? Use these insights to refine your current budget. Write everything down, whether in a notes app, spreadsheet, or budgeting tool, so you have a clear reference point throughout the season.

Remember: a budget isn't about restriction, it's about intention. You're deciding where your money goes instead of wondering where it went.

Get Creative With Gift-Giving

Gift-giving doesn't have to break the bank to be meaningful. In fact, some of the most cherished presents come from thoughtfulness, not price tags.

Source: Capital One Shopping

Holiday gift sales alone accounted for over 70 % of total holiday spending in recent seasons. Start by making a list of everyone you plan to shop for, then set a spending cap for each person. Stick to it.

Consider these money-saving tips for holidays when it comes to gifting:

Homemade gifts pack serious sentimental value. Think photo albums filled with shared memories, custom-scented candles, or baked goods in decorative jars. These personalized touches often mean more than store-bought items and can save you up to 50% compared to retail prices.

Gift exchanges like Secret Santa or White Elephant reduce the total number of presents you need to buy while keeping things fun. Set a reasonable price limit, $20 or $25 works well, and watch everyone get creative within those boundaries.

Experience gifts create lasting memories without physical clutter. Offer babysitting services, plan a hiking adventure, or organize a game night. Your time and presence are valuable gifts that cost little to nothing.

These approaches transform gift-giving from a financial burden into an opportunity for genuine connection.

Shop Smart: Timing And Tools Matter

When you shop, it matters as much as what you buy. Black Friday and Cyber Monday aren't just marketing hype. They offer legitimate savings if you approach them strategically. The key is planning ahead so you're not caught up in impulse purchases.

Make a list, research prices ahead of time, and use comparison tools or deal alerts to shop smarter.

Stick to your list. “Limited-time” deals create urgency, but if it’s not planned, it’s probably not worth buying.

Use cashback apps or rewards cards wisely, and always pay balances off right away to avoid interest.

Timing matters beyond Black Friday, too. Shopping early, like late October or early November, gives you more options and less stress, helping you avoid the last-minute panic that leads to overspending.

DIY Decorations That Wow

Transform your space without breaking the bank by getting creative with decorations. Before buying anything new, dig out what you already have from previous years. You'd be surprised how fresh old decorations can look with a little rearranging or updating.

Making Your Own Decorations

It is easier than you think and can become a fun activity with family or roommates. Create garlands from paper, pinecones, or even popcorn. Craft wreaths using materials from nature walks or dollar store supplies. Design ornaments from salt dough, felt, or recycled materials.

Organize A Decoration Swap

Do it with friends or neighbors. Trade items you're tired of for something new-to-you. It costs nothing, and everyone gets a refreshed look for the season. Shopping post-holiday clearance sales for next year is another winner, save up to 75% on quality decorations.

These money-saving tips for holidays prove you don't need a massive budget to create a festive atmosphere, and DIY decorations often carry more meaning than store-bought ones anyway.

Plan Budget-Friendly Celebrations

Holiday gatherings don't require fancy venues or catered meals to be memorable. Host a potluck at home and have everyone contribute a dish. In one survey, 82 % planned to save on everyday essentials to fund holiday celebrations and experiences. This spreads the cost, reduces your workload, and adds variety to the menu. Most people are happy to bring something, especially when it means celebrating together.

For entertainment, skip expensive activities and focus on connection. Organize holiday movie marathons, cookie decorating competitions, game nights, or carol sing-alongs. These activities cost little to nothing but create the warm, festive atmosphere everyone craves.

If travel is part of your holiday plans, book as early as possible to secure better prices. Consider alternative dates. Flying a day or two before or after peak times can save hundreds. Look into staying with family or friends instead of hotels, or explore home-sharing options that offer more space for less money.

The best money-saving tips for holidays around celebrations focus on what truly matters: time with loved ones, proving that simple gatherings are often the most meaningful.

Focus On Experiences Over Things

Material gifts lose their shine quickly, but experiences create lasting memories. This shift in perspective is one of the most valuable money-saving tips for holidays you can adopt. Instead of buying yet another gadget or clothing item, plan activities that bring people together.

Plan simple experiences like ice skating, visiting a holiday market, or taking a walk to see neighborhood lights.

Host cozy at-home activities, such as a holiday movie marathon with homemade popcorn and hot chocolate.

Spend time baking cookies or building gingerbread houses together, and let everyone add their own touch.

For kids, especially, these shared moments often mean more than gifts that are quickly forgotten.

Experience-based celebrations also eliminate the clutter problem, no wrapping paper waste, no storage issues, no returns, leaving you with photos, stories, and stronger connections with the people you care about.

Start A Year-Round Holiday Fund

One of the smartest money-saving tips for holidays is to plan way ahead. Instead of scrambling in December, start setting aside small amounts each month beginning in January. Even $50 per month adds up to $600 by the holidays, significantly reducing financial stress.

Automate this process by setting up a separate savings account specifically for holiday expenses. Schedule automatic transfers from your checking account each payday. When the money moves automatically, you won't miss it, and you won't be tempted to spend it on other things.

Some banks offer holiday savings accounts that lock your money until a specific date, which can help if you struggle with dipping into savings. Others provide small interest boosts for consistent deposits. Explore your options and choose what works best for your situation.

Starting your holiday fund now means next year's celebrations are already covered, letting you shop without guilt and celebrate without worry.

Track Your Spending In Real Time

Even the best budget fails if you don't track your progress. Keep tabs on every holiday purchase as it happens. Use a budgeting app, a simple spreadsheet, or even a dedicated notebook, whatever method you'll actually stick with.

Real-time tracking lets you see exactly where you stand at any moment. Spent too much on gifts for one side of the family? You'll know how to adjust spending for others before it's too late. Noticed decorations eating up more budget than planned? Pause and reassess before buying more.

The goal isn't perfection, it's awareness and the ability to course-correct before small overspending turns into financial stress.

Also Read:

How to Build Credit Without a Credit Card: Steps to Get Started

Your Guide to Understanding a Payment Due Date vs. Closing Date on Credit Cards

Start Smart: A Beginner’s Guide to Understanding Your Starting Credit Score

Your Partner In Building Financial Confidence

The holidays are about connection, joy, and celebrating what matters most, and none of that requires going into debt or draining your savings.

That’s why now you can integrate the Arro app with your bank accounts and credit cards to see the dynamics of your spendings in simple terms.

See what your average spending looks like, get suggestions from your AI financial coach Artie, and see where you can improve your budgeting skills.

Learn more about the budgeting feature

Why Choose Arro?

At Arro, we believe building credit shouldn't be confusing, expensive, or out of reach. That's why we've created a credit card that supports you in learning, earning, and growing, all within one simple app.

With no hard credit checks, no deposit required, and 1% cashback on gas and groceries, Arro makes it easy to start improving your credit while rewarding your everyday spending.

Every on-time payment, every lesson completed, and every small step forward helps you unlock higher credit limits and better credit health. Thousands of people are already building stronger credit with Arro, and having fun doing it.

Ready to start your own journey? See how easy it can be to build credit with confidence.

Download the Arro App

FAQ

What are the best money saving tips for holidays if I'm on a tight budget?

Start by setting a realistic spending limit based on what you can actually afford, not what you think you should spend. Focus on homemade gifts, organize gift exchanges to reduce the number of presents needed, and prioritize free or low-cost experiences over expensive material items. Track every purchase in real time to stay accountable.

How much should I budget for holiday expenses?

A practical guideline is to allocate about 1% of your annual income toward all holiday costs. Break this into categories: 50% for gifts, 30% for food and gatherings, 10% for decorations, and 10% for miscellaneous expenses. Adjust these percentages based on your priorities and circumstances.

When is the best time to shop for holiday gifts?

Black Friday and Cyber Monday offer significant discounts if you shop strategically with a prepared list. However, shopping in late October or early November often provides the best combination of selection, pricing, and stress-free decision-making. Avoid last-minute shopping, which typically leads to impulse purchases and overspending.

How can I save money on holiday decorations?

Reuse decorations from previous years, create DIY projects using inexpensive materials like paper and pinecones, or organize decoration swaps with friends. Shopping post-holiday clearance sales for next year can save up to 75% on quality items. The key is getting creative rather than buying everything new.

What's the easiest way to avoid holiday debt?

Start a dedicated holiday savings fund early in the year by automatically transferring small amounts monthly. Use cash or debit for purchases instead of credit cards, track all spending in real time, and stick firmly to your predetermined budget. If you do use credit cards for rewards, pay off balances immediately.

Are homemade gifts really acceptable for adults?

Absolutely. Thoughtful homemade gifts like photo albums, baked goods, or handcrafted items often carry more sentimental value than expensive store-bought presents. The key is putting genuine thought and effort into creating something personal. Most people appreciate the time and care more than the price tag.

How do I handle holiday expenses when I have no savings?

Start small by identifying one or two people to prioritize for gifts and communicating honestly with others about your situation. Focus on free experiences, homemade presents, or gifts of time and service. Consider earning extra income through seasonal work or selling unused items to create a small holiday budget.

What are some budget-friendly holiday activities for families?

Organize movie marathons at home, visit free holiday light displays, bake cookies together, host game nights, or plan outdoor activities like sledding or ice skating at public rinks. These cost little to nothing but create meaningful memories. Potluck gatherings with friends also spread costs while maintaining the festive atmosphere.

How can I politely suggest a gift exchange to reduce costs?

Be direct and honest: "Hey, I'd love to celebrate together this year. How about we do a Secret Santa with a $20 limit so everyone gets a gift, but we're not all stressed about buying for everyone?" Most people appreciate the suggestion, as many feel the same financial pressure but hesitate to speak up first.