Step 1: Why Your Rental History Actually Matters

Step 2: Your Best First Move Is On-Time Payments

Step 3: How Rent Reporting Credit Tools Work

Step 4: What To Do If You Don’t Have A Co-Signer

Step 5: Habit-Based Credit Building That Sticks

Step 6: What To Check Before You Pay For Rent Reporting

Step 7: Rent Reporting VS. Credit Cards

Small Steps, Big Credit Wins With Arro

FAQs

If you rent, you already know the drill: income checks, background checks, and credit checks. Sometimes it feels like everything gets inspected except the thing you’re actually consistent with: paying your rent on time.

And if you’ve ever been turned down for an apartment because your credit file was too thin, or asked for a co-signer you didn’t have, you’re definitely not the only one.

Roughly 44 million households in the U.S. rent. For newcomers, the challenge is even bigger; many arrive with zero U.S. credit data, even if they handled bills responsibly in their home country.

In this article, we will walk through simple, practical moves renters can use to build credit, including on-time payment habits, rent reporting credit tools, and co-signer alternatives. Our goal is to give you a clear, calm starting point so you can build a credit profile that actually reflects the responsibility you already show every month.

Key Takeaways

Renters can build credit without depending on landlords or co-signers.

Rent reporting credit services help your rent show up on your credit file.

On-time payments remain the strongest factor in your credit score.

Newcomers and Gen Z renters benefit most from added tradelines.

Simple, consistent habits build long-term credit strength.

Step 1: Why Your Rental History Actually Matters

For most renters, the monthly rent payment is the most significant bill they pay. Yet for decades, it didn’t count toward credit scores. That meant renters kept paying on time, month after month, and still had to “start from zero” whenever they applied for an apartment, a credit card, or even a small loan.

That’s finally beginning to shift.

More renters now use tools that let their on-time rent payments show up on their credit reports, often called rent reporting credit services. Instead of taking on a new loan or opening another account, renters can build credit using a bill they already pay. For anyone new to the U.S. credit system or still early in their journey, this additional history can help fill gaps that traditional credit data often misses.

A stronger rental payment record can make a real difference when navigating things like:

rental applications

lower interest rates

credit card approvals

long-term financial stability

Rent may not have counted in the past, but today it can play a meaningful role in helping you show the financial responsibility you already practice every month, and that’s a solid place to begin.

Step 2: Your Best First Move Is On-Time Payments

Before trying any credit-building tools, the most powerful habit you can build is simple:

Paying your bills on time.

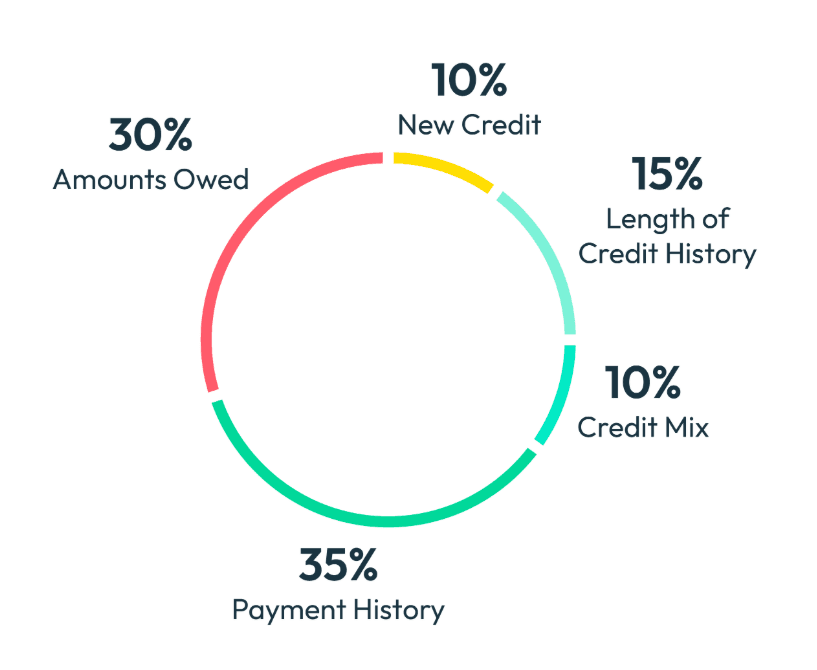

Source: FICO

Payment history makes up to 35% of your credit score, so consistency matters more than anything else. Every on-time payment helps show a steady pattern of responsibility, the kind landlords and lenders look for.

And this doesn’t just apply to credit cards. Your regular bills play a part in shaping healthy habits, too, including:

phone bills

utilities

streaming services

buy now/pay later plans

and eventually, reported rent

A steady streak of on-time payments creates momentum, even if you’re just getting started or rebuilding from scratch. It’s one of the simplest ways to strengthen your credit foundation, one month at a time.

Step 3: How Rent Reporting Credit Tools Work

This is usually the moment renters lean in a little. Rent is your biggest monthly payment, so why doesn’t it help your credit on its own?

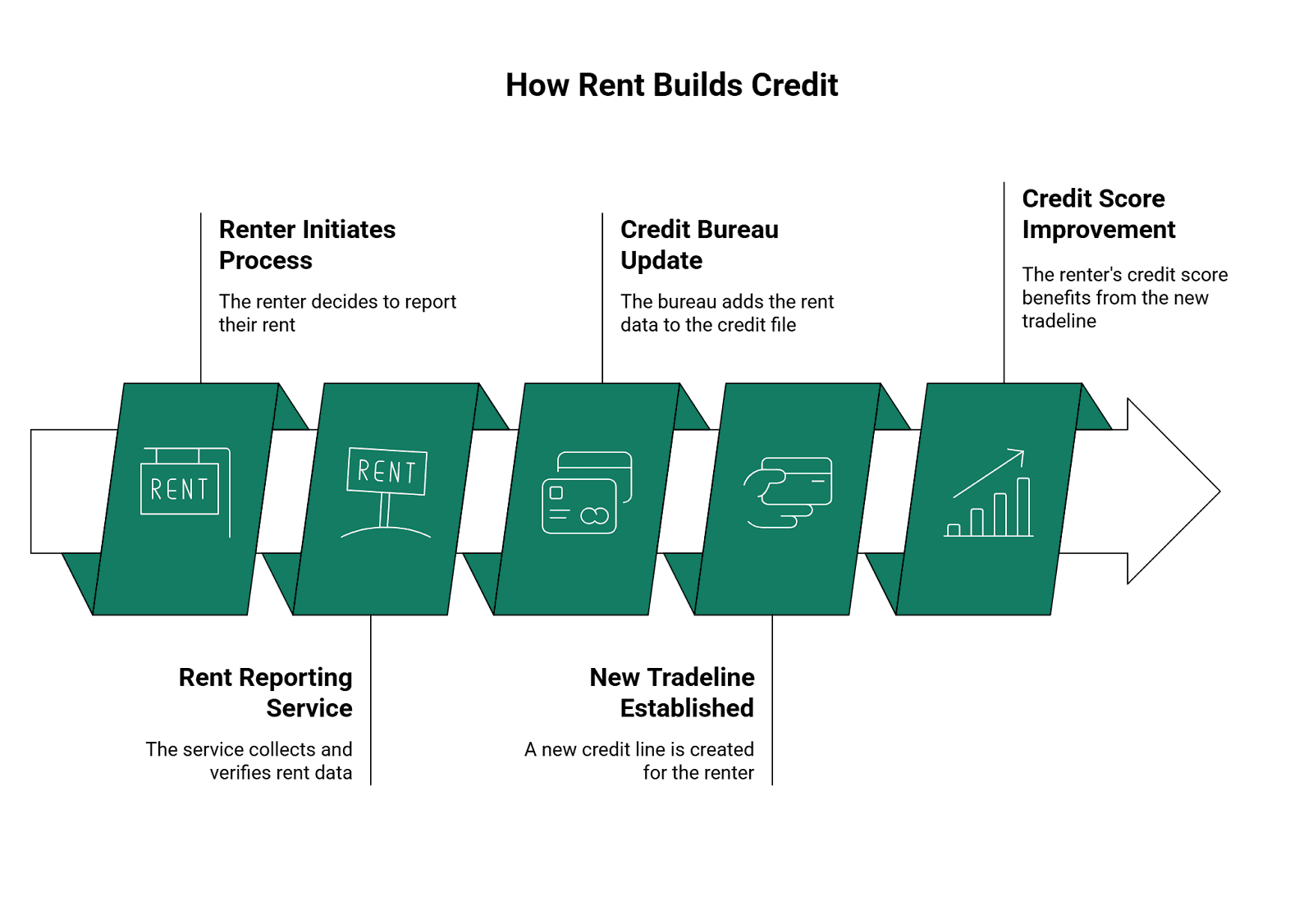

Most landlords don’t report rent to the credit bureaus, which is why rent reporting credit services exist. They step in as the “middle layer” to ensure your on-time payments are actually recorded.

Here’s what the process usually looks like:

You sign up for a rent reporting service

You verify your rental payments (often through bank records or receipts)

The service sends those payments to one or more credit bureaus

A new tradeline appears on your credit report

Over time, your consistent rent payments help strengthen your credit file

It’s a simple concept, but for many people, it fills the biggest gap in their credit journey.

Who Benefits The Most?

renters with no credit history

newcomers building U.S. credit from scratch

people with thin credit files

anyone who wants their largest monthly payment to finally “count”

Rent reporting credit doesn’t replace healthy habits, but it can give renters a meaningful head start, especially when their financial responsibility hasn’t been visible on paper until now.

Step 4: What To Do If You Don’t Have A Co-Signer

A lot of younger renters or newcomers get told the same thing: “Just ask someone to co-sign for you.” But that’s not possible for everyone, and the good news is, it’s not your only path forward.

Here are simple ways to build credit on your own:

Starter credit cards: Small limits, easy to manage, and great for building a repayment history.

Secured cards: You put down a deposit, use the card like normal, and build credit as you pay it off.

Utility or phone bill reporting: Some services let everyday bills show up on your credit file.

Rent reporting credit: Helps your biggest monthly payment work harder for you without adding debt

Autopay: A quiet hero. It keeps your streak going and helps prevent late payments.

You don’t need a co-signer to start building credit; you just need a few consistent steps that move you forward.

Also Read:

Arro Credit Card: Increase Your Odds of Passing Tenant Credit Checks

How to Build Credit: Your Complete Guide to Building Credit from Scratch

Want to Conquer your Debt? Arro Can Help

Step 5: Habit-Based Credit Building That Sticks

No matter what tools you use, a credit card, rent reporting credit, or both, your everyday habits make the biggest difference. Credit grows through consistency, not perfection.

Here are simple habits that work for renters at any stage:

Keep your balances low: Using less than 30% of your limit helps keep your score healthier.

Pay a little early when you can: It gives you breathing room if life throws something unexpected your way.

Track your progress: Even small improvements feel motivating when you can see them.

Learn in small bites: Short lessons or tips make credit feel easier, not overwhelming.

Celebrate the small wins: A few months of on-time payments or a lower balance is real progress.

These habits might look small, but they stack up and over time, they help your credit grow in a steady, sustainable way.

Step 6: What To Check Before You Pay For Rent Reporting

Before paying for one, make sure you understand the basics so you know exactly what you’re signing up for.

Start with cost. Some services charge a monthly fee, others add setup costs, and a few charge extra if you want past rent reported. It’s worth knowing the full price upfront.

Then look at what gets reported. Some providers only send on-time payments to the credit bureaus, while others include late payments, too. You should also check which bureaus they report to, since not all services cover the same ones.

Consider how the service verifies your rent. Certain tools require landlord involvement, while others let you self-report. If you'd rather not bring your landlord into the process, choose one that allows independent verification.

If you’ve been renting for a while, see whether the service offers retroactive reporting. Some allow up to two years of past payments, which can help strengthen a thin credit file.

And finally, check how easy it is to cancel. A service that lets you opt out without hassle is always a plus.

Rent reporting can be useful, especially if you're early in your credit journey, but it's not a requirement. The right service should fit your budget, your comfort level, and your goals.

Step 7: Rent Reporting VS. Credit Cards

There isn’t a perfect order for everyone; it really depends on where you’re starting from and what feels manageable for you right now.

If you want to build credit without taking on new debt, rent reporting can be an easier first step. It’s helpful for people who are brand-new to the U.S. credit system or haven’t opened any accounts yet. Using your rent, a bill you already pay, can make the early stages of credit building feel less intimidating.

On the other hand, starting with a credit card makes sense if you want rewards, cashback, or more control over what gets reported. A card also helps build other parts of your credit profile, like credit mix and utilization, which rent reporting alone doesn’t cover.

Many renters end up using both over time. Rent reporting adds a tradeline based on your largest monthly payment, while a credit card adds payment history and helps shape your overall credit habits. When they work together, they can create a more rounded and steady path toward building credit.

Use the option that fits your situation first, and remember, you can build from there at your own pace.

Small Steps, Big Credit Wins With Arro

Building credit as a renter doesn’t have to feel confusing. With steady habits, on-time payments, rent reporting credit tools, and a few beginner-friendly alternatives to co-signers, you can build real momentum, even if you’re starting from scratch. Your rent already shows responsibility; credit just needs a way to reflect it.

Arro is designed to make that process easier. There’s no hard credit check to get started, no deposit, and 1% cashback on everyday essentials. Inside the app, you learn in small steps, track your credit progress, and get support from Artie, your 24/7 AI Money Coach who can answer questions, break things down, and cheer you on. Everything is built to help you understand what to do, stay consistent, and see your credit grow over time.

Small steps add up, and you don’t have to figure them out alone.

Start building credit with clarity and confidence.

Download the Arro app and take your first step forward.

FAQs

1. Can rent reporting affect my credit score if I move to a new apartment?

Yes. When you move, your rent reporting service can continue reporting payments as long as you update your new lease details. Your tradeline doesn't disappear; it simply reflects a new address and continues building history as you make on-time payments.

2. Will rent reporting help if I already have some negative marks on my credit?

It can. Rent reporting won’t erase past negative items, but adding a consistent stream of on-time rent payments can strengthen the “positive” side of your credit file. Over time, steady payments help balance out older issues as they age and carry less weight.

3. Can roommates use rent reporting individually, or does everyone need to sign up?

Roommates can choose individually. Rent reporting only tracks your portion of the rent as verified through your payment method or bank records. Your roommate’s decision to use (or not use) rent reporting won’t affect your credit file.

4. Does rent reporting help build credit if I pay rent through apps like Venmo or Zelle?

Yes, most rent reporting services accept digital payment proof, including screenshots or bank statements showing app transfers. As long as the payment clearly shows who paid, who received it, and the amount, it can typically be verified.

5. How long does it take before rent reporting shows any results?

Rent reporting usually appears on your credit report within a few weeks, depending on the service and bureau. While you may not see an immediate score change, most people start noticing their tradelines’ impact after a few months of consistent payments.