Arro Team

Looking for your next place, but stuck at credit checks? The Arro Card is your go-to credit card for building credit and achieving a strong score to pass tenant screenings and landlord checks, without a cosigner.

Tenant Application And Credit Checks

What’s Included In A Rental Credit Check?

What Is The Biggest Challenge For First-Time Renters?

Arro Card & App: Build Credit Responsibly

What Is The Path To Passing Credit Checks For Rental Applications?

Your Path To Rental Approval Starts Here

FAQs

In fact, the average tenant has a credit score of around 650, and recent analysis shows that more than 5 million rental applications found the average U.S. renter's credit score was 638 in 2020. If you're wondering how to pass a rental credit check, the key is to build strong credit that demonstrates to landlords you're financially responsible.

Arro can help you build strong credit and improve your chances of being approved for your next rental!

In this article, we'll walk you through what landlords look for in tenant credit checks, how credit impacts your rental application, and most importantly, how the Arro Card helps you build the credit needed to pass these screenings with confidence.

Key Takeaways

A strong credit score is essential to pass tenant credit checks and secure rental approval.

Arro Card offers a no-deposit, low-credit-limit starting point, perfect for those new to credit or rebuilding it.

Using Arro responsibly, making on-time payments, and using the app to learn about credit helps build your credit score and improve your chances of rental approval.

Arro reports to all three major credit bureaus, ensuring your positive payment history is visible to landlords.

The Arro app offers personalized financial coaching to help you understand and manage your credit effectively.

You can increase your credit limit by demonstrating responsible use and completing educational activities in the Arro app.

Tenant Application And Credit Checks

When you apply for a rental, your credit score can be a game-changer. Landlords use credit checks to gauge whether you're financially responsible and likely to pay rent on time. A solid credit score shows them you’ve got your finances in order, which gives them confidence in you as a tenant.

But if your score is low, it may raise a red flag, prompting them to worry about late payments or other risks.

While landlords consider several factors when making their decisions, your credit score is one of the biggest influences. It’s often the deciding factor that determines whether your application moves forward or hits a roadblock.

So, how do you pass that rental credit check with flying colors? It starts with understanding what landlords are really looking for and the red flags they watch out for.

Knowing this can help you take the proper steps to build or improve your credit, so you can feel confident that when you apply for that dream rental, you’ve got your best foot forward.

What’s Included In A Rental Credit Check?

Most property owners/landlords check tenants' credit, often through one of the three major U.S. credit reporting agencies: TransUnion, Experian, or Equifax. Landlords run credit checks to take a deeper look into your financial background as a potential tenant. Landlords also use background checks.

Property managers & landlords have access to a lot of critical information about you through these checks that could include:

Job history

Verification of social security number

Credit score checks

Payment records

Signs of potential fraud

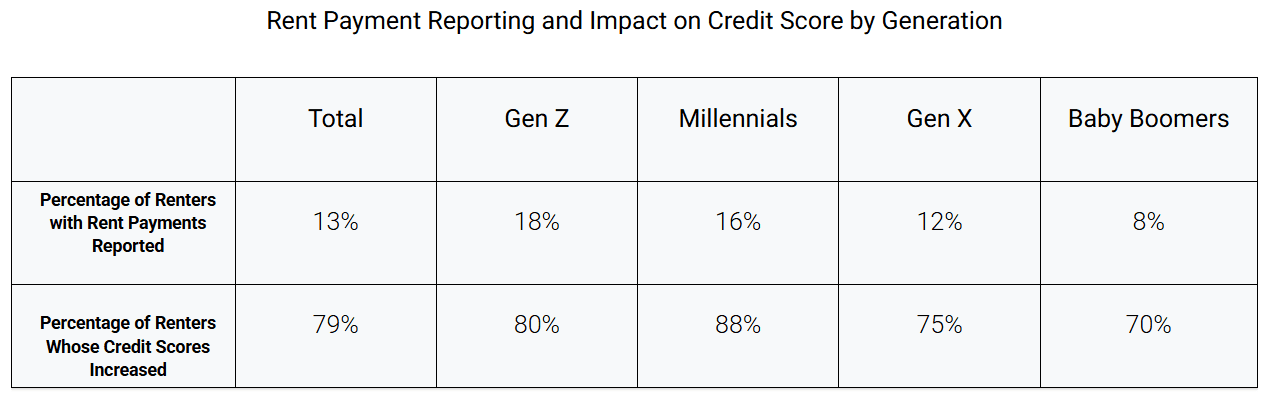

The share of consumers whose rent payments were reported to credit bureaus rose to 13% in 2025, up from 11% in 2024, showing that rental payment history is becoming increasingly important in your overall credit profile.

Source: TransUnion

Property managers & landlords are on the lookout for warning signs that you, as a renter, may struggle to make rent payments on time or pose a risk to community safety. The warning signs that landlords may determine are red flags include:

Bad or weak credit score / No credit score

Repeated delays in payments (credit & paying rent)

Any evictions

Bankruptcy filings

Excessive use of available credit lines (aka utilization)

Learning how to pass a rental credit check means addressing these potential red flags before you apply.

What Is The Biggest Challenge For First-Time Renters?

If you're a first-time renter, student, or simply new to credit cards, the need for a credit history can seem like a massive barrier.

Ever wonder, "How can I build a credit history when most cards need a credit check, and I need good credit for things like renting an apartment?" It's a common obstacle that can delay or even halt your housing search, often requiring a lease cosigner. In fact, 15% of American household renters were behind on their rent payments, highlighting why landlords take credit checks so seriously.

Asking yourself ‘Will I pass tenant referencing’ depends mainly on your credit history, which is why building credit early is so important.

Arro Card & App: Build Credit Responsibly

The Arro Card is designed with you in mind, especially if you're just starting your credit journey, getting your first credit card, or looking to improve your credit score.

With Arro, you start with an initial $50-$300 credit line and only a soft credit inquiry to begin building your credit, which is crucial for passing tenant screenings & credit checks when applying for a rental.

Credit Based On Your Bank Account, Not Your Credit Score

When you apply for an Arro Card, Arro checks your bank account instead of your credit score. We understand that everyone starts somewhere, and many who have never had a credit card or don't qualify for traditional credit cards may not disclose the full story and shouldn't be barred from starting or improving their credit.

Arro offers a credit card that gives you a fair chance to start building your credit and helps you secure life's essentials like housing.

This approach is essential for those learning how to pass a rental credit check when they don't have established credit yet.

No Credit History Required

For those who haven't applied for a credit card and don't have any credit history, the Arro Card is a great starting point! It's designed to help you begin your credit journey in a low-pressure environment, starting at $50- $300 and increasing with a track record of on-time payments. It also includes mini-activities in the Arro app that help you understand the basics of Credit and Finance, with no prior experience required to apply.

Building A Great Credit Score

By using the Arro Card responsibly, making purchases, and paying off your balance on time, you'll start building a positive credit history. With a track record of on-time payments and crushing those in-app mini lessons, Arro gives you opportunities to reduce your interest rate, increase your line of credit, and build up that credit score through completing in-app lessons and paying your credit balance on time.

Arro reports to all three major credit bureaus, ensuring that your good financial habits contribute to your overall credit score and that your future landlords will be able to see your great track record when evaluating how to pass a rental credit check.

What Is The Path To Passing Credit Checks For Rental Applications?

On-time payment on your Arro Card can boost your credit score, making you a top pick for landlords. Show off your financial smarts, build your credit score, and get the thumbs-up for your dream rental.

With rental markets becoming more competitive and the Wall Street Journal reporting that rental application fraud increased by approximately 40% between 2023 and 2024, landlords are scrutinizing applications more carefully than ever. Having a solid credit history through responsible use of the Arro Card helps you stand out as a trustworthy applicant.

Mastering how to pass a rental credit check comes down to three key factors: consistent on-time payments, low credit utilization, and a positive payment history, all of which the Arro Card helps you build.

Also read:

Start Smart: A Beginner’s Guide to Understanding Your Starting Credit Score

Your Guide to Understanding a Payment Due Date vs. Closing Date on Credit Cards

It’s All About the Plastic: Charge Card vs. Debit Card vs. Credit Card

Your Path To Rental Approval Starts Here

Building strong credit isn't just about meeting a number; it's about creating a solid foundation of financial responsibility that unlocks new opportunities. In today’s competitive rental market, a solid credit history is essential to securing approval for your dream apartment. With landlords scrutinizing applications more closely than ever, it's more important than ever to have your credit in top shape.

That's where the Arro Card comes in. It’s the perfect tool to help you build your credit from scratch, with no prior history needed. With an introductory credit line of $50–$300, you can start creating immediately. Plus, no security deposit is required to get started, just straightforward access to credit. Additionally, you can track your progress, learn about credit, and build financial confidence, all in one app with Artie, your AI-powered money coach.

Thousands of people are already building better credit with Arro, and you can join them today. From instant access to credit and 1% cashback on gas and groceries to ongoing educational support, Arro is designed to make credit building easy, rewarding, and fun.

Ready to start your own journey? Start building the credit that will help you get approved for your dream rental, and much more!

FAQs

How long does it take to build enough credit with Arro to pass a rental credit check?

Most Arro users begin to see positive changes within 2-3 months of consistent on-time payments. Since Arro reports to all three major bureaus monthly, your responsible credit behavior gets recorded regularly. Many landlords look for at least 3-6 months of positive credit history, so starting early gives you the best advantage.

Can I use my Arro Card to show landlords I'm financially responsible?

While the Arro Card itself is a credit-building tool, your responsible use demonstrates financial responsibility to landlords. They'll see your positive payment history through credit bureaus, which strengthens your application. You can also show your Arro app during conversations with private landlords to demonstrate your commitment to building better money habits.

What happens if I miss a payment on my Arro Card before applying for an apartment?

Missing a payment can affect your credit score and your chances of being approved for a rental. However, Arro provides payment reminders and autopay options to help prevent this. If you do miss a payment, contact Arro's support team immediately and get back on track quickly. Focus on establishing a pattern of on-time payments going forward, as landlords typically consider overall payment patterns rather than isolated incidents.

Does having a higher credit limit from Arro help with rental applications?

Yes! A higher credit limit helps in two ways. First, it lowers your credit utilization ratio, which is a major factor in your credit score. Second, it demonstrates that a financial institution extends you additional credit, which signals to landlords your responsibility. With Arro, you can increase your credit limit by completing financial education lessons and making on-time payments.

Should I wait until my credit score reaches a certain number before applying for apartments?

While most landlords prefer scores of 620-650 or higher, don't wait too long if you need housing. Start applying when you've established at least 3-6 months of positive credit history with Arro. Many private landlords are more flexible than large property management companies and will consider your complete financial picture, including recent positive payment history and your commitment to financial education through Arro.