How Is My Credit Limit Determined?

How Does Requesting A Credit Limit Increase Work?

Short-Term Impact On Your Credit Score

Long-Term Impact On Your Credit Score

Boost Your Credit Limit And Your Credit Score

The Simple Way To Increase Your Credit Limit

FAQs

You may have heard about credit limit increases, but how do they work, and do they actually help your credit score? How do you know if you need a higher credit limit, and is too much credit ever a bad thing? Knowing when to request a credit increase is a common question among many cardholders, and it's important to understand the process.

Credit cards can be a great way to build credit and establish financial autonomy. But as you're just getting into the world of credit, it can feel overwhelming trying to understand all the nuances and potential impacts of your every move. One question is whether requesting a credit limit increase will hurt your score.

In this blog, we’ll explore the pros and cons of increasing your credit limit, how lenders handle requests, its short-term impact on your credit score, and tips for managing it wisely. If you're wondering when to request a credit increase or how to manage it wisely, read on for some helpful insights.

Key Takeaways

Requesting a credit limit increase is simple, but understanding the impact on your credit score is key.

A higher credit limit can help improve your credit utilization and score if used responsibly.

Knowing when to request a credit limit increase is just as important as how to do it.

Short-term dips in your credit score from hard inquiries will recover with responsible credit use.

How Is My Credit Limit Determined?

To get a good understanding of credit limit increases and their impact, let's take a quick dive into how lenders determine your limit. Your credit limit is the maximum amount of money you can borrow at one time. Card issuers set your limit based on several factors, including your payment history.

Consistently paying your bills on time can lead to a higher limit. The issuer will also consider the number of accounts you have open, your available credit compared to how much you owe, and your income to ensure that you can afford your monthly payments. Given that about 46% of US households carry credit‑card debt, demonstrating a stable payment history and manageable balances signals responsible use to issuers.

Credit card companies have their own criteria for setting limits, but a good credit score and responsible borrowing can improve your chances of getting a higher limit. However, a higher limit doesn't mean you should borrow more than you can afford.

Responsible credit use is essential for maintaining a healthy credit score and finances. If you're wondering when to request a credit increase, start by focusing on these key factors.

How Does Requesting A Credit Limit Increase Work?

First and foremost, yes, you absolutely can ask for a credit limit increase. Many credit card issuers make it easy with an online request process that takes just a few minutes. When you request an increase in your credit limit, lenders take a detailed look at your financial history. Factors like payment history, the ratio of debt to available credit (credit utilization), and the date of your last hard inquiry all play into whether you receive a positive response from lenders.

If your accounts are in good standing and you meet the requirements, lenders will likely approve your request for an increase. But if any red flags arise during their due diligence, they may deny your request. Understanding when to request a credit increase involves ensuring these aspects are in check.

When Should I Ask For A Credit Limit Increase?

Demonstrating responsible use of your credit, you'll show the issuer that you're a reliable borrower and may be eligible for a credit limit increase.

Boost your chances of approval by paying more than the minimum and keeping your credit utilization low.

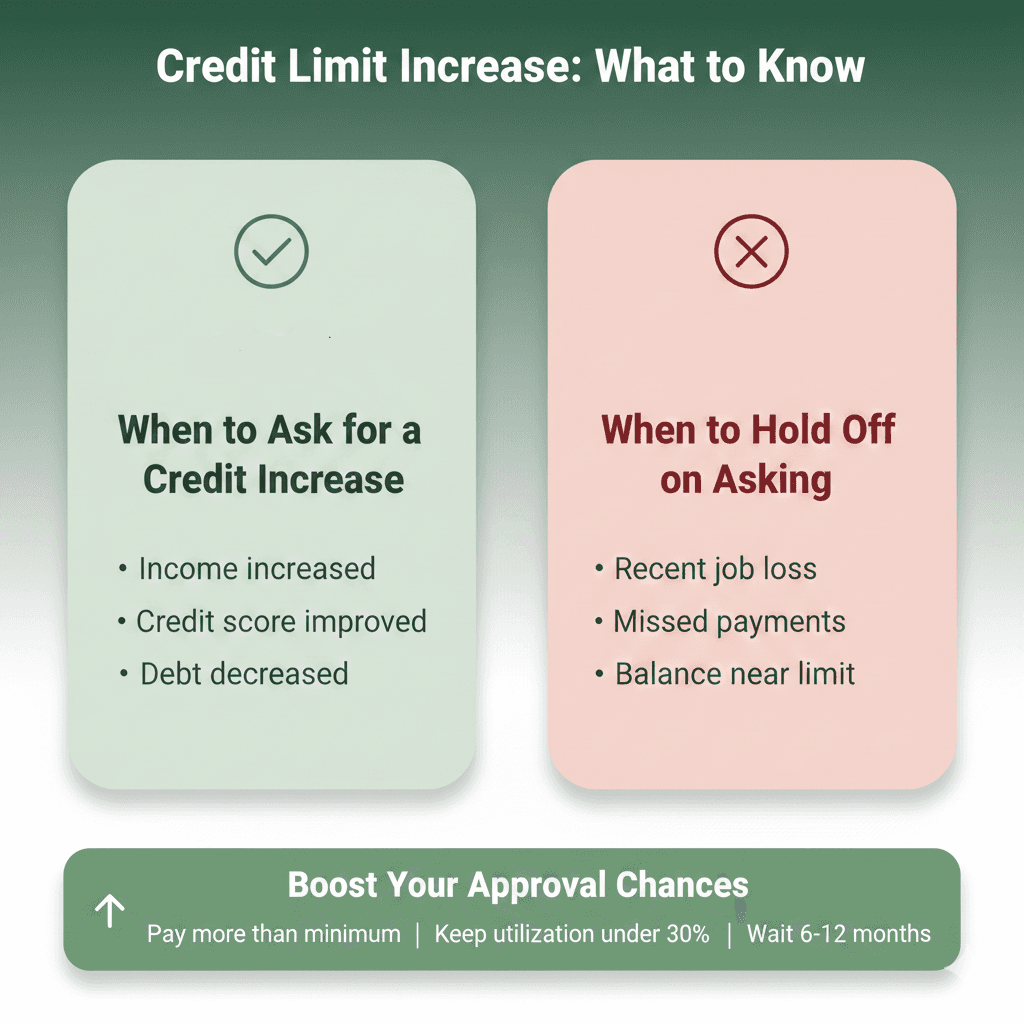

If you want to increase your chances of success when requesting a credit limit increase, it's advisable to wait until something positive has happened since you obtained your card, such as:

An increase in your household income

An increase in your credit score

A decrease in your overall debt

On the other hand, if you've recently experienced a job loss or income reduction, missed a payment, or paid less than the minimum, it's not recommended that you apply for an increase. Also, if your balance is at or near your credit limit, or you've recently opened a new line of credit, it may be best to wait. Knowing when to request a credit increase is easier once these factors are in your favor.

Even once you have a strong credit history, you may find that the card issuer offers you a lower credit limit than you were expecting when opening a new card. However, after consistently making one-time payments for 6-12 months, you may be eligible for a credit limit increase. To increase your chances of approval, pay more than the minimum required and keep your current utilization below 30%.

Short-Term Impact On Your Credit Score

Some lenders do a hard inquiry, and some do a soft inquiry when deciding on your credit limit increase. A hard inquiry is reflected on your credit report and might result in your score decreasing in the short term, whereas a soft inquiry will not be shown on your credit report. Lenders should notify you if they plan to conduct a hard inquiry before you request a credit limit increase.

When a lender initiates a hard credit inquiry for your credit increase request, it can temporarily cause your score to dip by a few points. That said, if you have good standing with lenders and consistently pay balances on time, any short-term dips should recover quickly. If you're asking, does requesting a credit increase hurt? Knowing this potential short-term impact is essential so you're prepared.

The long-term impact of requesting a credit increase is dependent on how responsibly you manage the new access to credit that's been granted to you. If you use this additional credit wisely (e.g., make payments on time, keep balances to a minimum), it can help your score over time. This is because lenders want to see that you can manage credit responsibly and avoid overextending yourself with too much debt. If you've been thinking about when to request a credit increase, keep these best practices in mind to maintain a positive financial trajectory.

Long-Term Impact On Your Credit Score

In the long term, having access to more credit can be a handy tool in managing finances, as long as you use it wisely. Make sure to always make payments by your due dates and keep your balances as low as possible so that lenders know you're attentive to your credit and using any additional credit responsibly.

This will demonstrate to them that you are a financially responsible individual who takes credit seriously, which can positively impact your overall credit score.

Pay on time: Timely payments demonstrate to lenders that you manage your credit responsibly, which is key when determining when to request a credit increase.

Keep balances low: Managing your balance is crucial. By keeping your credit card balance low, you demonstrate your ability to handle higher credit limits responsibly.

Lower credit utilization: Using a lower percentage of your available credit can boost your score and is an important step in determining when to request a credit limit increase.

The most significant positive impact on your credit score will be a lower credit utilization ratio. Keep your credit card balances low by making multiple small payments throughout the month and paying off your full statement balance each month.

You'll have lower utilization in the long term, which will increase your credit score, as it shows lenders that you can responsibly handle a higher credit limit. This is a good step in requesting a credit limit increase effectively and safely.

While requesting an increase can temporarily lower your credit score, you can come out ahead if you manage additional credit responsibly. Always pay debts on time, keep balances low, and avoid overextending yourself. With these practices in place, you should be able to enjoy the benefits of having more access to credit without hurting your overall financial health. Learning when to request a credit increase responsibly is a key part of that journey.

Boost Your Credit Limit And Your Credit Score

Requesting a credit limit increase is easy with most lenders, who typically offer a mobile or online process. Your lender will likely request information, such as your current income and employment details, to assess your request. If it's not clear at any point in the process, ask your lender whether they will conduct a hard credit inquiry.

You can also review your own credit reports before requesting a credit limit increase, just as you would when applying for new credit. This will give you the chance to identify and correct any errors, ensuring that your credit is in excellent shape. Ready to request your credit limit increase and learn when to request a credit increase? Now is the perfect time to take charge of your credit journey.

Also read:

Arro Credit Card: Increase Your Odds of Passing Tenant Credit Checks

How to Build Credit Without a Credit Card: Steps to Get Started

The Simple Way To Increase Your Credit Limit

With around US$ 1.2 trillion in revolving credit card debt nationwide, having tools to manage credit responsibly isn't just smart; it's necessary.

At Arro, building credit should feel empowering, not complicated. That's why we've created a credit card that works with you, not against you. With Arro, you can learn, earn, and grow, all from the convenience of one easy-to-use app.

No hard credit checks, no deposit required, and 1% cash back on everyday essentials like gas and groceries, building your credit has never been more straightforward or more rewarding.

Plus, you'll have Artie, your personal AI Money Coach, right there with you, cheering you on and helping you make smart money moves every day.

Each on-time payment, every lesson, and every step forward is a win, and with Arro, those wins add up. Thousands are already strengthening their credit with Arro, and you can too. Whether you're just starting or rebuilding, we're here to support you at every step of your credit journey.

Ready to start your credit journey with us? Take control of your credit with confidence.

FAQs

1. Can I request a credit limit increase if I just opened my credit card?

It's typically recommended to wait a few months after opening your credit card before requesting a limit increase. Most lenders prefer to see a history of on-time payments and responsible credit use, which helps show you're ready for a higher limit. However, if your financial situation has changed (e.g., a significant increase in income), it's always worth asking.

2. Will a credit limit increase affect my interest rate?

A credit limit increase by itself does not directly change your interest rate. However, if you can lower your credit utilization ratio (by increasing your credit limit while keeping balances low), it may improve your credit score and lead to better interest rates on future credit applications. It's always a good idea to check with your lender to understand how changes to your credit limit might impact your account terms.

3. How long does it take for a credit limit increase to reflect on my credit report?

The timing can vary depending on your lender. Typically, it can take 30 days to two billing cycles for the credit limit increase to appear on your credit report. Be sure to keep track of your statement dates to ensure the update is reflected. If you don't see it after a couple of billing cycles, contact your lender for clarification.

4. Can I request multiple credit limit increases in a short period?

It's generally best to space out credit limit increase requests to avoid potential negative impacts on your credit score. Multiple hard inquiries within a short period can temporarily lower your score. It's a good idea to assess whether your credit use and payment history are solid enough to justify a second increase before requesting again. Lenders may also have their own guidelines on how often you can request an increase.

5. What happens if my credit limit increase request is denied?

If your request for a credit limit increase is denied, don't be discouraged. Lenders usually provide a reason for the denial, such as a low credit score, high debt-to-income ratio, or recent missed payments. You can use this feedback to address areas of improvement before reapplying. It's also a good idea to continue using your credit responsibly, paying bills on time, and reducing any outstanding balances to improve your chances for approval in the future.