Let’s dive into the most common strategies for helping you pay off debt faster: a balance transfer loan vs a cash loan.

Is A Balance Transfer The Same As A Personal Loan?

Should I Get A Balance Transfer Or A Personal Loan?

Pros And Cons Of Balance Transfer VS. Personal Loan

Why Shouldn’t I Apply For A Balance Transfer Or Personal Loan?

Choosing The Right Path Forward

FAQs

If you’re one of the nearly 90 million Americans dealing with credit card debt, you’re definitely not alone. Many people start by figuring out whether a personal loan or a balance transfer makes more sense for them, and understanding how these options work can make your next step feel a lot clearer.

In this article, we will walk through how both options work, what to expect, and how to decide which one fits your financial goals, all while keeping the balance transfer loan vs cash loan comparison in mind.

Key Takeaways

Balance transfers can help reduce interest costs quickly if you can pay off the balance during the promotional period.

Personal loans offer predictable monthly payments and may be better for larger or longer-term debt.

Interest rates, fees, and your credit score all play major roles in choosing between the two options.

Each method comes with pros and cons, so the right fit depends on your goals, timeline, and repayment habits.

Knowing the risks, like transfer fees or higher post-promo APRs, can help you avoid unexpected costs.

Planning your repayment strategy ahead of time makes either option more effective in reducing debt.

Is A Balance Transfer The Same As A Personal Loan?

Let’s break down these two popular methods to help pay down debt and save money along the way, especially when comparing a balance transfer loan vs a cash loan:

Balance Transfer Credit Cards

Transfer debt from other sources and pay as low as 0% interest for an introductory period (typically 15–21 months). If you can pay off your entire debt during that introductory period, you can avoid paying interest; however, there is usually a fee associated with the initial balance transfer. This is one reason people often compare a balance transfer loan vs a cash loan before choosing.

Personal Loan

Pay off your other debts at a lower interest rate. These loans can have lower interest rates than most credit cards, which allows you to save money on interest over the life of the loan, another key factor in the balance transfer loan vs cash loan decision.

While there are similarities, a balance transfer is not the same as a personal loan. To begin with, balance transfers are linked to credit cards, whereas personal loans are not. A balance transfer credit card might be a suitable option if you wish to pay off high-interest credit card debt in a relatively short period of time. Personal loans, on the other hand, serve as better long-term solutions, depending on where you land in the balance transfer loan vs cash loan comparison.

If you transfer an existing credit card balance to a new card with a 0% average percentage rate (i.e., APR or interest rate) offer, you need to pay off the entire amount before the end of the promotional period to avoid interest charges. After this period, any outstanding amount starts accruing interest at the card’s regular balance transfer APR.

If you wish to pay off your credit card debt over a long period or need to repay a large debt, consider what personal loans have to offer. While personal loans allow you to borrow more funds than credit cards, they also come with a comparatively low APR.

Should I Get A Balance Transfer Or A Personal Loan?

When you need to pay off existing credit card debt, you really have three main choices:

Apply for a balance transfer credit card

Apply for a personal loan

or keep doing what you’re doing

Many people ask themselves, “Should I transfer my credit card balance?” at this stage, especially when weighing a balance transfer loan vs a cash loan.

The Amount You Owe

Balance transfers are more applicable for paying off small debts since higher interest charges can kick in after the introductory period. At the same time, personal loans can help you clear significantly large debts over time. Unfortunately, whether you get a personal loan or a balance transfer credit card, you won’t know the limit you qualify for until your application is approved, which is another reason the balance transfer loan vs cash loan comparison matters.

Interest Rates

Many balance transfer cards offer an introductory 0% APR for 12 to 21 months. However, any remaining balance starts accruing interest at a card’s regular APR once the promo period ends. While personal loans do not have 0% APR offers, their interest rates can be lower than the APRs of regular balance transfer credit cards. If you can manage to repay your entire debt before the end of the balance transfer credit card’s promo period. In that case, it might be the more cost-effective option, another point in the balance-transfer loan vs. cash loan conversation.

Fees

Credit cards with balance transfer offers usually charge a fee of 3% to 5% of the transferred amount. If you get a personal loan, you might need to pay a loan origination fee of up to 6%, although some issuers have eliminated this fee. Depending on your loan provider, you might be burdened with a prepayment penalty if you wish to pay off the loan earlier than scheduled. Fees can play a major role when comparing a balance transfer loan vs a cash loan.

Creditworthiness

Qualifying for a balance transfer credit card usually requires good to excellent credit. On the other hand, people with average credit can choose from several personal loan options. Your credit score can also impact the interest rate you receive on a personal loan.

Repaying On Time

With a balance transfer credit card, you can pay more than the minimum whenever you want. With a personal loan, your payments stay the same each month. Look at what you can comfortably afford and whether you can pay off most of the balance during a card’s promo period. If you lean toward a personal loan, compare monthly payments across different terms, so you know what fits your budget. This practical comparison is why so many people take time to evaluate a balance transfer loan vs cash loan.

Pros And Cons Of Balance Transfer VS. Personal Loan

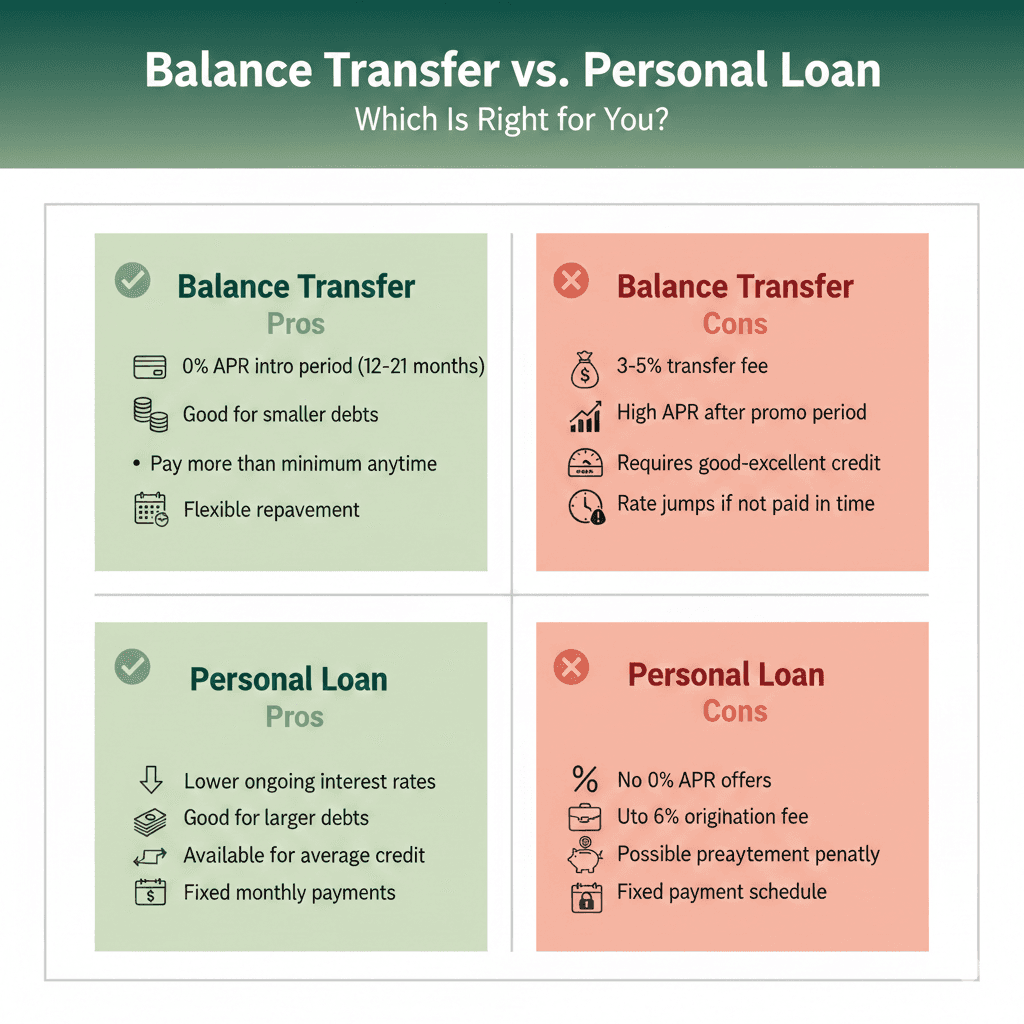

There is no clear winner in the personal loan vs. balance transfer comparison, as both have significant advantages and drawbacks. What is essential in both cases is that you have a clear repayment plan in place before you decide on a course of action. Looking at the pros and cons of a balance transfer and a personal loan can help you determine which might work better for you, especially if you're weighing a balance transfer vs. a cash loan trade-off.

Why Shouldn’t I Apply For A Balance Transfer Or Personal Loan?

While a balance transfer or personal loan can help you get out of debt, it’s not always the right fit. You probably shouldn’t get a balance transfer or personal loan if you have bad credit, struggle to manage credit cards, or don’t qualify for a reasonable interest rate. Balance transfers do provide a spending limit, which allows additional purchases and could increase your debt if spending habits aren’t monitored. These dangers show up in the balance transfer loan vs cash loan decision, too.

Some people avoid applying altogether because they’re worried about getting rejected and hurting their credit. The good news is that many lenders now offer pre-qualification tools, which let you see your estimated rate and amount without a hard inquiry. You can usually find these online, and they give you a clear idea of what to expect before you officially apply.

Before you decide between a balance transfer credit card or a personal loan, take a moment to review your situation:

Your current credit score, income, and existing debts

Any fees tied to the method you choose

How each option might affect your credit over time

Once you have a clear picture, you can compare cards or lenders to find the best terms for your situation, and keep the full balance transfer loan vs cash loan comparison in mind before choosing your path.

Also read:

Save Big, Stress Less: Arro's Tips For Black Friday Budgeting

5 Credit Myths That Could Haunt Your Score (and How to Banish Them)

Credit Builder Card: Your Complete Guide to Building Credit the Smart Way

Choosing The Right Path Forward

The best option between a balance transfer or personal loan ultimately depends on your goals, budget, and how quickly you want to become debt-free.

At Arro, we believe building credit shouldn’t be confusing, expensive, or out of reach. That is why we have crafted a credit card that supports you in learning, earning, and developing, all seamlessly integrated within a single app.

With no hard credit checks, no deposit, and 1% cashback on gas and groceries, Arro makes it simple to start improving your credit while rewarding your everyday spending. You’ll also get access to Artie, your personal AI Money Coach, who’s there 24/7 to answer questions, celebrate wins, and help you make smart financial moves.

Every on-time payment, every lesson, and every small step forward helps you unlock higher credit limits and better credit health. Thousands of people are already building stronger credit with Arro and having fun doing it.

If you’re ready to take control of your financial journey, we’re here to help. Start building credit with confidence.

FAQs

1. Will a balance transfer or personal loan affect my credit score right away?

Yes, both options can affect your credit score, but in different ways. A balance transfer may temporarily lower your score if it requires a hard inquiry, and new credit limits can shift your utilization. A personal loan also involves a hard inquiry, but it can help your credit mix, which may improve your score over time. How you repay either option matters more than the initial impact.

2. Can I use a balance transfer card for new purchases while paying down transferred debt?

Some cards allow new purchases at a 0% intro APR, but many do not. In many cases, new purchases begin accruing interest immediately, even while your transferred balance is at 0%. Always check whether purchases have the same promotional rate before using the card for anything else.

3. What happens if I can’t pay off my balance transfer before the promo period ends?

Any remaining balance will start accruing interest at the card’s standard balance transfer APR, which is often significantly higher. This can increase your total repayment cost. If you’re unsure you can pay off the full amount in time, a personal loan with a predictable payment schedule may be safer.

4. Can I pay off a personal loan early without penalties?

Some lenders allow early payoff with no fees, while others charge a prepayment penalty. Penalties can vary widely by lender. Before choosing a loan, read the fine print or ask your lender directly whether paying early affects your total cost.

5. Is it possible to use both a balance transfer and a personal loan together?

Yes, some people use both, but it requires careful planning. For example, you might transfer part of your debt to a 0% APR card while using a personal loan to pay off the rest. This can work if your debt is higher than a single credit limit allows, but managing two repayment schedules requires discipline.