Arro Team

Is Financial Aid A Loan? Let's Clear This Up

Essential Checklist For Applying For Student Loans

Unlocking Financial Aid With FAFSA

Filling Out FAFSA: A Step-By-Step Guide

Understanding Loan Options And Offers

Know What You're Getting Into Before You Borrow

Deciding On The Right School

The Importance Of Affordability

Your Guide To FAFSA And Student Loans With Arro

FAQs

Exploring student loans can feel daunting and tricky, but you're not alone.

Navigating student loans can be overwhelming, but you don't have to do it alone. In this article, we will guide you through the FAFSA application process, explain your loan options, and help you understand loan interest rates, amounts, and consolidation.

Is financial aid a loan? This is one of the most common questions students ask when starting their financial aid journey. The short answer: No, not always. Financial aid is actually an umbrella term that includes different types of assistance, some you'll need to repay (loans) and some you won't (grants and scholarships). Understanding this distinction is crucial to making smart financial decisions about your education.

Securing financial aid is a crucial step in achieving your education and career goals. Arro is here to simplify the process, offering clear steps and helpful tips to make informed decisions with confidence.

Let's break it down and make student loans less stressful.

Key Takeaways

FAFSA is your first step to securing financial aid, including federal loans and grants.

Gather your tax returns and financial data before starting your FAFSA application.

Understanding the types of loans and the terms is crucial to making informed borrowing decisions.

Grants like Pell Grants can provide free money that doesn't need to be repaid.

Is financial aid a loan? The answer depends on the type of aid you receive; grants and scholarships do not need to be repaid, but loans do.

Is Financial Aid A Loan? Let's Clear This Up

Great question! And here's the good news: financial aid isn't just loans, it's actually a mix of different types of support. Some of it you'll need to repay, and some of it is free. Understanding what you're getting is key to making smart choices about your education.

Think of financial aid like a care package for college. When you fill out FAFSA, you're opening the door to several types of help:

The Free Stuff (Yes, Really Free!)

Grants are need-based money you never have to repay. The Pell Grant is the most common one, and it's based on your family's financial situation. Scholarships work the same way but are usually awarded for achievements, talents, or meeting specific criteria. And then there's work-study, which gives you a part-time job on campus so you can earn money while you're in school.

The Money You Borrow

Here's where loans come in. Federal student loans are borrowed from the government and need to be repaid with interest. But here's a helpful distinction: subsidized loans don't charge you interest while you're still in school (the government covers it!), while unsubsidized loans start racking up interest right away. There are also private loans from banks, but these typically come with less favorable terms than federal ones.

Your Financial Aid Package = The Whole Picture

When schools send you financial aid offers after you complete FAFSA, they'll break down exactly what you're getting. You'll see how much is grants and scholarships (the free money, maximize this first!) versus how much you'd need to borrow. The goal? Take as much free money as you can get, then carefully consider loans only for what you truly need.

So, is financial aid a loan? It can include loans, but that's not the whole story. It's really about getting access to all the support available to you, and making the smartest choices with what you're offered. You've got this!

Essential Checklist For Applying For Student Loans

Let's start with the basics. Here's what you need to get the ball rolling:

Financial Documents: Gather your tax returns, bank statements, and Social Security number. Make sure you have all the required financial documents ready before starting the application process.

FAFSA Time – your gateway to federal financial aid. Filling out the FAFSA is the first and most crucial step to securing financial aid.

Weigh Your Loan Options – not all offers are created equal. Take time to carefully compare the loan options available to you to ensure you choose the best one for your financial situation.

School Selection – it's about finding the right fit for you. Choosing the right school will not only shape your education but also impact your financial aid opportunities.

With these steps in place, you'll be ready to tackle the application process and make the best choices for your education and finances.

Unlocking Financial Aid With FAFSA

The Free Application for Federal Student Aid (FAFSA) is the key to securing federal loans, grants, and work-study opportunities. This is the very first step in understanding what federal financial aid you are eligible for based on your financial situation. Is financial aid a loan? Not always. FAFSA helps you access various types of aid, including grants that don't need to be repaid.

Once submitted, FAFSA will help determine your eligibility for different types of aid. Even if you think you might not qualify, it's worth applying; you never know what assistance might be available. Taking the time to complete this process can open doors to financial support that helps ease the burden of tuition and related expenses.

Filling Out FAFSA: A Step-By-Step Guide

Filling out your FAFSA can feel like a big task, but breaking it down step by step makes it more manageable. Here's a clear guide to walk you through the process.

FAFSA Application: Start by filling out the free FAFSA application at Apply for Aid - FAFSA. This is where it all begins, so make sure you follow the instructions carefully.

Begin With Personal Details – name, DOB, and more. Personal details are required to create your application and verify your identity.

Provide A List Of Prospective Schools – choose where your next chapter may unfold. You need to decide on the schools where you want your financial aid package sent.

Determine Your Dependency Status – this affects the information required. Your dependency status will determine whether you need to provide your parents' financial information.

If you're a dependent, you'll need your parents' financial information.

This is a necessary step for most applicants under the age of 24.

Enter Financial Data – including taxes, income, and assets. Accurate financial data is essential for determining how much aid you are eligible to receive.

Review, Sign Electronically, and Submit. Congratulations, you're on your way! Once everything is entered, double-check for accuracy before submitting your application.

Once you've completed the steps, you'll be ready to submit and take the next step toward securing the financial aid you need. Just remember to review everything carefully before you hit submit.

Understanding Loan Options And Offers

After applying for FAFSA, schools that you have used to and have been accepted to will send you financial aid offers. Is financial aid a loan? It depends on what's included in your offer; some aid is free money (grants), while other parts are loans you'll need to repay.

Once you receive those offers, here's what is important to evaluate:

Look At The Total Cost & the total package of aid offered. Consider the overall cost of attending and how much aid you will receive.

Understand The Type Of Loans – subsidized means that interest isn't being added while you are in school studying. Subsidized loans can save you money on interest by postponing it while you're in school. Understanding FAFSA loan interest rate options is crucial, as rates can vary between subsidized and unsubsidized federal loans.

Familiarize Yourself With Loan Limits And Interest Rates. Knowing the maximum amount you can borrow and the interest rates will help you manage your future payments better. FAFSA loan amounts vary depending on your year in school, dependency status, and the type of loan you're eligible for.

Undergraduate and Graduate Loans: Learn about the types available for both undergrad and grad students on the FAFSA website.

Different loans are available for undergraduate and graduate students, so make sure to review the options.

PLUS Loans: This is a federal loan option for graduate students or parents of undergrads, designed to cover additional costs that other financial aid doesn't.If you need more funding for your education, a PLUS loan might be a viable option to consider. Is financial aid a loan? In the case of PLUS loans, it certainly is.

Master Promissory Note (MPN): An MPN is a legal document that you sign to agree to repay your loans. Once signed, it covers all federal loans you take out while in college.

Understanding and completing the MPN is crucial for receiving and managing your loans.

Take the time to carefully review each offer so you can make an informed decision and choose the best option for your needs.

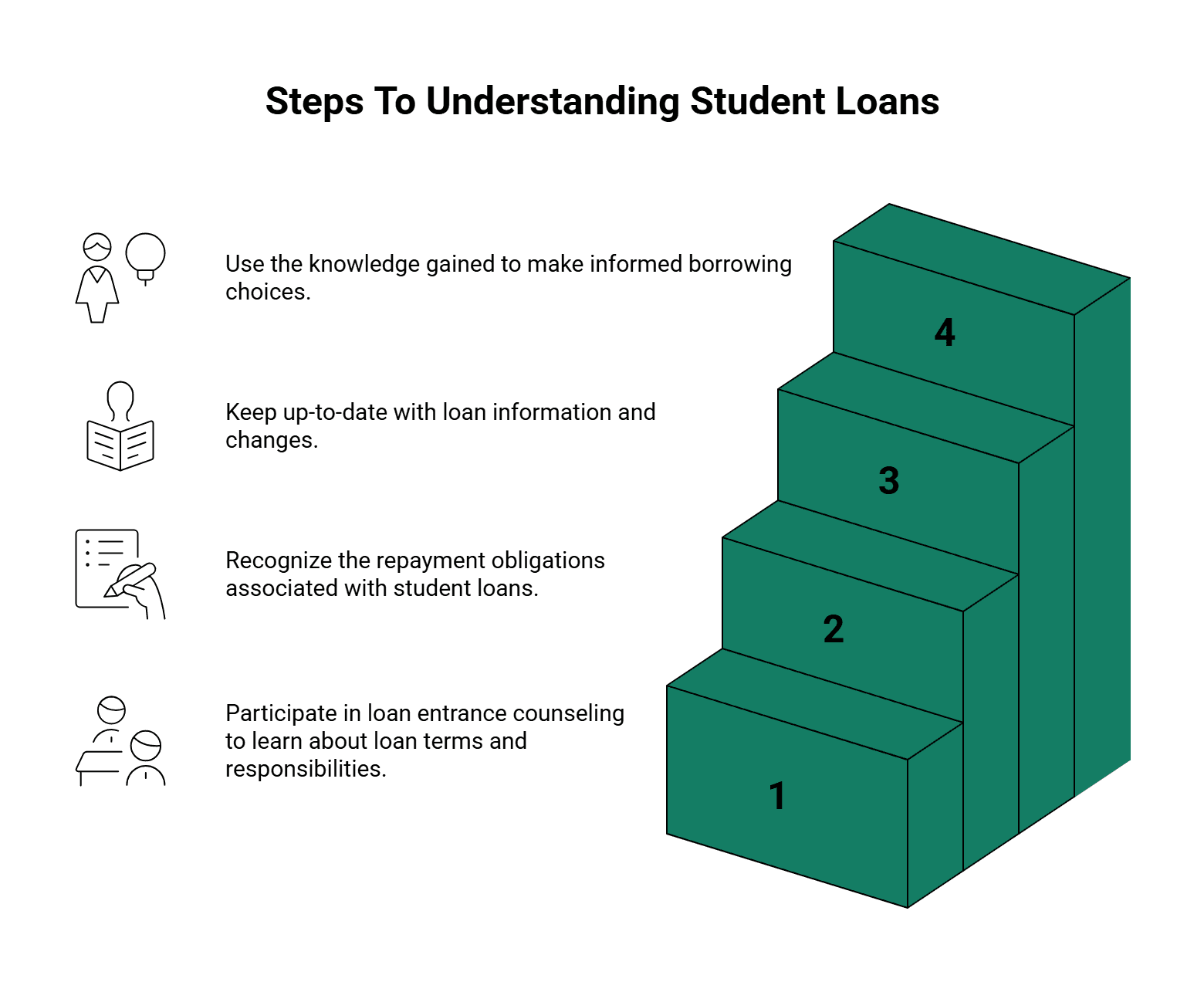

Know What You're Getting Into Before You Borrow

Before you take on any student loans, it’s essential to understand what you're committing to fully. Is financial aid a loan? When it comes to federal student loans, yes, and you need to understand your repayment obligations before borrowing. Here’s what you need to know to stay informed and make wise decisions.

Loan Entrance Counseling

Loan entrance counseling is a must-do for anyone getting a federal student loan for the first time. It teaches you about your loan, how to handle your financial aid money while in school, and how to repay what you owe. This is a critical step that helps you understand your commitment.

Annual Student Loan Acknowledgment

The Annual Student Loan Acknowledgment lets you see how much you’re borrowing every year.

It helps you track your debt and think about how it will affect your financial future.

The Annual Student Loan Acknowledgment lets you see how much money you're borrowing in student loans every year. It's a way to keep track of your debt and think about how it affects your future money situation. This helps you make smart choices about borrowing and paying back your loans.

According to the important notice on the StudentAid.gov site, the Annual Student Loan Acknowledgment process remains available there. However, borrower completion of the Annual Student Loan Acknowledgment before disbursement will not be required for the 2022–23 award year and beyond.

Deciding On The Right School

Choosing a school involves much more than just academics:

Consider each school’s programs and how they align with your career & future goals. Ensure the school offers programs that support your long-term career and personal aspirations.

Look at graduation and employment rates. Researching these rates can give you an idea of how effectively the school helps students graduate and find employment.

Campus culture can significantly impact your college experience. Finding a campus culture that aligns with your values and interests will make your time at school more fulfilling.

Considering these factors will help you choose a school that’s the right fit for your academic goals, future career, and personal growth.

The Importance Of Affordability

Aim for a school that matches your financial reality and future earning potential. It’s about making a choice that allows you to thrive both academically and financially. Is financial aid a loan? Understanding the fundamental distinction between loans and grants is essential when evaluating affordability.

Exploring Grants: Free Money For College

When it comes to funding your education, grants can be a game-changer. Here are two great options to help ease the financial burden.

Pell Grants: These are federal grants for undergraduate students who need financial assistance with college costs and don’t have to be repaid. Pell Grants are a great way to get funding without worrying about repayment.

TEACH Grants: Planning to teach? See if you qualify for a TEACH Grant. If you’re pursuing a career in education, a TEACH Grant could be a valuable resource.

Exploring these grants can help you secure the financial support you need to focus on your studies, so take the time to see if you qualify for these valuable opportunities.

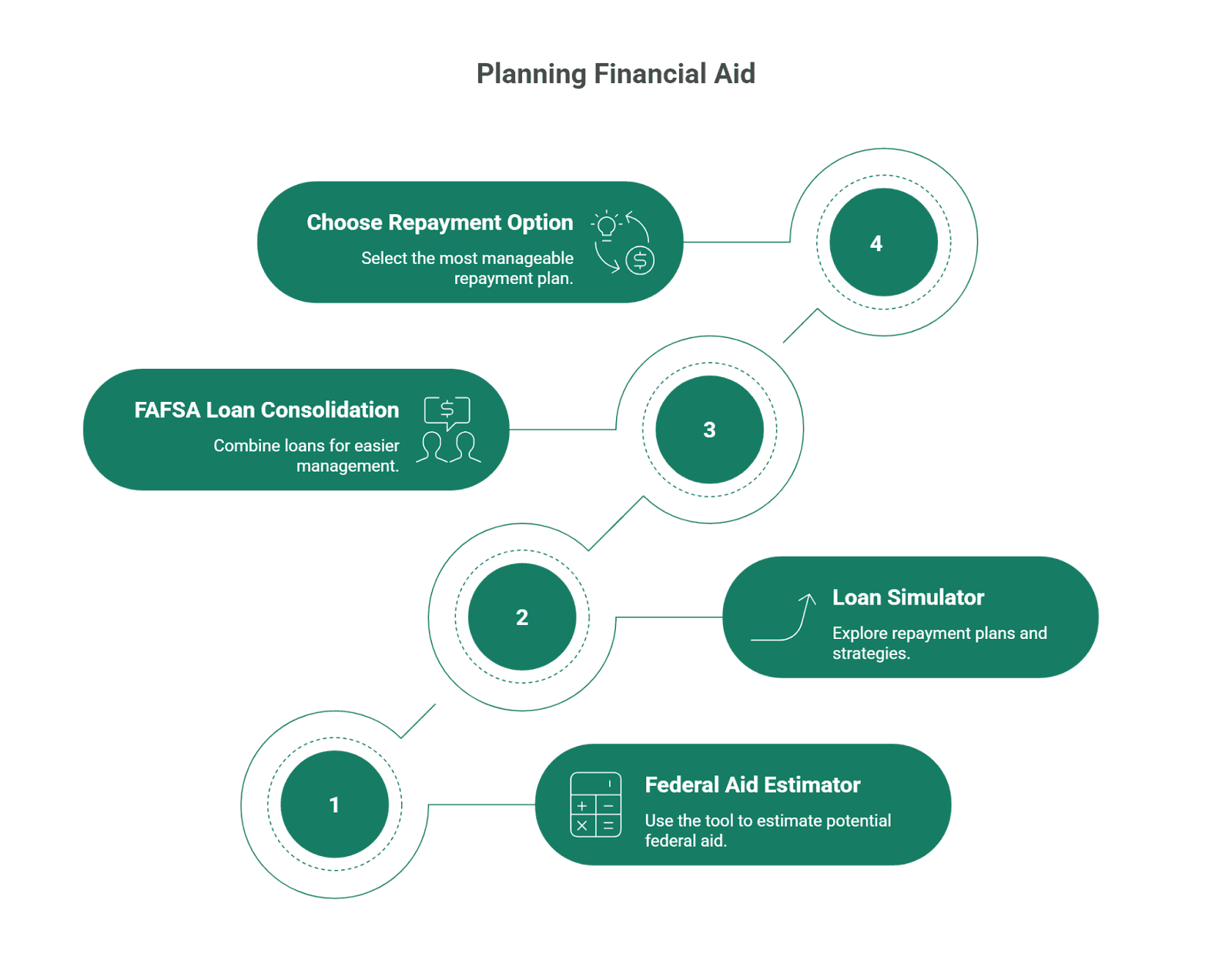

Tools And Calculators To Plan Your Financial Aid

Before diving into the application process, using the right tools can make a big difference.

Here are a couple of resources to help you plan your financial aid and loan repayment with confidence.

Federal Student Aid Estimator: This tool helps you estimate how much federal financial aid you might receive before you apply. Using this tool helps you plan your finances and prepare for the application process.

Loan Simulator: This tool shows you repayment plans and strategies to help you manage and pay off your student loans when the time comes. Is financial aid a loan? If you've taken out federal student loans, this simulator will help you understand repayment options, including FAFSA loan consolidation, which combines multiple federal loans into one for easier management. It’s helpful to explore different repayment options so you can choose the one that's most manageable for your future.

Using these tools will give you the clarity and confidence to make smart decisions about your financial aid and loan repayment, helping you stay on track for the future.

Also read:

Credit Builder Card: Your Complete Guide to Building Credit the Smart Way

Arro Credit Card: Increase Your Odds of Passing Tenant Credit Checks

Aim High: What an 800 Credit Score Means and How to Get There

Your Guide To FAFSA And Student Loans With Arro

Applying for student loans and filling out FAFSA can seem overwhelming at first, but with the right guidance, it becomes a manageable process. Remember, you’re not alone in this journey. At Arro, we’re here to help make financial decisions simpler and more accessible, offering the support you need to navigate the world of loans and credit confidently.

At Arro, we believe building credit shouldn’t be confusing, expensive, or out of reach. That’s why we’ve created a credit card that supports you in learning, earning, and growing, all within one seamless app.

No hard credit checks, no deposit required, and 1% cash back on gas and groceries, Arro makes it easy to start building your credit while rewarding your everyday spending.

You’ll also have access to Artie, your personal AI Money Coach, available 24/7 to answer questions, celebrate wins, and guide you toward smarter financial choices. Every on-time payment, every lesson completed, and every small step forward brings you closer to unlocking higher credit limits and better credit health. Thousands of people are already building stronger credit with Arro and enjoying the process.

Ready to take control of your financial future? See how simple and rewarding it can be to build credit with confidence.

FAQs

1. Is financial aid a loan?

Not always! Financial aid is an umbrella term that encompasses both grants and loans. When you fill out FAFSA, you may receive grants and scholarships (which you never have to repay), as well as federal student loans (which you do repay with interest). Your financial aid package will show you exactly what's what, so you can accept the free money first and only borrow what you actually need.

2. How can I improve my chances of receiving financial aid through FAFSA?

Submit your FAFSA early to increase your chances of getting the full amount of aid, as many states and schools offer funds on a first-come, first-served basis. Ensure your information is accurate to avoid delays and track any additional documents your school may need.

3. What happens if I miss the FAFSA deadline?

Missing the FAFSA deadline can limit the types of aid you qualify for, but some states and schools have different deadlines, so it’s still worth applying. If you miss federal aid deadlines, you can explore other options like private scholarships or loans.

4. Can I apply for FAFSA if I’m not attending school full-time?

Yes, part-time students can apply for FAFSA. Your aid may differ based on your enrollment status, but you’re still eligible for federal grants, loans, and work-study opportunities.

5. How does my credit score affect my eligibility for FAFSA?

Your credit score doesn’t impact your FAFSA eligibility. However, for federal student loans like PLUS loans, your credit history may be considered, and a poor score might require a co-signer.

6. Are there any additional resources I can use to make FAFSA easier to complete?

The Federal Student Aid website offers helpful guides and videos. You can also visit your school’s financial aid office, use the FAFSA mobile app, or seek assistance from the FAFSA Help Line or online forums.