What Is A Security Deposit?

How Does Credit Affect Security Deposits?

Utility Deposits: The Hidden Costs Of Low Credit

Phone Plans: Why Your Credit Matters

How To Avoid Large Deposits: Tips For Building Credit

Your Path To Easier Deposits Starts Here

FAQs

When you’re settling into a new apartment or signing up for essential services, you may face the requirement of a security deposit or utility deposit. Around 15% of U.S. households are required to pay utility deposits due to low credit scores. These upfront costs can be especially challenging for people with thin or low credit. But did you know that your credit plays a significant role in how much you pay for things like phone plans, utilities, and even your security deposit?

Improving your credit score is one of the best ways to avoid hefty deposits. A higher score shows landlords, utilities, and phone providers that you’re financially responsible. Even small improvements, like paying down credit card balances or fixing errors on your credit report, can significantly lower the deposit amount you’re asked to pay.

In this article, we will explore how credit scores impact these costs and what steps you can take to avoid hefty fees.

Key Takeaways

Security deposits and utility deposits are often higher for individuals with low credit scores.

Cell phone providers may require a deposit for low-credit individuals, though some providers report payments to credit bureaus, helping you build credit over time.

The best way to avoid high deposits is to improve your credit score by making on-time payments, reducing debt, and checking your credit report for errors. If you have low credit, negotiate with landlords or utilities, or consider a co-signer to reduce upfront costs.

What Is A Security Deposit?

A security deposit is an amount of money paid upfront to a landlord or property management company before moving into a rental property. This deposit serves as security for the landlord in case the tenant causes damage to the property, misses rent payments, or leaves without paying outstanding bills.

Typically, the security deposit is equal to one month's rent, but the amount can vary based on the rental agreement. When you move out and leave the property in good condition, you’ll usually get the deposit back. However, if you have poor credit, you might face a higher deposit or additional upfront costs.

How Does Credit Affect Security Deposits?

While high security deposits can be a barrier to securing your next rental, there are several strategies you can use to reduce or even avoid them.

Improve Your Credit Score

One of the best ways to avoid hefty security deposits is to improve your credit score. A higher credit score signals to landlords that you are financially responsible and more likely to make consistent, on-time payments. If you're starting from a low score, consider using a secured credit card or enrolling in a credit-building program.

Negotiate With Your Landlord

If your credit is less than stellar, don’t be afraid to negotiate. If you can demonstrate stable income through recent pay stubs, provide positive references from previous landlords, or even show proof of on-time rent payments through a service that reports rental history. In that case, some landlords may be willing to lower the deposit. It’s worth asking if they’d accept a smaller amount or offer an installment plan, especially if you’re moving into a long-term lease. Sometimes, showing your commitment to paying rent regularly can ease their concerns.

Consider A Co-Signer

If your credit score is preventing you from avoiding a large deposit, consider asking a family member or friend to co-sign the lease. A co-signer guarantees rent payment, reducing the landlord's perceived risk. This can result in a lower deposit or no deposit at all, depending on the agreement. Keep in mind, though, that your co-signer will be held responsible for the rent if you fail to pay, so it’s essential to maintain good communication and financial responsibility.

By taking these steps, improving your credit, negotiating with your landlord, or finding a co-signer, you can often lower the financial burden of a security deposit and secure a rental property that better fits your budget. These actions not only help with your initial deposit but also set you up for a smoother, more affordable life down the road.

Utility Deposits: The Hidden Costs Of Low Credit

Utility companies, like those providing electricity, gas, water, and internet services, typically let most people pay at the end of the month once their charges are confirmed. This gives you some flexibility, almost like the utility company is giving you a bit of “credit” by letting you pay after usage. However, if you have a low credit score, you might be asked to pay a deposit upfront instead of being given that flexibility.

Here’s where it gets tricky: Over 22 million households are cost-burdened, spending more than 30% of their income on rent and utilities. With a lower credit score, the utility company is not extending the usual “credit” of waiting until the end of the month to pay. Instead, they ask for a deposit upfront to cover the risk of non-payment. The deposit acts as a security for the utility provider, ensuring they’re protected. So, while most people get to pay later, if your credit score isn’t in the best shape, you’ll need to pay that deposit upfront.

Good Credit: With a solid credit history, utilities are more likely to waive the deposit since you are considered a low-risk customer who will pay bills on time.

Low Credit: If your credit score is low, utility companies might require a deposit to protect themselves from potential non-payment. For example, electricity or gas providers may ask for hundreds of dollars upfront, depending on the utility and your credit profile.

Utility companies also sometimes check your payment history with them, so if you’ve missed payments in the past, they might require a higher deposit.

Improving your credit score can lower these upfront costs and make it easier to set up your essential services.

Phone Plans: Why Your Credit Matters

When you sign up for a cell phone plan, your credit score can significantly influence whether you’ll need to pay a deposit and what kind of plan you can access.

Good Credit: If your credit score is good, you’ll likely qualify for postpaid plans where you receive the phone first and pay the bill later. These plans generally don’t require a deposit and may come with additional perks, such as discounts or free upgrades.

Low Credit: Prepaid plans don’t require a deposit or credit check, but they come with higher rates and fewer features. Plus, you miss out on valuable perks like free phone upgrades, discounts, and rewards, benefits that save you money in the long run. While postpaid plans might require a deposit, they offer more value over time with these money-saving perks.

Knowing how your credit score affects your options can help you choose the best phone plan and avoid paying unnecessary deposits.

How To Avoid Large Deposits: Tips For Building Credit

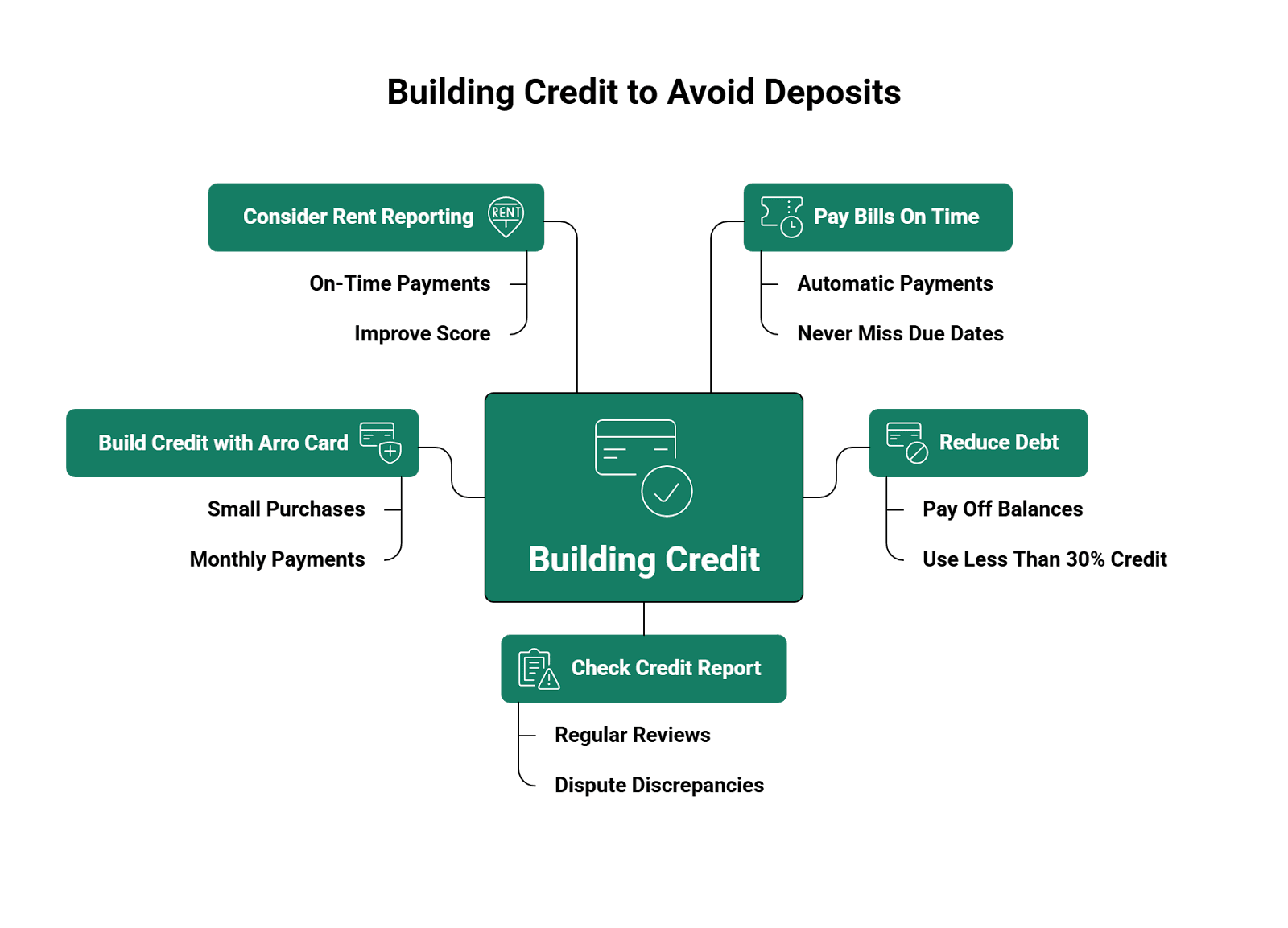

The best way to reduce or eliminate security, utility, and phone plan deposits is to improve your credit. Here are some simple tips to help you build your credit score:

Pay Your Bills On Time: Your payment history makes up a large portion of your credit score. Set up automatic payments for rent, utilities, and phone bills to ensure you never miss a due date. Even a single missed payment can negatively impact your credit, so consistency is key to maintaining a strong score.

Reduce Your Debt: Aim to keep your credit utilization low by paying off credit card balances and loans. Try to use less than 30% of your available credit to maintain a healthy credit score. The lower your utilization, the more favorable it looks to lenders, showing that you're able to manage your credit responsibly.

Check Your Credit Report: Regularly review your credit report to ensure it is accurate. Dispute any discrepancies with the credit bureaus to ensure your report is accurate. Errors such as outdated information or incorrect balances can drag down your score, so keeping an eye on your report helps you avoid unwarranted damage.

Build Credit With an Arro Card: If you have little or no credit, consider using a secured credit card. This can help you build credit by making small purchases and paying them off each month. Secured cards are a great way to establish a positive payment history, which can gradually improve your score over time.

Consider Rent Reporting: Many people don’t realize that on-time rent payments can help build credit. Look into services that report your rent payments to the credit bureaus to help improve your score. This is an easy way to make your regular rent payments work in your favor, adding to your credit history without taking on additional debt.

Following these steps consistently will help you build your credit over time and avoid the extra burden of large deposits.

Your Path To Easier Deposits Starts Here

In today’s world, credit scores play a major role in determining how much you’ll pay upfront for things like security deposits, utility deposits, and phone plans. Understanding how your credit impacts these costs is crucial to avoiding large upfront payments and managing your finances more effectively. The good news? Improving your credit score is possible with the right steps.

Whether you’re just starting out, rebuilding, or trying to improve your score, each on-time payment, small debt reduction, and regular check-in with your credit report brings you one step closer to reducing your security deposit and lowering the costs associated with essential services.

Why Choose Arro?

At Arro, we believe that building credit shouldn’t be complicated or expensive. That’s why we’ve designed a credit card that seamlessly supports you in learning, earning, and growing, all within one simple app.

With no hard credit checks, no deposit required, and 1% cashback on gas and groceries, Arro makes it easy to start building your credit while rewarding your everyday spending. Plus, you get Artie, your personal AI Money Coach, available 24/7 to answer questions, celebrate wins, and guide you in making wise financial choices.

Every on-time payment, every lesson learned, and every small step forward helps you unlock higher credit limits and better credit health. Thousands of people are already on their way to better credit with Arro, and they're enjoying the journey.

Ready to start your own credit journey? See how simple it can be to build credit with confidence.

FAQs

1. Why do utility companies require deposits?

Utility companies typically require deposits from customers with low credit scores as a form of protection. If you fail to pay your bills, the deposit acts as a security for the company, ensuring they aren’t left with unpaid charges.

2. Will paying my security deposit affect my credit score?

No, paying a security deposit itself doesn’t affect your credit score. However, if you cause damage to the property or miss rent payments, it can negatively impact your credit score, as landlords may report the incident to the credit bureaus.

3. Can I avoid paying a security deposit?

Yes, you can avoid paying a high security deposit by improving your credit score. You can also negotiate with your landlord or provide a co-signer, which may reduce or eliminate the deposit amount.

4. Do prepaid phone plans require a credit check?

No, prepaid phone plans typically do not require a credit check or deposit. However, they may come with higher rates and fewer perks compared to postpaid plans, so it’s worth considering the trade-offs.

5. How do I build credit to avoid large deposits?

To avoid large deposits, focus on building your credit by paying bills on time, reducing debt, and using a secured credit card. Regularly check your credit report for errors and dispute any inaccuracies to ensure your credit score improves.