Think back to January. Maybe you were scared to even apply for a credit card. Maybe your score felt like a number you couldn't control. Maybe "credit invisible" felt permanent.

Why This Year's Credit Wins Matter More Than You Think

Real Numbers, Real Progress: 2024 Credit Success Stories

What Makes Credit Building Actually Work

The Habits That Changed Everything

Your 2026 Credit Goals Start Right Here

How Arro Supports Your Next Chapter?

FAQs

Now look at where you are.

The journey wasn't perfect. Budgets got tight. You questioned whether one payment really mattered. Progress felt slow. But building credit isn't about perfection; it's about showing up, even when change feels invisible.

This year, you chose yourself. You decided your past didn’t have to dictate your future. In this article, we'll highlight the progress we’ve made, showcase how Arro supports your credit journey, and show you how to carry this momentum into 2026.

Key Takeaways

You don’t need perfect finances to build credit, just consistent habits and smart support.

Members who made on-time payments for six months saw meaningful score improvements, with the average Arro member gaining 40 points.

Understanding why credit matters transforms abstract numbers into real opportunities, apartments, cars, and better loan rates.

The average U.S. credit score held steady at 715 in 2024, proving people kept building despite economic pressure.

Starting early positions you ahead of the 84% of 18-year-olds who remain credit invisible.

Your 2026 goals are achievable when you treat credit building as a marathon, not a sprint.

Why This Year's Credit Wins Matter More Than You Think

Credit scores feel arbitrary until they suddenly matter. That apartment application. The car loan you need. Even that cell phone plan. In fact, 71% of consumers had good or better credit in 2024. Despite inflation and economic uncertainty, people kept building. That's not luck, that's intentional choices about financial futures.

Your credit journey this year wasn't just about raising a number. Every on-time payment chipped away at barriers. Every month of responsible use rewrote your story.

For those starting from scratch, building credit meant learning a system nobody teaches in school. For rebuilders, it meant proving your past doesn't define you. For newcomers to the U.S., it meant establishing a financial identity in a country that seemed determined to lock you out.

The wins matter because they're proof. Proof that credit building isn't some mysterious algorithm. Proof that consistent effort moves the needle. Proof that you have more control than you thought.

Real Numbers, Real Progress: 2025 Credit Success Stories

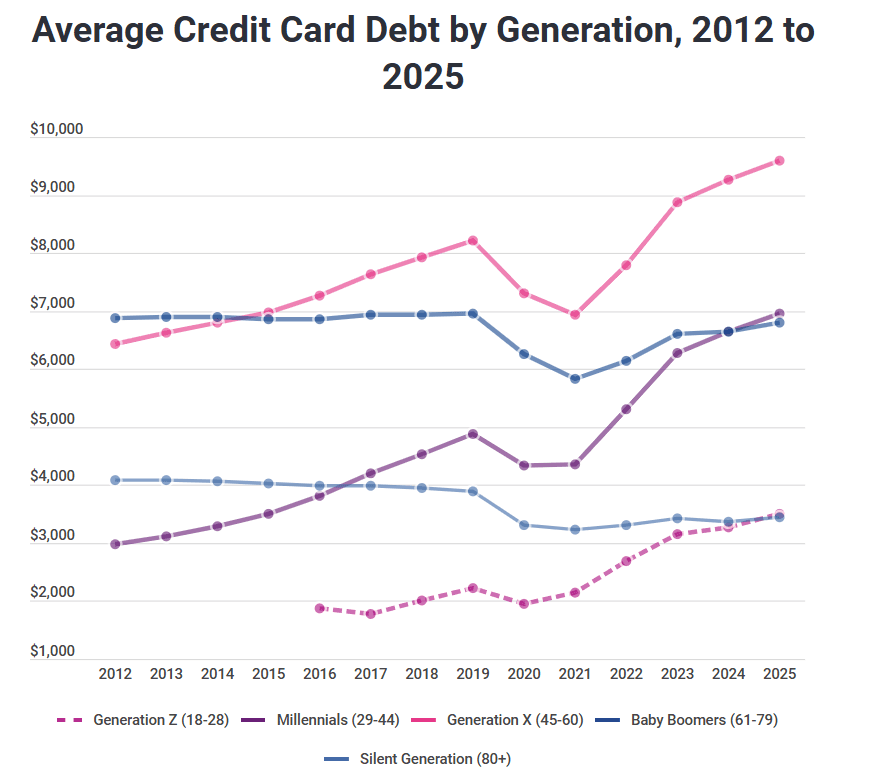

Numbers reflect the progress we’re making together. Let’s talk about the key statistics that matter. According to Experian, consumers in their 20s show more responsibility than older generations did at the same age regarding credit delinquency. Between 2014 and 2024, the average FICO score in the U.S. increased from 692 to 717.

Source: Experian

Here’s what credit building looked like in 2025:

Members starting with thin or no credit files who consistently make on-time payments begin building a credit history that gets reported to all three major bureaus. Going from "credit invisible" to having an active credit file opens doors that were previously closed.

Those rebuilding after financial setbacks are proving that second chances are real. Consistent payment behavior over time demonstrates creditworthiness to lenders, regardless of past challenges.

Newcomers to the U.S. are breaking through the catch-22 of needing credit to build credit. Credit builder cards that don't require an existing U.S. credit history provide that crucial first step toward establishing financial stability.

What Makes Credit Building Actually Work

Here's what nobody tells you: building credit isn't complicated, but it is consistent. The difference between success and struggle isn't intelligence or income, it's understanding what actually matters.

Payment history makes up 35% of your credit score. Show up every month, pay what you owe, and do it on time. Simple, but not always easy when money's tight, or life gets chaotic.

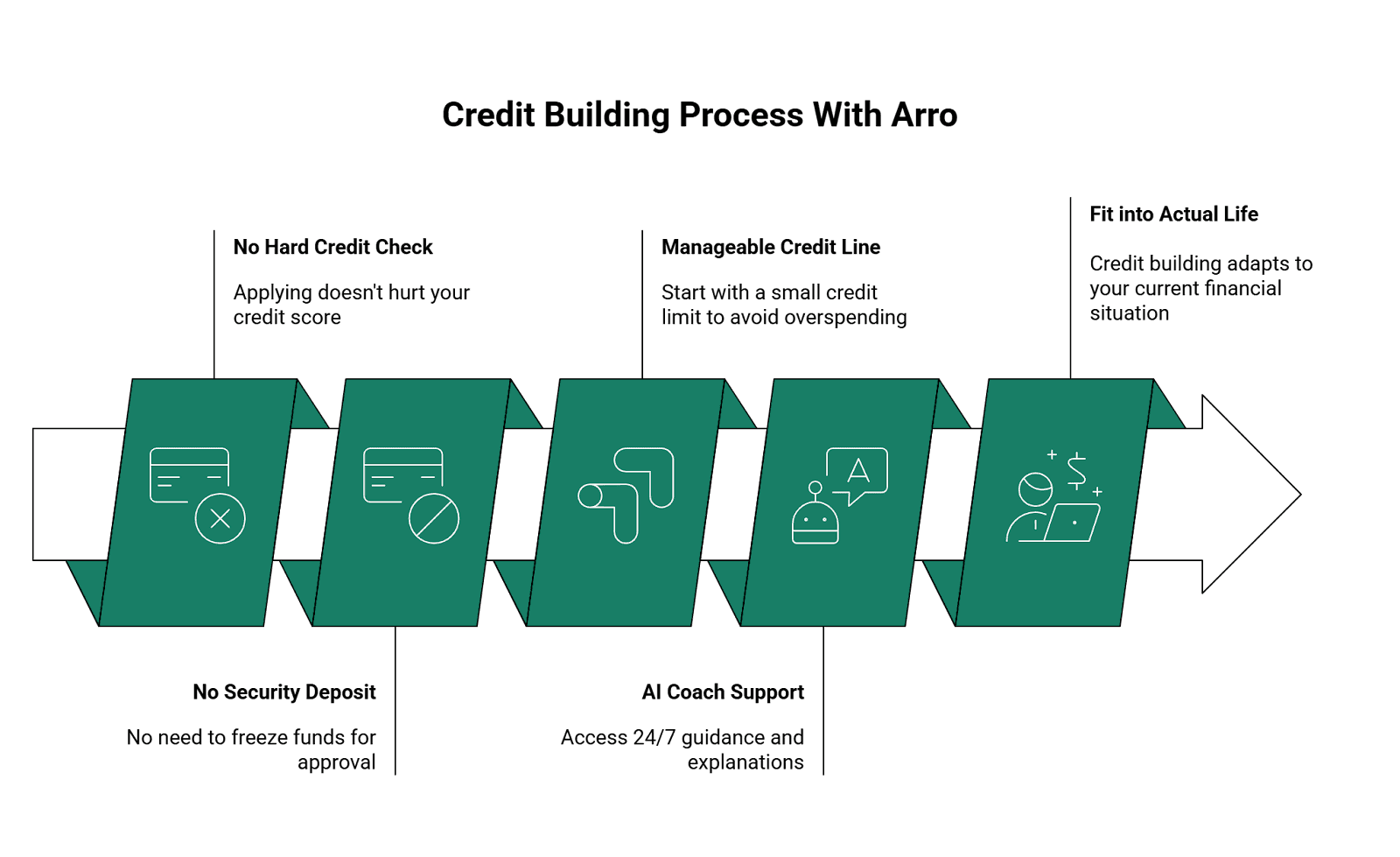

The Arro approach removes the biggest barriers:

Members who succeeded didn't have perfect finances. They had AutoPay set up. They checked accounts regularly. They treated their credit line like training wheels, something to practice with, not to max out.

One insight we heard repeatedly: "I finally understood WHY it matters." Credit isn't just a number. It's what lets you rent that apartment without double deposits. It's what drops your car insurance rates by hundreds annually. It's what qualifies you for 0% financing on the laptop you need.

When you connect "making this payment" to "getting that apartment," motivation shifts from abstract to urgent.

The Habits That Changed Everything

Forget complicated hacks. Here's what actually moved the needle:

Setting up AutoPay. The biggest predictor of success? Removing the decision entirely. Your payment happens automatically. You never miss it because you never have to remember it. Setting AutoPay for the full statement is best, but setting it up for at least the minimum required payment makes sure you never miss a payment, which is the most impactful way to build your credit.

Checking credit regularly, not obsessively. Successful members looked at their scores maybe once every couple of months. Enough to track progress. Not so much that tiny fluctuations caused panic.

Using credit for regular purchases, not emergencies. Members who thrived used their Arro Card for gas or groceries they already budgeted for. They earned 1% cash back. Then they paid it off. Credit became a tool for building history, not a bailout.

Actually engaging with Artie and bite-sized lessons. Members who used the AI coach made better decisions. They learned the difference between utilization and balance. They understood why paying before the statement date could help. Knowledge removed guesswork.

Celebrating small wins. Every 10-point credit score increase. Every month, keep the on-time payment streak alive.. Every notification that their score has updated. Acknowledging progress kept people motivated when results felt slow.

Members who struggled? They skipped AutoPay and forgot payments. They maxed out limits immediately. They never checked progress. They treated credit building like a sprint when it's a marathon.

Your credit improves because you show up consistently. Week after week. Month after month. Even when progress feels invisible.

This year proved that people who succeed with credit aren't lucky; they're consistent. And consistency is a choice you make every day.

Your 2026 Credit Goals Start Right Here

You've built momentum in 2025. Let's channel that energy into 2026 with clear, achievable goals.

First, acknowledge where you are right now. Not where you wish you were. Where do you actually stand today? If your score increased 30 points this year, that's your baseline. If you went from no credit to 650, that's your starting line.

Realistic 2026 goals based on where you're starting:

Just beginning (scores under 600 or no credit): Aim to establish six months of consistent payment history. Focus on building the habit. Target: Hit 650 by mid-year, 680 by December.

Rebuilding (scores 600-680): Your goal is to break into "good" credit territory, 700+. It's achievable with 12 months of on-time payments and keeping utilization under 30%. Target: Cross 700 by fall 2026.

Already in good standing (680+): Now you're optimizing. Focus on keeping utilization low and lengthening your credit history. Target: Break into "very good" range (740+) by year-end.

2026 is different because you're not starting from scratch. You have data. You have experience. You know what works.

How Arro Supports Your Next Chapter

Credit line increases for consistent behavior mean your initial credit limit can grow to $2,500 as you prove yourself. More available credit with the same spending means better utilization ratios. You can even unlock higher limits by completing learning activities in the app.

Continued reporting to all three bureaus means every good month counts. Your positive history builds automatically.

1% cash back on gas and groceries means your responsible spending gets rewarded. That adds up over a year.

Artie evolves with you. As your credit improves, the guidance shifts. You get tips for your current level, not generic advice.

New ways to build your credit. New products and features in 2026 will give your credit score more lift and give you more tools to manage your finances.

Set your goal right now. Write it down. "By December 2026, my credit score will be ___." Put a number there. A target based on consistent effort.

Then identify your biggest obstacle. Is it remembering to pay? Set up AutoPay today. Is it overspending? Set a personal limit below your actual limit. Is it understanding what helps? Commit to one lesson per month in the app.

Your 2026 credit goals aren't dreams. Their decisions. You decide to show up. You decide to pay on time. You decide to keep the momentum going.

Also Read:

Credit Builder Card: Your Complete Guide to Building Credit the Smart Way

How to Build Credit Without a Credit Card: Steps to Get Started

Ready to make 2026 your best credit-building year yet? Your financial future starts with your next decision.

FAQs

1. What should I do if I have trouble keeping track of my spending while building credit with Arro?

If you’re having trouble keeping track of your spending, Arro’s AI coach, Artie, can help. It provides personalized tips and reminders based on your spending habits. You can also set spending limits and goals in the app to stay on track and avoid overspending. Using Arro’s budgeting features and automating payments with AutoPay can also help you stay organized and prevent any missed payments.

2. Can I use my Arro Card for things other than building credit, like everyday purchases?

Yes, you can use your Arro Card for everyday purchases, such as gas and groceries. Many Arro members find it helpful to use the card for their regular, planned expenses to build credit while staying within their budget. Plus, you'll earn 1% cash back on gas and groceries, which is a nice perk while building credit.

3. What happens if I reach my credit limit but still need to make a purchase?

If you reach your credit limit, you’ll need to pay down some of your balance before making additional purchases. However, Arro allows you to grow your credit limit over time with responsible use. As you make on-time payments and complete educational activities in the app, your credit line can increase, giving you more flexibility to make larger purchases.

4. Does Arro offer tools to help me stay motivated and engaged in my credit-building journey?

Absolutely! Arro incorporates gamification to keep you motivated. As you make on-time payments and complete lessons, you earn rewards like higher credit limits and Arro Points. Additionally, you can track your progress through Artie’s personalized tips and feedback, which help you stay engaged and focused on your goals. Plus, celebrating milestones like credit limit increases or reaching a certain score keeps you encouraged.

5. How does Arro ensure my data is secure while I use the app and make transactions?

Arro takes your privacy and data security seriously. The app uses industry-standard encryption to protect your personal and financial information. Additionally, Arro is partnered with trusted financial institutions to ensure secure transactions. You can also manage your account settings to monitor activity and receive alerts about your transactions, giving you full control over your financial data.