Table of Contents

How To Earn More From Your Savings Account?

How To Trick Yourself Into Saving More

Different Types Of Savings Accounts

Setting Up Your 2026 Savings Goals

How To Open A Secondary Savings Account

FAQ

New year, new financial goals. But here's something most people don't realize: where you keep your money matters just as much as how much you save.

A savings account is more than just a place to park cash. It's a tool that helps you build emergency funds, reach milestones, and grow your wealth through interest. And if you're serious about hitting your 2026 goals, you need more than one.

Behavioral psychology research shows that people who separate their money into dedicated accounts save significantly more than those who keep everything in one place. When you create mental boundaries around your money, you're less likely to dip into funds earmarked for specific purposes.

This guide covers everything you need to know about savings accounts, from basic definitions to advanced strategies for managing multiple accounts.

Key Takeaways

Savings accounts are secure deposit accounts that earn interest while keeping your money accessible for emergencies and goals

Behavioral psychology shows that separating money into multiple savings accounts significantly increases the likelihood you'll reach your financial goals

High-yield savings accounts can earn 10-15x more interest than traditional savings accounts

The best savings strategy for 2026 involves one primary account for emergencies and secondary accounts dedicated to specific goals

Opening a secondary savings account takes less than 10 minutes and creates powerful mental boundaries that prevent overspending

How To Earn More From Your Savings Account?

A savings account is a deposit account at a bank or credit union that pays interest on your balance. Unlike checking accounts designed for daily transactions, savings accounts are built for storing money you don't need immediate access to but want available without penalties.

Every savings account comes with FDIC insurance up to $250,000 per depositor at banks or NCUA insurance at credit unions. Your money is protected even if the financial institution fails. Interest is typically calculated daily and paid monthly, so your money grows automatically.

How They Differ From Checking Accounts

Checking accounts prioritize accessibility with unlimited transactions, debit cards, and checks. Savings accounts prioritize growth and security with limits on certain withdrawals and transfers.

The biggest difference? Interest rates. Checking accounts rarely pay interest, but if they do, the rate is typically around 0.01%. Savings account rates range from 0.50% at traditional banks to over 4.00% at digital banks.

Why You Need A Savings Account

Financial emergencies don't announce themselves. Car repairs, medical bills, and job loss happen without warning. A savings account gives you a cushion that prevents these situations from spiraling into debt.

Beyond emergencies, savings accounts help you reach specific goals like weddings, down payments, or vacations. When you watch your balance grow month after month, you build confidence in your financial capabilities. This momentum often leads to better money decisions across the board.

How To Trick Yourself Into Saving More

Behavioral economists have studied how people treat money differently based on its designated purpose. This concept, called mental accounting, explains why separating your savings into multiple accounts works so effectively.

When you label money for a specific goal, your brain creates a commitment to that purpose. Researchers at the University of California found that people with goal-specific accounts saved 28% more than those using general savings accounts.

One large balance feels abstract. Three smaller balances labeled "Emergency Fund," "Hawaii Trip," and "New Car" feel concrete and purposeful.

The Problem With One General Savings Account

Imagine you have $5,000 in a single savings account. When an unexpected $800 expense appears, you think: "I have $5,000, so I can afford this."

Now imagine that same $5,000 split across four accounts: $2,000 for emergencies, $1,500 for a vacation, $1,000 for a car down payment, and $500 for holiday gifts. Suddenly that $800 expense requires a much harder decision. You'd need to raid your vacation fund or delay buying a car.

This friction is exactly what makes multiple savings accounts effective. The extra thought required to move money between accounts often prevents impulse decisions that derail your goals.

Banks that offer goal-based savings features report that members who use multiple savings accounts maintain 35% higher balances on average. Young professionals especially benefit from this strategy; building credit and managing savings simultaneously becomes more manageable when each financial goal has its own dedicated space.

Also Read:

Arro’s Commitment to Financial Literacy - Arro | Grow Credit Your Way

Streaming, Subscriptions, and Small Bills: Which Ones Can (and Can’t) Help Your Credit?

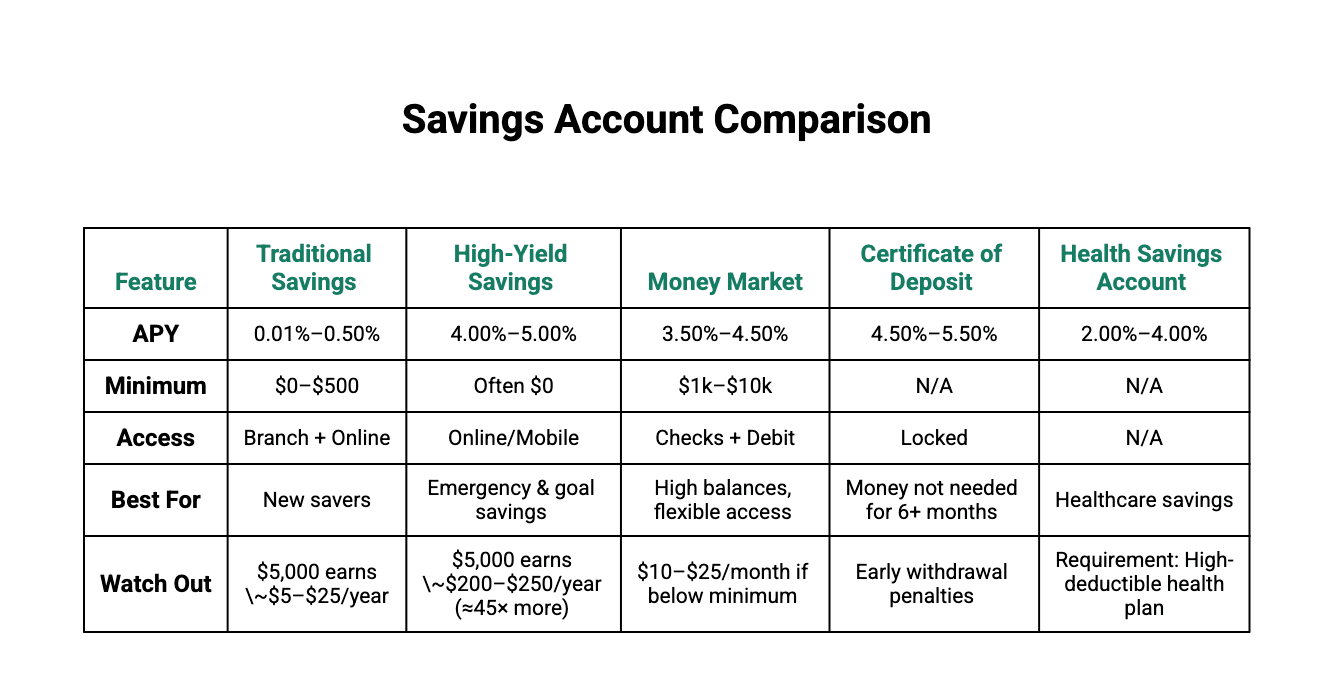

Different Types Of Savings Accounts

Traditional Savings Accounts

Traditional savings accounts at brick-and-mortar banks typically pay modest interest rates of 0.01% to 0.50% annually. The main advantage is in-person accessibility. The downside? Earning $5 annually on a $1,000 balance won't help you reach goals faster.

These accounts work best for beginners building their first emergency fund or for small balances you might need to access quickly.

High-Yield Savings Accounts

High-yield savings accounts change the game completely. These accounts, primarily offered by online banks, pay interest rates between 4.00% and 5.00% as of early 2026.

The math is compelling. A $5,000 balance in a traditional savings account earning 0.10% generates $5 in annual interest. That same balance in a high-yield account earning 4.50% generates $225.

Download the Arro app to see special bank offers from SoFi and others. Online banks offer higher rates because they don't maintain expensive branch networks. Your money is just as safe; FDIC insurance covers high-yield accounts the same way it covers traditional ones.

Learn More About Arro

Money Market Accounts

Money market accounts blend features from checking and savings accounts. They offer competitive interest rates similar to high-yield savings, plus check-writing privileges and debit card access.

The catch is higher minimum balance requirements, often $1,000 to $10,000. Fall below the minimum, and the monthly fees erase your interest earnings. If you're building savings from scratch, start with a high-yield savings account first.

Certificates Of Deposit (CDs)

CDs offer fixed interest rates for fixed time periods, typically three months to five years. Rates usually exceed high-yield savings accounts, especially for longer terms.

The tradeoff is liquidity. Withdraw money before the CD matures, and you'll pay an early withdrawal penalty. CDs work well for money you absolutely won't need until a specific future date.

Specialty Savings Accounts

Banks offer various niche products: student accounts with lower minimums, custodial accounts for minors, and seasonal accounts, such as holiday clubs, that restrict withdrawals until specific dates.

Health Savings Accounts (HSAs) deserve special mention. These triple-tax-advantaged accounts let you save for medical expenses with pre-tax dollars, grow the money tax-free, and withdraw it tax-free for qualified healthcare costs.

Setting Your 2026 Savings Goals

Vague goals produce vague results. "Save more money" sounds nice but leads nowhere. You need specific targets attached to specific purposes.

List everything you want to accomplish financially in 2026. Include short-term desires like a vacation and medium-term milestones like a car down payment. Assign dollar amounts and deadlines.

"Save $3,000 for a Hawaii trip by July" gives you a concrete target. "Build a $5,000 emergency fund by December" creates urgency. Just like building credit requires intentional action, building savings demands specific plans rather than general intentions.

The 50/30/20 Budget Rule Applied To Savings

The popular 50/30/20 budgeting framework allocates 50% of after-tax income to needs, 30% to wants, and 20% to savings and debt repayment.

If you earn $3,500 monthly after taxes, the 20% rule suggests $700 for savings and debt payments. After debt payments, you might have $400 available for savings.

Subdivide that $400 across your specific goals: $200 to your emergency fund, $100 to vacation savings, and $100 to a new car fund. Suddenly, your abstract 20% becomes three concrete monthly contributions. Motivated to save faster? See where you can move some of your 30% budget for wants into more savings.

Setting Realistic Monthly Contributions

Work backward from your goal to determine monthly contributions. Want $3,000 for a July vacation? You have six months, which requires saving $500 each month.

Can't afford $500? Adjust either the timeline or the goal. Save $300 monthly for a $1,800 trip, or extend your timeline to 10 months for the full $3,000.

Break monthly amounts into per-paycheck contributions. If you're paid biweekly, a $500 monthly goal becomes roughly $230 per paycheck. According to research from the Consumer Financial Protection Bureau, people who monitor savings regularly are 42% more likely to reach their goals.

Automating Your Success

The "pay yourself first" principle removes willpower from the equation. Set up automatic transfers from your checking account to your various savings accounts on payday.

Most employers allow splitting direct deposits across multiple accounts. Route your savings contributions directly into their designated accounts before the money ever reaches your checking account.

When money automatically flows into savings, you adjust your spending to your remaining checking balance without feeling deprived. Start small if needed; even $25 per paycheck builds the habit.

How To Open A Secondary Savings Account

Match your account selection to your timeline. Short-term goals need liquidity, making high-yield savings accounts perfect. Long-term goals might justify CDs if rates significantly exceed savings accounts, but don't sacrifice flexibility for a marginal rate increase.

Step-By-Step Process

Opening a secondary savings account takes about 10 minutes online:

Step 1: Research and compare rates. Arro members can access competitive high-yield rates through bank partnerships in the Arro app.

Step 2: Gather required documents, government-issued ID, Social Security number, date of birth, contact information, and your existing bank account number and routing number.

Step 3: Complete the online application. Most banks offer mobile-friendly applications you can use on your phone.

Step 4: Fund your account. Minimum initial deposits range from $0 to $100 at most online banks.

Step 5: Set up automatic transfers aligned with your payday to lock in the "pay yourself first" strategy.

Step 6: Name your account strategically using specific goal names like “House Down Payment” rather than generic labels like "Savings Account 2."

Most goal-specific savings work best without easy access points, reducing temptation to withdraw funds prematurely.

Managing Multiple Accounts Without Overwhelm

Check your accounts monthly, not daily. Arro lets you view all accounts from one dashboard, even if they're at different institutions.

A simple spreadsheet tracking goals, current balances, target amounts, and monthly contributions keeps you organized. Update it monthly after transfers complete.

Ready to maximize your 2026 savings? Arro members can check the Arro app for the latest bank offers that can boost their savings. Connect your accounts in the Arro app for easy tracking

See how Arro can help you access these benefits.

FAQ

How many savings accounts should I have?

Most people benefit from two to four savings accounts: one emergency fund and two to three goal-specific accounts. More than five can become difficult to manage, while having just one reduces the psychological benefit of separating your money by purpose.

What's the difference between a primary and a secondary savings account?

Your primary savings account holds your emergency fund, three to six months of expenses you can access immediately for unexpected costs. Secondary savings accounts are dedicated to specific goals like vacations, down payments, or large purchases, creating mental boundaries that help you avoid dipping into these funds.

Are high-yield savings accounts safe?

Yes, high-yield savings accounts at FDIC-insured institutions are just as safe as traditional savings accounts, protecting deposits up to $250,000 per depositor. The higher interest rates come from lower overhead costs at online banks, not from taking on additional risk.

Can I withdraw money from a secondary savings account anytime?

Most savings accounts allow withdrawals without penalty, though some institutions may limit certain types of transfers or the number of transfers per month. Check your specific account terms, but the whole point of a secondary savings account is to avoid withdrawing until you reach your designated goal.

How much interest can I earn with a high-yield savings account?

As of early 2026, competitive high-yield savings accounts offer rates between 4.00% and 5.00% APY, compared to 0.01% to 0.50% for traditional bank savings accounts. On a $5,000 balance, that's $200 to $250 versus $0.50 to $25 annually.

Do I need separate savings accounts at different banks?

Not necessarily. Many banks allow you to open multiple savings accounts under a single login, making account management easier. However, using different institutions can create additional psychological separation and may help you find the best rates for different goals.

What's the minimum amount needed to open a secondary savings account?

Many online high-yield savings accounts have no minimum opening deposit, while traditional banks may require $25 to $100. Look for an account with a $0 minimum balance, then start your automatic transfers as soon as possible.

How quickly can I open a new savings account?

Opening a savings account online typically takes five to 10 minutes. You'll need identification, your Social Security number, and bank information if you're transferring funds. Many accounts are approved instantly and accessible immediately, or within 1 to 2 business days.