What Is Financial Education?

How Can Financial Education Help Me?

The Evolution Of Financial Education

Where Do I Begin If I Want To Learn More About Financial Literacy?

Arro’s Mission Is To Help Customers Succeed

Why Choose Arro?

FAQs

It’s been 19 years since the US Senate passed Resolution 316 by unanimous consent, which designated 2004 as the first Financial Literacy Month. Since then, Americans have experienced a major economic crisis and seen total credit card debt rise from $700 billion to nearly $1 trillion.

And that’s exactly why, at Arro, we’re committed to finding a way to give our customers access to credit while also supporting them toward a better financial future. Many believe financial education is crucial, but it remains difficult to teach effectively.

In this article, we’ll break down what financial literacy is, explore the importance of financial literacy, and answer the key question of why financial literacy is important for anyone working toward a stronger financial future.

Key Takeaways

Financial education empowers individuals to make better financial decisions and build credit effectively.

Arro integrates financial literacy directly into the credit-building process, offering a seamless, educational experience.

Incentives, like higher credit lines and lower interest rates, are linked to completing educational tasks and making timely payments.

Financial literacy education can be most effective when it is accessible and relevant at key decision-making moments.

Arro’s AI Money Coach, Artie, offers personalized support and real-time guidance to help users stay on track with their financial goals.

Clear financial incentives and actionable lessons help users engage consistently and see real progress in their credit journey.

What Is Financial Education?

Financial education is designed to give people the information they need to make good financial decisions. This is commonly referred to as ‘financial literacy’ or the ability to use and understand key financial products and skills such as budgeting, saving, and debt management.

Financial education could refer to:

formal classes, taught through schools, coaches, and continuing education programs

less formal resources such as blogs or social media

All of these resources share the goal of helping people use financial products and apply skills more effectively to achieve their goals and navigate challenges.

This is not to say that “Financial Literacy Month” has been a failure, in fact, over this past year more than 30 US state legislatures have debated bills offering or requiring a financial literacy class before students graduate high school, with pushes coming from both major political parties, but rather to say that many of the problems that drove the push for increased financial literacy aren’t going away.

And while few people would argue that financial literacy is a cure-all for all financial problems or, on the other hand, that it is irrelevant, much of the research on programs’ effectiveness is inconclusive.

How Can Financial Education Help Me?

The negative experiences people have had while navigating their finances shape the narrative around financial literacy. In our research, we spoke with one person who got his first credit card because his friend suggested it, and then promptly racked up $2,000 in unnecessary clothes and shoes that he took years to pay back. Another person we spoke with avoided getting any type of credit because she saw her parents go through a bad experience.

However, when she desperately needed a new car, she was denied an auto loan because she had no credit score. These stories are common, but because personal finance is a highly sensitive topic, most people don’t feel comfortable discussing it, even with their closest friends and family, which is a clear example of why financial literacy is important for people at every stage of life.

Could financial education have improved these situations? Even if everyone received standard financial education, unfortunately, measuring the efficacy of programs and even agreeing on what financial literacy is in practice isn’t straightforward. Especially in schools, where running tests is often either impractical or unethical, it is easier to understand the proliferation of programs than their effectiveness.

The Evolution Of Financial Education

Although it has been nearly 20 years since the first financial literacy month, the adoption of financial literacy classes for students is a more recent trend.

Source: Pew Research Center

Today, only seven states require financial literacy education in schools, and only an estimated 30% of public school students have access to courses. Parallels can be drawn to the adoption of broader health education in high schools over time, which is now required in some form by 39 states and available to most students.

Studies have shown that comprehensive programs are effective in driving successful health outcomes, results that may be replicated with financial education, which highlights the broader importance of financial literacy as part of a student’s long-term well-being.

Even as financial education programs become more widespread in schools, however, there are still lingering problems. Firstly, this ignores the millions of people who have already finished high school. Secondly, studies evaluating financial literacy programs for adults have been successful in teaching some topics, such as encouraging saving for retirement and planning, but have struggled to drive positive outcomes in areas such as debt management and budgeting.

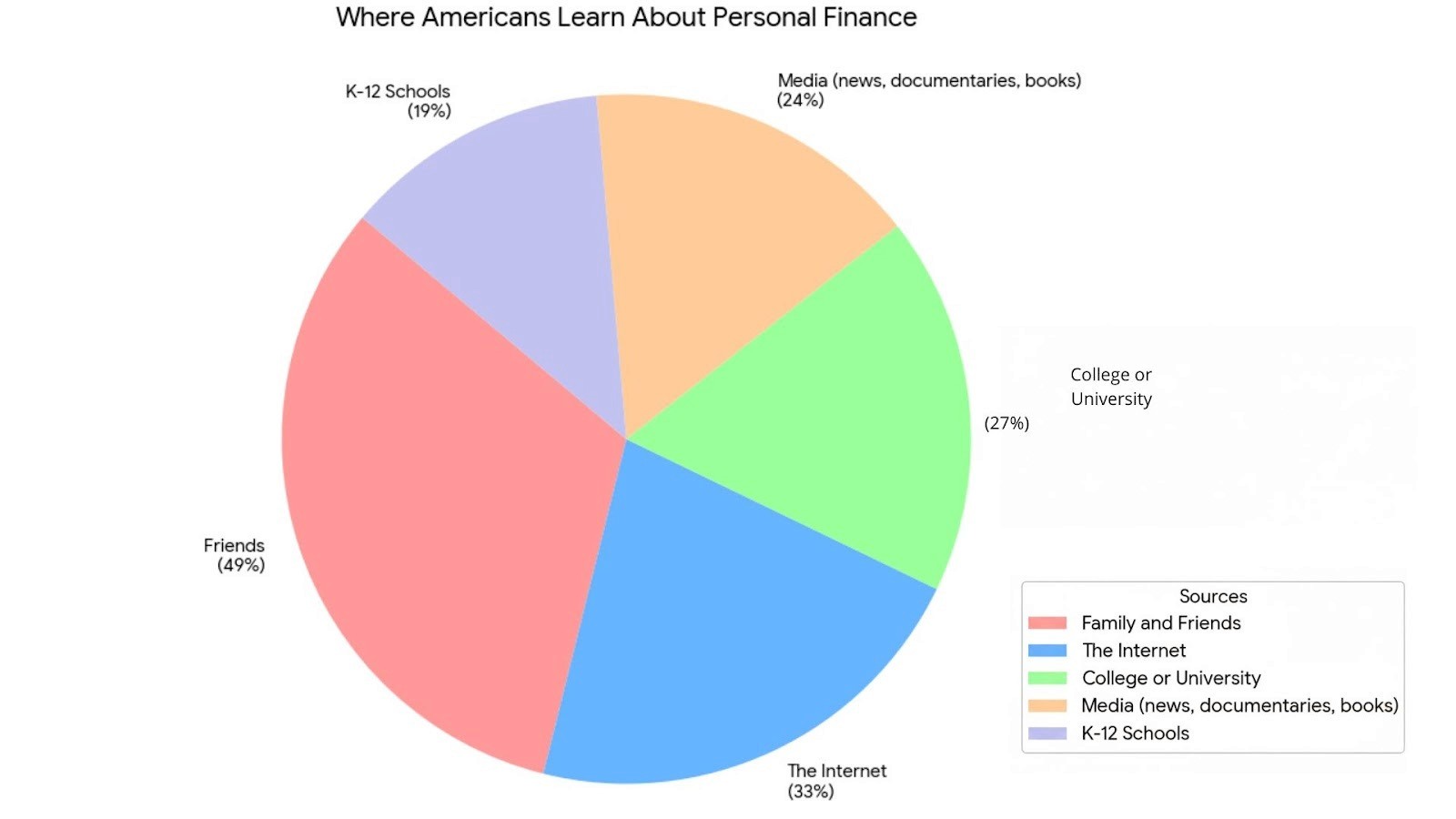

Many financial challenges a person may face across their adult life are nearly impossible to prepare for and teach in a single class. Instead, many Americans rely on their credit card companies or their friends and family to get advice about topics like using a credit card or investing.

Where Do I Begin If I Want To Learn More About Financial Literacy?

People want to improve their finances and financial security. In their survey of 2023 New Year’s resolutions, Forbes found that only goals about improving physical and mental health ranked higher than improving finances. And there is plenty of high-quality information available online to help people improve their financial literacy. Large banks such as Bank of America, Capital One, and Chase all link to learning resources on the front page of their websites.

So what stops people from using these resources to answer their financial questions and achieve their goals? Incentives and Timing.

People respond to incentives.

A sale offered by a department store helps encourage people to visit.

Lower insurance premiums encourage people to take defensive driving courses.

Lottery drawings helped to encourage people to get the COVID-19 vaccine.

For some people, learning can be its own incentive, but this often isn’t enough to motivate them to make time in their stressful, busy lives. The most successful programs, whether for-profit or not, provide an additional incentive for people to engage, whether by offering a financial reward or by making it easier for them to accomplish their goals.

Programs like savings matching and making 401(k)s opt-out rather than opt-in have helped people build emergency and retirement savings, demonstrating how smart design and incentives can effectively support financial behaviors. Similarly, financial literacy education works best when it's paired with actionable incentives and timely guidance.

Secondly, financial literacy is only helpful to the extent that it is accessible at the moment when it is needed. This can be accomplished by providing people with easy-to-remember rules or by integrating the education directly within a product, making financial literacy practical and applicable to everyday decisions.

For example:

It is easy to find resources on the internet about how to minimize credit card interest charges. Still, this information needs to be easily accessible at two key points in time—moments when financial literacy becomes most valuable for making real financial decisions.

When someone is making their monthly budget

When they are paying off their balance

A credit card attempting to encourage better financial habits needs to provide this information to customers at these key points in time and provide them with a strong incentive to engage with it.

Also read:

Aim High: What an 800 Credit Score Means and How to Get There

How to Build Credit Without a Credit Card: Steps to Get Started

Arro’s Mission Is To Help Customers Succeed

Financial education works best when both sides are invested: an effective guide and an engaged learner. Too many credit card companies talk about education, but mostly collect interest and fees, leaving customers in the dark. And for many, the motivation to learn doesn’t kick in until things get tough.

At Arro, we see financial education as a partnership. By combining useful tips, clear incentives, and the right support, we help people boost their credit scores, pay down debt, and achieve their financial goals. It’s about growing together. This is why financial literacy is important; it empowers people to take control of their financial futures.

How Arro Empowers Users Through Incentives

Customers also have a strong incentive to engage with Arro’s financial literacy content. Most credit card companies use black box models to determine whether customers are eligible for increased credit lines or decreased interest rates. This often leads to bad outcomes where people either don’t know what they need to do to achieve their goals, or their credit line is raised more quickly and to a higher amount than they are comfortable managing.

Instead, Arro’s learning program allows customers to determine their own pathway to a higher credit line and lower interest rate through their own actions, such as taking financial education activities, making payments, or setting a budget.

Financial Education Works Best As A Partnership

Like most types of education, financial education requires both an effective teacher and an engaged learner. Most credit card companies only provide lip service to financial education while they happily collect interest charges and late fees from their customers. Arro believes that financial education can be a partnership between companies and customers that can help people raise their credit scores, pay down debt, and achieve their financial goals.

Why Choose Arro?

At Arro, we believe building credit shouldn’t be confusing, expensive, or out of reach. That is why we have crafted a credit card that supports you in learning, earning, and developing, all seamlessly integrated within a single app. This is what financial literacy is all about: making credit-building easy, accessible, and rewarding.

With no hard credit checks, no deposit, and 1% cashback on gas and groceries, Arro makes it simple to start improving your credit while rewarding your everyday spending. You’ll also get access to Artie, your personal AI Money Coach, who’s there 24/7 to answer questions, celebrate wins, and help you make smart financial moves.

Every on-time payment, every lesson, every small step forward helps you unlock higher credit limits and better credit health. The importance of financial literacy is evident in the results: every positive action you take strengthens your financial future. Thousands of people are already building stronger credit with Arro and having fun doing it.

Ready to take the first step toward better financial health?

FAQs

1. How does Arro’s AI Money Coach, Artie, provide personalized financial guidance?

Artie, Arro’s personal AI Money Coach, provides real-time financial advice tailored to each user’s specific needs. Artie offers actionable tips, celebrates your wins (like hitting payment streaks), and helps you stay on track with your financial goals. Wondering ‘What is financial literacy’? Artie makes it simple by breaking down complex financial concepts into bite-sized lessons and reminders, ensuring you always have guidance when you need it.

2. What steps does Arro take to ensure its members’ financial security?

Arro helps members build financial security through transparent practices and educational support. Our 'no surprises' model means you'll never face unexpected fees or charges, helping you maintain better control over your finances and budget with confidence. Combined with Artie's 24/7 guidance and our structured pathway to higher credit limits through responsible behaviors, Arro gives you the tools and knowledge to build a stronger financial foundation for your future.

3. What are some common obstacles people face when trying to improve their financial literacy?

Common obstacles include overwhelming, conflicting information online, a lack of practical resources that connect education to real-life situations, and low motivation without immediate rewards or feedback. Arro helps to overcome these challenges with bite-sized lessons, a 24/7 AI financial coach, and real rewards.

4. Can Arro help members with no credit history at all?

Yes! Arro is designed to help individuals with no credit history, including young adults, students, and newcomers to the country. Unlike many traditional credit card companies, Arro doesn’t require a credit history for approval. Arro also doesn’t perform hard credit checks, so you can start building your credit without the worry of impacting your score. Through the integration of financial education and incentivized learning, even users with no credit history can build a strong financial foundation.

5. How does Arro make financial literacy more accessible and engaging compared to other platforms?

Arro makes financial literacy practical by integrating lessons directly into the credit card app. The gamified approach, rewards, and real-time guidance from Artie, the AI Money Coach, keep users engaged and motivated to apply what they learn to their financial goals.