How Credit Score Affects Car Insurance Rates

The Power Of Micro-Limits In Building Credit

How Your Small Credit Line Can Lower Car Insurance

Tips To Maximize The Impact Of Small Credit Limits

Small Steps, Big Wins: Build Credit And Save On Insurance

FAQs

Let's be real: when you're starting with a small credit limit, it might seem modest.

But here's the thing: small limits can lead to big results. A small credit line is the first step toward building your credit score, which helps you unlock lower car insurance premiums over time.

In Forbes' study, approximately 66% of policyholders saw lower car insurance rates when insurers used credit-based scoring in determining premiums. By using that small limit wisely, you’re building your credit, which means better rates and big savings on car insurance in the long run. In this article, we’ll show you exactly how it works!

Key Takeaways

A small credit line can lead to big savings on car insurance by improving your credit score over time.

Insurers use your credit score to assess risk, with higher scores typically leading to lower premiums.

Making on-time payments and keeping your credit utilization low can help you build your credit and unlock better rates.

Improving your credit score can unlock valuable discounts, including savings for completing financial education programs.

Each on-time payment and responsible credit use adds to your financial reputation and leads to lower car insurance rates.

Building credit with a small limit is just the start; gradually increasing your credit line opens up more opportunities for better premiums and rewards.

How Credit Score Affects Car Insurance Rates

Here’s the deal: your credit score is a big deal when it comes to car insurance. Believe it or not, car insurance companies look at your credit score as part of determining your premium. The logic is simple: insurers believe that if you manage your credit well, you’re more likely to manage your car, too. And if you manage your car well, you’re less likely to cause accidents.

Better Credit Equals Lower Premiums: A better credit score typically translates to lower premiums.

Manage Your Credit Well: When you make on-time payments and keep your balance low, your credit score improves, helping you become less of a risk in the eyes of insurers.

So, how does this tie into your small credit line? As you start building your credit, your credit score will improve. Over time, this improved credit score helps lower your car insurance premiums. The more you manage that little limit responsibly, the more your premiums drop. It’s like a snowball effect, but in a good way!

Start small, and your credit score will grow, leading to lower insurance premiums as a result.

The Power Of Micro-Limits In Building Credit

Starting small doesn’t mean staying small. A small credit line might seem modest at first, but it’s actually an important starting point. Here’s why even a small credit line can be a powerful tool:

Small Limits Mean Low Risk: With a small credit line, you're not taking on too much at once.. It’s a manageable way to start building credit without worrying about high interest rates or large deposits. It’s all about starting at a pace that works for you.

Building a Positive Credit History: By using that small credit line and paying it off regularly, you show you’re responsible with credit. Over time, this builds your credit history, which helps you qualify for better opportunities, like lower insurance premiums.

Boost Your Credit Utilization Ratio: Credit utilization (how much of your available credit you use) plays a big role in your credit score. Keeping your usage below 30% of your available credit helps keep your score healthy and growing.

The small steps you take now with a micro-limit will set the foundation for bigger wins in the future, whether it’s improving your credit score or lowering your car insurance premiums.

How Your Small Credit Line Can Lower Car Insurance

You might still be wondering: “How does this all lead to cheaper car insurance?” It’s pretty simple when you break it down:

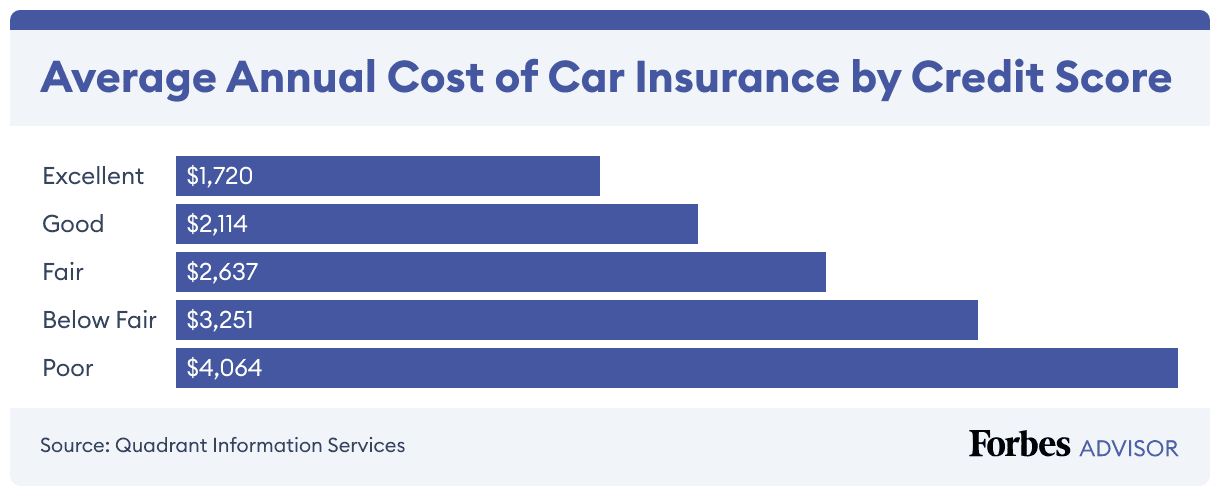

Source: Forbes

Premiums = Credit Score

As your credit score improves, your car insurance premiums get cheaper. Insurers look at your credit score to gauge how much risk you present; higher credit scores usually indicate lower risk. The better your score, the less you’re seen as a liability, which means lower premiums. That small credit line is just the beginning.

Forbes says car insurance companies consider factors like credit score, driving history, and vehicle type, with better credit typically leading to lower rates.

Every on-time payment and responsible use of credit increases your credit score, leading to progressively lower insurance rates. Starting small is part of the process that sets you up for bigger savings down the road.

Trust With Insurers

Insurance companies don’t just look at your driving history; they also pay attention to your financial habits. A healthy credit score signals that you’re a responsible individual who can manage your finances, including car-related expenses.

As you build your credit, insurers start to see you as low-risk, and when they see low risk, they reward you with lower premiums. Over time, the better your credit, the better your credit score for car insurance rates. That’s the magic of growing your credit score; it works in your favor with insurers!

Unlock Discounts

As your credit improves, you’ll likely unlock some valuable discounts. Some insurers offer savings to customers with high credit scores or reward those who complete financial education programs. And with Arro, you’re already ahead of the game.

As you build your credit and earn points through the Arro App, you're setting yourself up for better rates and even more discounts. The more you grow your credit, the more you unlock, making the whole process feel like a game with rewards at every level.

The more you improve your credit, the more you unlock lower insurance premiums and better offers.

Tips To Maximize The Impact Of Small Credit Limits

Building credit with a micro-limit is one thing, but there are ways to supercharge your progress and get the most out of your small credit line. Here’s how to maximize your credit score for car insurance savings:

Make On-Time Payments, Every Time: Seriously, never skip a payment. Timely payments are the golden ticket to building credit. Set up auto-pay with Arro to make sure you’re never late. Every payment you make builds your financial reputation.

Keep Your Credit Utilization Low: Don’t exceed 30% of your available credit. For example, with a $300 limit, keep your balance under $90.This helps boost your credit score, which could lead to lower insurance rates.

Gradually Increase Your Credit Limit: Once you’ve demonstrated responsible use, Arro may offer you the opportunity to increase your credit line. This not only improves your credit score but also gives you more flexibility in how you use your credit.

Monitor Your Credit Regularly: With Arro, you can track your progress and watch your credit score climb. Keep an eye on it, and use the insights to make smarter decisions along the way.

Maximizing your credit potential is about smart management and leveraging Arro’s tools and rewards.

Also read:

Small Steps, Big Wins: Build Credit And Save On Insurance

Starting with a small credit line can make a big difference over time, improving your credit score for car insurance, unlocking discounts, and building a foundation for long-term financial growth. Responsible use, low utilization, and on-time payments all add up to real savings and better opportunities.

At Arro, building credit is simple, rewarding, and accessible. Our credit card combines learning, earning, and development in one app, so you can improve your credit while enjoying everyday rewards.

There are no hard credit checks or deposits, and you earn 1% cashback on gas and groceries. Artie, your AI Money Coach, is available 24/7 to give personalized guidance, celebrate wins, and help you make smart financial moves. Every on-time payment and completed lesson helps unlock higher credit limits and stronger credit health.

Thousands of people are already improving their credit with Arro, and having fun doing it.

See how easy it can be to build credit with confidence, improve your credit score for car insurance, and unlock even bigger financial wins over time.

Ready to start your journey?

FAQs

How long does it usually take to see credit improvements from a small credit limit?

Everyone’s timeline looks a little different, but many people start seeing small changes in their credit score within 1–3 months of consistent on-time payments and low utilization. Bigger improvements usually show up after 6–12 months of steady habits. The key is consistency; your score increases as your good behavior accumulates.

2. Does opening a small credit line hurt my credit at first?

Not with Arro. Because Arro doesn’t run a hard credit check, opening your account won’t cause the temporary score dip people normally experience with new credit. Instead, you get the benefit of adding positive payment history to your credit file right away. There’s a chance you may see a slight dip with a new trade line lowering your average age of open credit accounts, but your on-time payments will quickly recover since on-time payments are most important to your credit.

3. Can improving my credit help lower insurance rates even if I don’t own a car yet?

Yes! Many insurers look at your credit-based insurance score when you eventually apply for car insurance, even if the policy is years away. Building credit now means you may qualify for better pricing later, whether you're getting your first car or switching insurers down the road.

4. Does using only a tiny portion of my small credit limit still help my credit score?

Absolutely. You don’t have to spend a lot to build credit. Using even $10–$20 and paying it off consistently can demonstrate responsible behavior. Credit scoring models reward consistency, not the size of your purchases. Think of it as credit reps, small movements, repeated often, that strengthen your financial profile.

5. How do insurance companies verify my credit score for pricing?

Insurers don’t see your full credit report. Instead, they use a credit-based insurance score, a simplified metric focused on risk prediction. It draws on factors such as payment history, your income, job, and debt types. Better habits = better score = better pricing.