More and more banks are offering secured credit cards, particularly for people just getting started on their credit journey or trying to rebuild their credit. But what is a secured credit card, and does it make sense for you?

In this article, we'll explore what secured credit cards are, how they work, whether they can help build your credit, and if there are better options available for your situation.

Key Takeaways

Secured credit cards require an upfront cash deposit, typically equal to your credit limit, tying up your funds while you build credit.

Secured credit cards help build credit through on-time payments, but they function like lending yourself money at interest.

Approval rates are high for secured cards, even for applicants with no credit or low scores, providing accessible access to credit.

The deposit can be recovered by closing the account or graduating to an unsecured credit card after consistent payments, but this isn't guaranteed.

Alternatives like Arro offer credit building without deposits, using bank account data to approve more people while also offering educational resources and rewards.

What Is A Secured Credit Card?

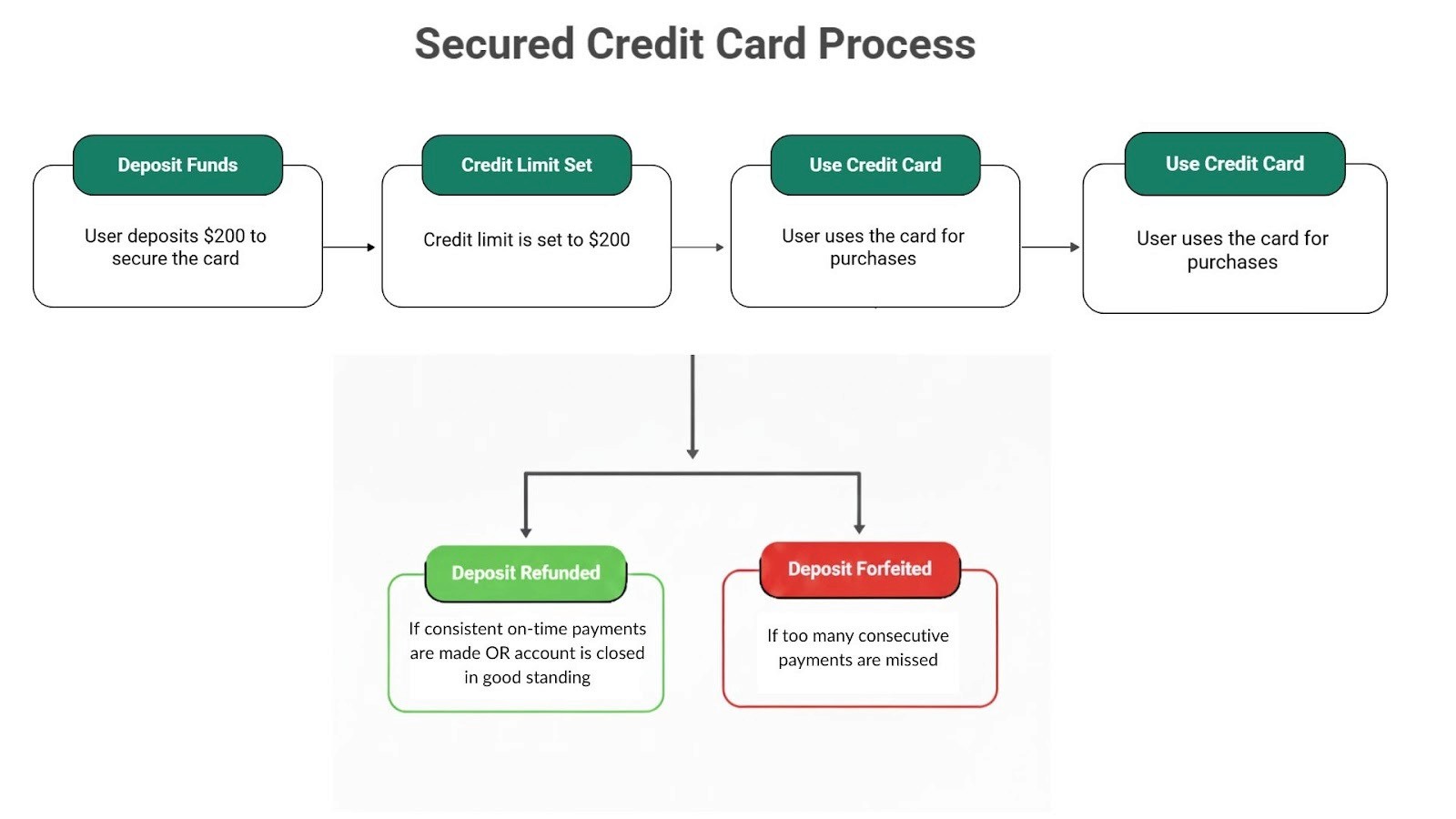

The main difference between secured and unsecured credit cards is that secured cards require a cash deposit up front in order to open an account. If you're approved for a secured credit card, the card issuer will ask you to send money equal to either part or all of the credit card's initial credit limit to fund your account. If you choose not to send the money, then you won't be able to open the account.

How Do Secured Credit Cards Work?

Secured credit cards are similar to regular credit cards. You can use them to shop both in stores and online, just like you would with any other card. But, as with any credit card, here’s what you need to know:

Monthly Payments: You’ll need to make payments towards your monthly balance, just like a regular credit card.

Interest and Fees: Be cautious, interest and late fees can apply if you're not careful.

Graduating to an Unsecured Credit Card: Some issuers may "unsecure" your card and return your deposit after you’ve made enough on-time payments.

Closing the Account: You can get your deposit back by closing your account, as long as everything is paid off.

Deposit Risk: If you miss too many consecutive payments, the issuer may take your deposit.

With responsible use, you can recover your deposit, improve your credit score, and continue building your financial future without upfront deposits or long-term financial stress.

Can A Secured Credit Card Help You Increase Your Credit Score?

Secured credit cards are often used as a gateway into the credit market if you're having trouble getting approved elsewhere. Issuers generally have a high approval rate for secured card applications - even if you don't have credit or your credit score is low - because of the deposit. This is helpful if you're building credit for the first time or rebuilding it.

Opening any credit card and moving some of the purchases you typically make using a debit card or cash to the card is a great way to start building your credit, especially since payment history is the most important factor affecting your FICO Score. Do secured credit cards build credit? Yes, secured credit cards help you build credit, as long as you make on-time payments.

People with a credit score under 650 can often see a significant improvement in 6-12 months by making consistent, on-time payments on a credit card. In this way, a secured credit card helps you build your credit in the same way that an unsecured card does. Just be careful because missed payments may also be reported to the credit bureaus, which will hurt your score.

Are There Better Options Than A Secured Credit Card?

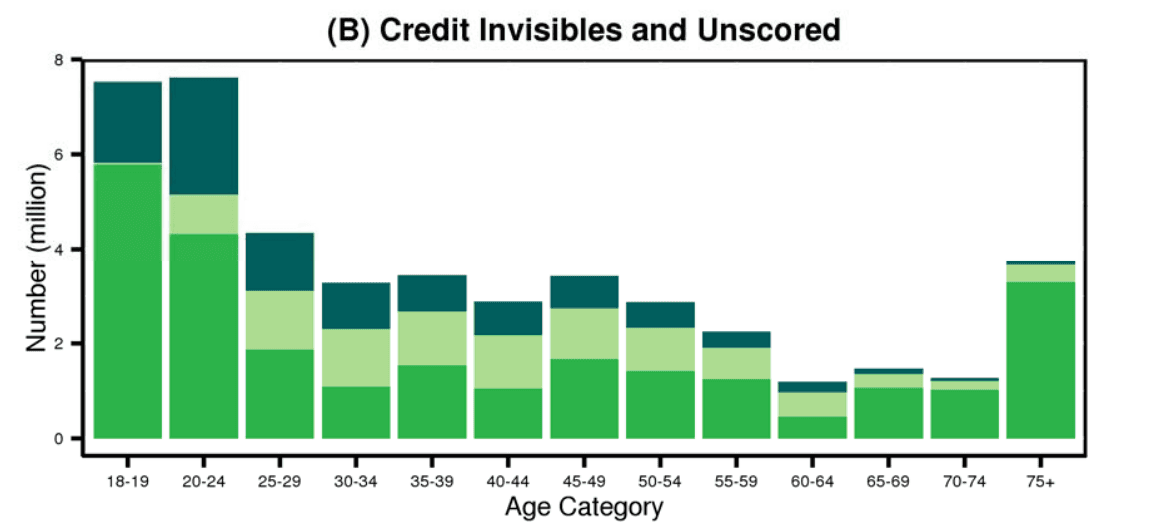

Each year, millions of people in the U.S. struggle to get approved for traditional credit because they lack a credit history.

Source: Consumer Financial Protection Bureau (CFPB)

At one point, around 26 million Americans (roughly 1 in 10 adults) were “credit invisible,” meaning they had no credit history. Many of those consumers consider secured credit cards as a first step to building credit.

Upfront Cash Requirement: You must pay an upfront fee, often $200 or more, just to obtain access to credit.

Limited Control: Your money is tied up as collateral, which defeats the purpose of using credit in the first place.

Deposit Return: The bank may return your deposit only after closing the account or after consistent on-time payments, but this isn’t guaranteed.

Similar to Debit Cards: A secured card behaves similarly to a debit card, except you pay interest and late fees on your own money.

Arro was created to help you build credit while providing access to a credit line for emergencies, without upfront deposits. By using alternative data, we approve more people than secured card companies, without requiring a deposit. You shouldn’t have to pay money up front just to access credit, and you’ll have clear guidance on how to grow your credit line and manage your interest rates.

No Upfront Deposits: No more handing over your hard-earned cash just to get access to credit.

No Interest on Your Own Money: No more charging you interest to lend you back your own money.

Transparent Evaluation: No more hearing that you're "being evaluated" for interest rate decreases without any follow-through.

With Arro, you can start building your credit without the upfront cost, enjoy greater flexibility, and truly take control of your financial future, without the hassle of secured deposits or hidden fees.

Building Credit Made Simple With Arro

Building credit shouldn't be complicated, expensive, or require tying up your hard-earned money. While secured credit cards can help you establish a credit history through consistent payments, they often mean lending yourself your own money at interest, which doesn't make sense when better options exist.

At Arro, building credit shouldn't be confusing, expensive, or out of reach. That's why we've crafted a credit card that supports you in learning, earning, and developing, all seamlessly integrated within a single app. With no hard credit checks, no deposit, and 1% cashback on gas and groceries, Arro makes it simple to start improving your credit while rewarding your everyday spending.

You'll also get access to Artie, your personal AI Money Coach, who's there 24/7 to answer questions, celebrate wins, and help you make smart financial moves.

Every on-time payment, every lesson, every small step forward helps you unlock higher credit limits and better credit health. Thousands of people are already building stronger credit with Arro and enjoying the process.

See how easy it can be to build credit with confidence. Ready to start building credit?

FAQs

1. Can I use a secured credit card to build credit if I have a history of bankruptcy?

Yes, you can use a secured credit card to rebuild your credit even after bankruptcy. Secured cards are often an option for those with poor or damaged credit history, including bankruptcy, because they don’t require a credit score for approval. The key is making consistent, on-time payments, which can help improve your credit score over time.

2. Are there any fees I should watch out for with secured credit cards?

Yes, many secured credit cards come with annual, application, or maintenance fees. These can vary by issuer, so it's essential to read the terms and conditions carefully. Choose a card with manageable fees that align with your financial goals, and consider alternatives with lower costs, such as Arro.

3. Can a secured credit card help me get a loan in the future?

A secured credit card can help improve your credit score, which can make it easier to qualify for loans in the future. However, it’s important to remember that a secured card works like a temporary solution for credit building. Once you have a better credit score, you’ll have access to unsecured cards and better loan options, typically with lower interest rates.

4. How long does it take to see an improvement in my credit score using a secured card?

With responsible use, you can typically see an improvement in your credit score within 6–12 months. The more consistent you are with on-time payments, the quicker you’ll see progress. It’s also essential to keep your credit utilization low (under 30%) to maximize the positive impact on your score.

5. Can I get a refund on my security deposit without closing my secured card account?

In most cases, your deposit can only be refunded by closing your secured credit card account or, after you’ve demonstrated responsible use over time, depending on the issuer. Some banks may "unsecure" your card, allowing you to get your deposit back after consistently making on-time payments, but this isn’t guaranteed by all issuers.