What Makes U.S. Credit Different From Back Home

Building Credit In The USA: Your First 90 Days

Key Credit Habits At A Glance

Your Next 90 Days Start Now

FAQs

Landing in the U.S. with zero credit history can feel like a catch-22. You need credit to rent an apartment, but landlords want to see your credit history. You need a credit card to build that history, but banks want to see existing credit.

More than 40 million people living in the U.S. were born in another country, making up about one-fifth of the world’s migrants. Most landlords require a minimum credit score of 620 to 650 to rent an apartment, a score you likely don’t have when you first arrive. The good news: thousands of people start from scratch and build solid credit within their first year.

Once you understand when to pay, how much to spend, and which moves matter, you can turn those first 90 days into a launchpad for your financial future. In this article, we will guide you through the steps to build credit in the USA.

Key Takeaways

Your first 90 days set the foundation for key financial decisions in your U.S. future, from apartment rentals to car loans.

Learning how to build credit in the USA starts with one rule: always pay on time.

Apply for a credit card designed for newcomers: look for options with no hard credit inquiry and no deposit requirements to get started.

Focus on two key dates once you have your card: the statement closing date (when your statement is issued) and the payment due date (when payment must be received).

Carrying a balance on a credit card or loan doesn’t build credit faster; paying in full each month does.

After 90 days of consistent payments and low balances on your credit card, you’ll have a credit score that opens doors in banking, housing, and beyond.

What Makes U.S. Credit Different From Back Home

In many countries, your banking history speaks for itself. Show a bank statement with steady deposits, and you're trusted. The U.S. system doesn't work that way.

Here, lenders rely on credit scores, three-digit numbers calculated by companies like Experian, Equifax, and TransUnion that predict how likely you are to repay borrowed money.

When you arrive with no U.S. credit history, you're invisible to this system. It doesn't matter if you managed loans successfully in another country or if you have significant savings. Without a U.S. credit file, you start at zero. Understanding how to build credit in the USA means accepting this reality and then working within it.

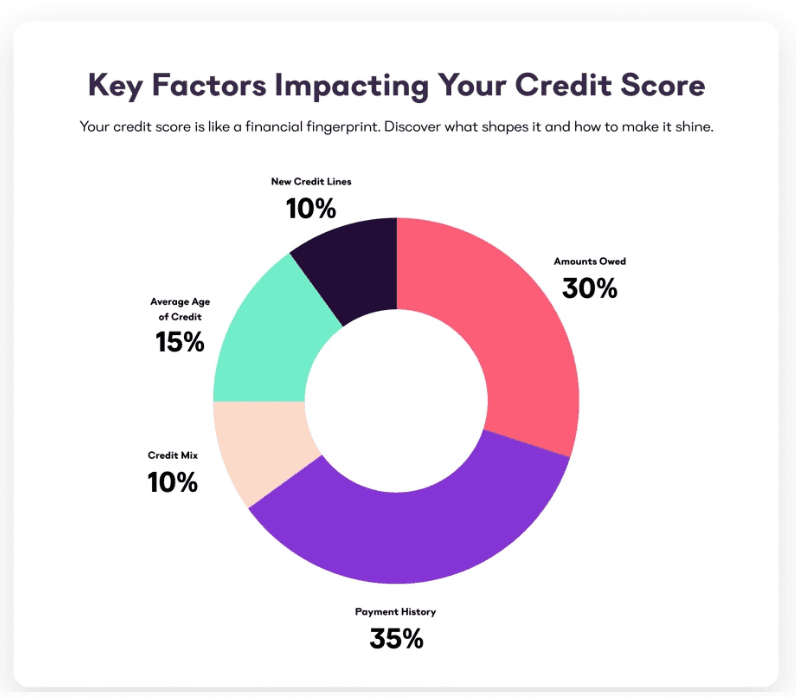

The credit score comes from five main factors:

Source: Apartment List

According to the report, the average credit score for U.S. renters is 650. But as a newcomer starting from zero, you're competing against people who've been building credit for years. That's why every move you make in these first 90 days counts.

Building Credit In The USA: Your First 90 Days

Follow this week-by-week plan to build your credit and set yourself up for financial success in the U.S.

Week 1: Get Your Foundation In Place

Your first week determines whether credit becomes a valuable tool or a source of stress. Start by getting a credit card designed for people with no credit history. Some cards require security deposits; others don't. Both can work, but cards with no deposit frees up your cash for other needs.

Get a Credit Card: Choose a card designed for people with no credit history. Some cards require security deposits, while others don’t; both options work, but cards without deposits allow you to keep more cash available.

Set Up AutoPay: Open the app or website and activate AutoPay for at least the minimum payment. The best option is to turn on AutoPay for the full statement, but either way, this step prevents the most common credit-building mistake: missing a payment. Late payments can stay on your credit report for seven years and damage your score. AutoPay removes that risk entirely.

Set Your Spending Limit: If your credit card has a $500 limit, set your personal limit to $150. This helps keep your utilization ratio, the percentage of available credit you’re using, within the responsible range. Even if paid off, high utilization can temporarily lower your score because lenders view it as a red flag.

Choose two or three small recurring expenses you already pay: a streaming subscription, your phone bill, maybe transit costs. Put only these charges on the card. Nothing else. This strategy makes your credit card use predictable and manageable as you learn to build credit in the USA.

Weeks 2-4: Make Your First Statement Work For You

Understanding how to build credit in the USA requires knowing the difference between two critical dates: the statement closing date and the payment due date. These dates control everything, and most newcomers mix them up.

Statement Closing Date: This is when your statement is issued and includes all activity before that date. Once your statement closes, you'll see your payment due date, total amount due, and minimum payment due. If you don't pay the total amount due by the payment due date, you'll be charged interest on the remaining balance.

Credit Reporting Date: Note that most credit card companies report your balance to credit bureaus on a consistent date each month, which may not align with your statement closing date. This reporting date determines what balance the bureaus see, regardless of when your statement closes.

Payment Due Date: This is about three weeks after the statement closes. It's the deadline to pay at least your minimum payment (though you should always pay the full statement). Missing this deadline results in late fees, interest charges, and damage to your payment history.

Two-Payment Strategy: Many credit card users make two payments monthly to keep their reported balance low. Since issuers report to bureaus on a consistent date each month (often mid-cycle), paying before this date lowers what bureaus see. AutoPay then handles the due date payment, keeping your utilization low and payment history perfect. This keeps your utilization low and your payment history flawless.

Landlord Expectations: According to property management sources, landlords typically look for:

Scores of 700+ for the best terms and lowest security deposits.

650-700 for standard terms.

620-650 may require higher security deposits.

Below 620 often needs a co-signer or a larger upfront payment.

Your goal in these first weeks is to build toward a score of 620+.

During your first month, use the credit card for those two or three recurring charges. Five days before your statement closes, check your balance. If you're over 30% of your limit, make a payment to bring it below 30%. When your first statement arrives, read every line: verify the closing date, the due date, the balance, and that AutoPay is configured correctly.

Weeks 5-8: Lock In The Two-Payment Rhythm

Month two is about consistency. Exact charges, same spending cap, same payment pattern. The goal isn't variety or optimization, it's building muscle memory that will serve you for years. Learning how to build credit in the USA is less about clever tricks and more about reliable routines.

Make your mid-cycle payment before the statement closes to keep your balance low and protect your credit score. Let AutoPay handle the payment due date, and confirm both are cleared. This routine takes about ten minutes per month and helps build a score that saves you thousands in future loans.

Avoid complicating things during this phase. Don't add new charges, try to earn rewards, or apply for more credit cards. Focus on proving you can manage this responsibility. By week eight, you'll have made two on-time payments and kept your balance low for two billing cycles. This consistent behavior builds trust with the credit system.

This matters more than you might think. The U.S. Census Bureau reports that net international migration accounted for 84% of the nation's population increase between 2023 and 2024, with 2.8 million people arriving.

That's 2.8 million people who need to learn how to build credit in the USA, and those who nail these basics in the first 90 days get ahead of everyone else.

Weeks 9-12: Verify Everything Is Working

Three months in, you've established a clear pattern: three on-time payments, consistently low utilization, and no interest paid. Now it's time to verify that the credit bureaus are accurately recording your good behavior.

ChatGPT сказал:

Get Your Free Reports: Visit AnnualCreditReport.com to access your free credit reports annually from all three bureaus. Check that your credit card shows the correct limit, history, and balance. Minor errors, like a $500 limit listed as $50, can hurt your score.

Dispute Mistakes: If you find errors, you can dispute them. The Consumer Financial Protection Bureau provides steps for filing disputes, and credit bureaus have 30 days to investigate.

Understand Lender Views: Reviewing your reports shows how lenders see your payment history, utilization, and credit age, helping you understand how to build credit in the USA.

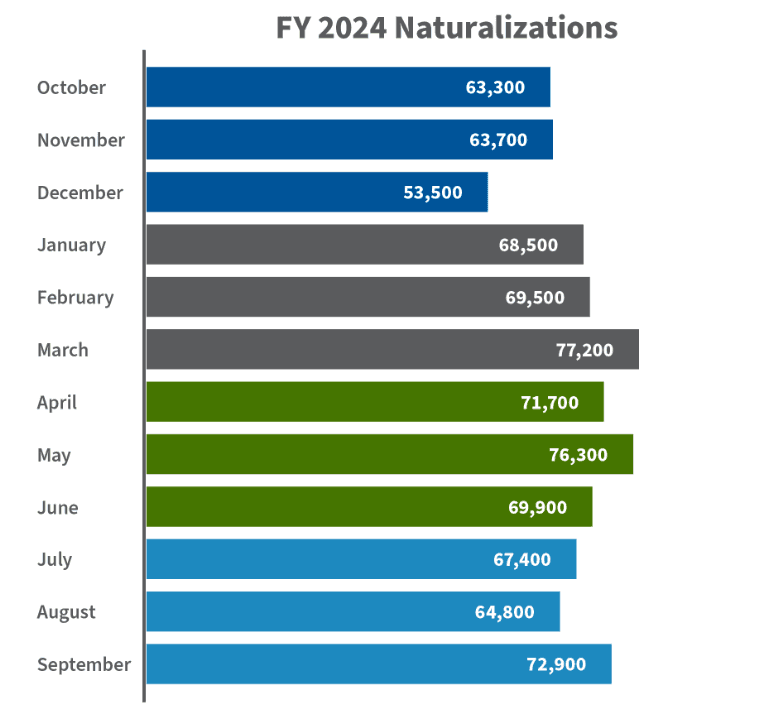

Source: U.S. Citizenship And Immigration Services

By day 90, you should have a functioning credit score, often in the 600s or low 700s, depending on your card issuer's reporting practices. Around 818,500 people became naturalized citizens in 2024 alone. Each one of them had to navigate this same credit-building journey. This credit score unlocks the next level: better credit cards, approval for apartment rentals, and eventually auto loans and mortgages with reasonable interest rates.

Also Read:

Aim High: What An 800 Credit Score Means And How to Get There

Arro Credit Card: Increase Your Odds Of Passing Tenant Credit Checks

Key Credit Habits At A Glance

Here are the key credit habits you should focus on to build a strong foundation in your first 90 days:

These five habits form the backbone of responsible credit use; master them in your first 90 days, and you'll have the foundation for decades of financial success.

Your Next 90 Days Start Now

You came to the U.S. with ambition and plans for a better future. The credit system isn’t designed to make that easy for newcomers. Still, now you know the pattern: low balances, on-time payments, and consistency until the system recognizes you as trustworthy.

In the first 90 days, every on-time payment and month of low utilization builds your credit. By day 90, you’ll have a credit score, and within a year, you’ll qualify for apartments and car loans at better rates.

In FY 2024, 818,500 green-card holders became naturalized citizens, each facing the same challenge: learning how to build credit in the USA. Success often depends on what happens in the first 90 days.

At Arro, we get it. Building credit in a new country shouldn't feel like navigating a maze blindfolded. That's why we built a credit card that actually supports you while you learn how to build credit in the USA, no hard credit checks, no deposit required, and 1% cashback on gas and groceries so your everyday spending works for you instead of against you.

You’ll also get Artie, your personal AI Money Coach, available 24/7 to answer questions, celebrate your wins, and guide you when you’re unsure.

Every on-time payment, lesson, and small step forward unlocks higher credit limits and better financial health. Thousands are already building stronger credit with Arro and enjoying the process.

Your financial future in the U.S. doesn’t have to be overwhelming. With the right tools, clear guidance, and a system that works for you, those first 90 days lay the foundation for everything you’ll build.

See how straightforward it can be to build credit with confidence, no surprises, no confusion, just real progress you can track every step of the way.

Ready to start your own journey?

FAQs

1. How can I track my progress while building credit in the U.S.?

To track your credit-building progress, regularly check your credit score and reports. Many credit card companies, including Arro, offer free credit score monitoring. You can also use free services like Credit Karma to keep tabs on changes in your score. This will help you understand which behaviors are improving your credit and where you may need to adjust.

2. Can I use my credit card for everyday purchases while building credit?

Yes, you can use your credit card for everyday purchases, but it's important to stay within your spending limits and ensure you make payments on time. Limit your purchases to a few manageable expenses (such as subscriptions or monthly bills) to avoid overspending and keep your utilization ratio low. This will help you build credit without risking debt.

3. How can I avoid common credit mistakes in the first few months?

To avoid common mistakes, set up AutoPay for at least the minimum payment to avoid late fees and missed payments. Keep your credit utilization below 30% by paying down your balance before the statement closing date. Stick to a budget and avoid unnecessary purchases or opening too many credit accounts at once. These steps will help you stay on track as you build your credit.

4. What happens if I don’t see my credit score improving after the first 90 days?

If your credit score isn’t improving after the first 90 days, don’t panic. It may take longer for your score to reflect your efforts, especially if you're starting from scratch. Ensure that you’re following the key credit habits (like timely payments and low utilization) and check your credit reports for any errors. If necessary, reach out to a credit counselor or financial advisor to adjust your approach.

5. Is it better to focus on building credit with a credit card or a credit-builder loan?

Both options have their benefits. A credit card offers more flexibility and can help you build credit quickly if you use it responsibly. However, a credit-builder loan can also be a great way to establish a positive payment history, especially if you don’t have a credit card. If you're just starting, a credit card (such as an Arro Card) may be a more accessible option, but you can use both methods for a well-rounded approach to building credit.