The Basics Of Utility Credit

Why Set Up Automatic Payments?

Best AutoPay Tactics To Avoid Late Fees

How Arro Can Help You Stay On Track

FAQs

Setting up utility services for the first time or managing an existing account often means dealing with recurring bills. If not handled properly, missed payments can result in unnecessary late fees and a negative impact on your credit score. One of the simplest ways to stay on top of payments and avoid penalties is by setting up automatic payments, usually called AutoPay. By doing this, you ensure that your utility bills are paid on time every month, without any hassle.

In this article, we will explore the basics of utility credit, why setting up automatic payments is a smart move, and the best tactics to avoid late fees and build positive credit history.

Key Takeaways

Automatic payments ensure your utility bills are paid on time, preventing missed payments and avoiding late fees.

By paying on time each month, you can build a utility credit history that may help improve your credit score.

Choose a reliable payment method and set your payment date early; otherwise, in the worst-case scenario, your utilities may be temporarily shut off

Monitor your usage and keep your details updated to ensure smooth, uninterrupted payments.

The Basics Of Utility Credit

Utility credit refers to how your on-time payments for utilities like electricity, water, and gas can impact your credit score. While not all utility companies report your payment history to credit bureaus, many do, and consistent on-time payments can help improve your credit score over time. Even if your provider doesn’t report to the bureaus, keeping up with your utility payments is still important.

An additional benefit of paying on time is that many utility companies allow you to pay at the end of the month, rather than requiring prepayment. This flexibility helps with managing your cash flow while still benefiting from utility credit, which can be used for credit-building purposes if you decide to report your payments to the bureaus.

Here’s why:

Avoid late fees: Missing payments can lead to fees that add up quickly and put unnecessary strain on your finances.

Pay at the end of the month: By staying current with your utility payments, you can avoid the need to prepay and instead pay at the end of the billing cycle, offering greater flexibility with your cash flow.

Build a positive payment history: Consistently paying your bills on time helps you develop better financial habits. Plus, if you ever decide to report your utility payments to credit bureaus, having a strong payment history could give you a credit boost through services that can help, some of which are free or low-cost.

By staying consistent with your utility payments, you create a solid financial foundation that will support your long-term goals, whether it’s improving your credit or managing your finances more effectively.

Why Set Up Automatic Payments?

Setting up AutoPay for your utilities offers several key advantages:

No More Missed Payments: Once set up, you don’t have to worry about forgetting a due date.

Avoid Late Fees: Missed payments often come with late fees that can add up quickly, especially when they’re a recurring issue.

Build a Positive Payment History: By paying on time every month, you’re demonstrating financial responsibility. If your utility company reports payments, this can help improve your utility credit.

Peace of Mind: AutoPay eliminates the stress of keeping track of multiple bills and due dates, allowing you to focus on other things.

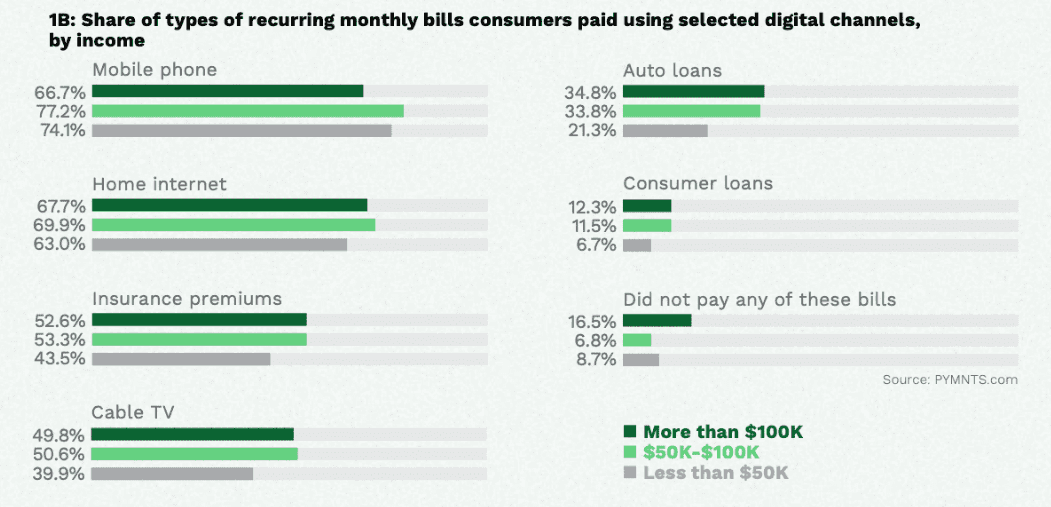

Source: PYMNTS.com

In fact, roughly 39% of consumers in the US already use automatic payments for their recurring bills, so it’s not just a trend; it’s a smart and growing norm. Setting up AutoPay helps you get ahead of your bills and focus on what matters most.

Automatic payments ensure you never miss a due date, giving you more control over your financial health.

Best AutoPay Tactics To Avoid Late Fees

Setting up AutoPay is an excellent first step toward managing your utility payments, but to get the most out of it, it’s important to handle it with care. By following these tactics, you can ensure everything runs smoothly, keeping your finances on track and avoiding those pesky late fees.

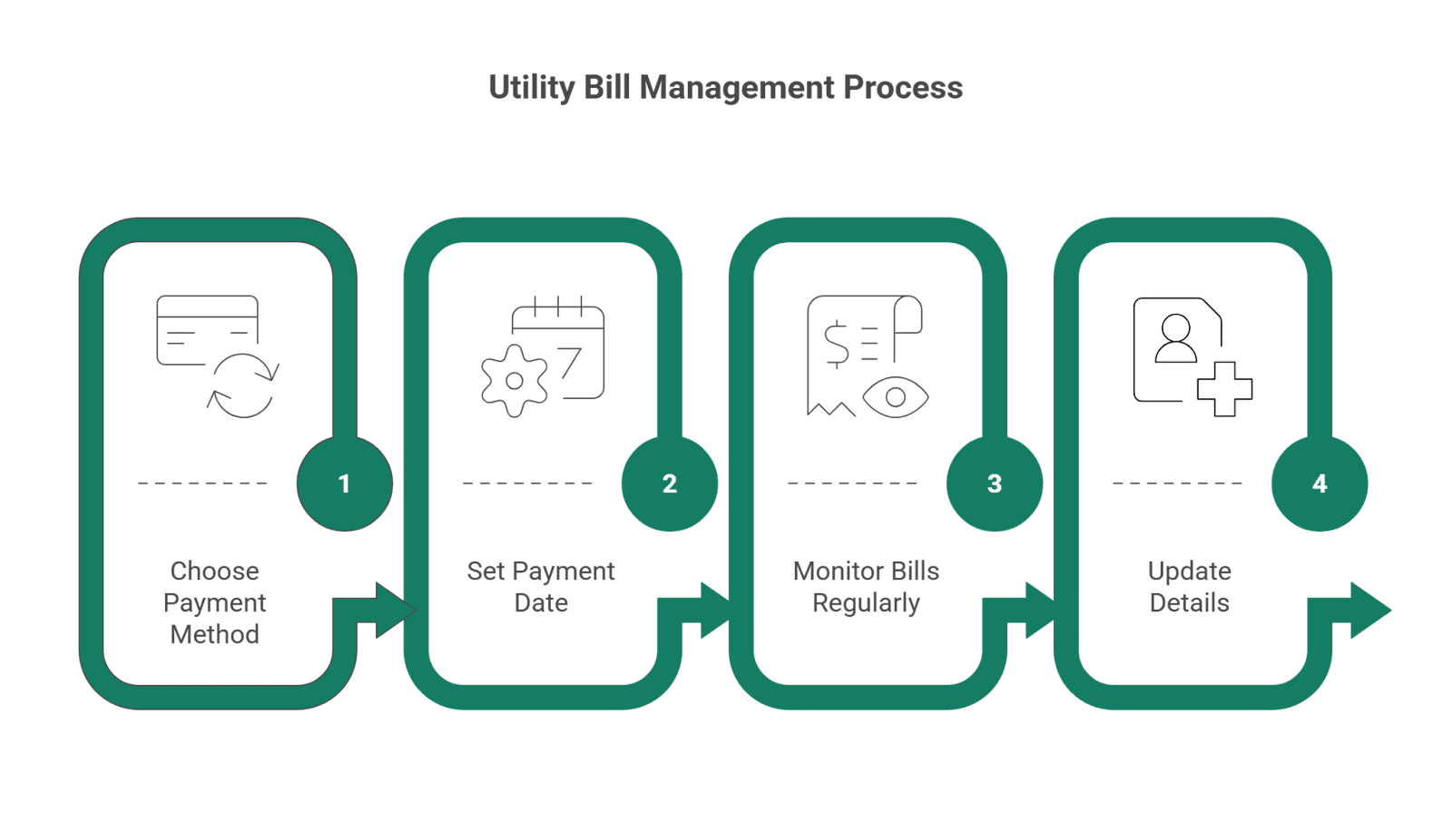

1. Choose The Right Payment Method

Linking your AutoPay to a reliable bank account or credit card is crucial. Make sure the account you use has enough available funds to cover the bill. This simple step can save you from potential overdraft fees or failed transactions caused by insufficient funds.

Pro Tip: Keep your linked payment method up-to-date. If your bank account or credit card changes, update the details in your AutoPay settings to ensure seamless transactions. It’s the small steps that can prevent big headaches later on.

2. Set a Payment Date That Works For You

One of the great things about AutoPay is the flexibility. Most utility companies allow you to select the payment date, so you don’t have to worry about missing a deadline. Try choosing a date that’s a few days before the actual due date. This gives your payment time to process, ensuring it clears without any delays.

Tip: By giving yourself a buffer, you stay one step ahead, avoiding the stress of last-minute payments. You’ll feel more in control of your budget, knowing everything is taken care of in advance.

3. Monitor Your Bills Regularly

Even though AutoPay takes care of the payment itself, it’s still a good idea to keep an eye on your utility bills. Unusually high usage can result in larger-than-expected bills, and catching these discrepancies early can help you avoid financial surprises.

Note: Regularly monitoring your bills helps you spot usage fluctuations. If you notice a spike, you can adjust your payment or change your consumption habits to stay within your budget. It’s about staying proactive and in control.

4. Keep Your Details Updated

Life changes, and so can your bank account or credit card details. Always ensure your AutoPay settings are up to date, especially if you’ve changed accounts. Updating your information promptly ensures your payments go through smoothly, without disruption.

Final Thought: Make it a habit to check your account details regularly. This simple task can save you from missed payments or service interruptions, keeping everything on track without extra stress.

Following these straightforward tactics, you’ll not only avoid late fees, but you’ll also build good financial habits that will last for years. Keeping your payments automated and organized means less to worry about and more time to focus on what matters most.

Also read:

Arro Credit Card: Increase Your Odds of Passing Tenant Credit Checks

5 Credit Myths That Could Haunt Your Score (and How to Banish Them)

Save Big, Stress Less: Arro's Tips For Black Friday Budgeting

How Arro Can Help You Stay On Track

At Arro, we understand the challenges of managing bills and building utility credit. Our tools are designed to help you stay on top of your finances and avoid late fees. With features like automatic payment reminders and budget tracking, Arro helps you stay informed and in control of your utility bills.

If you need a reminder, you're not alone. About 41% of households use AutoPay for recurring bills, making it easier to stay organized and avoid late payments. By using Arro, you can confidently track your expenses and continue to build positive utility credit.

We believe building credit shouldn’t be confusing, expensive, or out of reach. That’s why we’ve created a credit card that makes credit building simple, with seamless integration of learning, earning, and development all within a single app.

With no hard credit checks, no deposit, and 1% cashback on gas and groceries, Arro makes it easy to start improving your credit while rewarding your everyday spending. You’ll also get access to Artie, your personal AI Money Coach, who’s available 24/7 to answer questions, celebrate wins, and help guide you toward smarter financial decisions.

Every on-time payment, every lesson, and every small step forward helps you unlock higher credit limits and better credit health. Thousands of people are already building stronger credit with Arro, and they’re having fun doing it.

Ready to start your own journey? See how easy it can be to build credit with confidence.

FAQs

Can I set up AutoPay for my utilities if I have a bad credit history?

Yes, AutoPay can be set up regardless of your credit history. Utility companies generally do not require a credit check to establish AutoPay. As long as you ensure there are sufficient funds in your account, you can automate payments to avoid missing any due dates.

How do I know if my utility provider reports payments to credit bureaus?

Not all utility providers report payments to credit bureaus. To find out, contact your utility company directly and ask if they report your payment history to the major credit bureaus (Experian, TransUnion, or Equifax). Alternatively, you can also use services like Experian Boost to include your utility payment history in your credit score calculation.

Can AutoPay be set up for all types of utility bills (gas, electric, water, etc.)?

Yes, most utility companies offer the option to set up AutoPay for various types of utility bills, including gas, electricity, water, and even internet or phone services. You can usually set this up through the utility company's website or mobile app.

What should I do if I need to pause my AutoPay due to financial difficulties temporarily?

If you’re experiencing financial hardship, it’s a good idea to contact your utility provider to discuss options. Some companies may offer payment extensions or allow you to pause AutoPay for a brief period. Additionally, adjusting the AutoPay amount to just the minimum required can help avoid late fees.

Are there any benefits to paying more than the minimum AutoPay amount for my utilities?

While utility bills typically require you to pay the full amount due, paying more than the billed amount can help reduce your balance faster. If your utility company reports payment history to credit bureaus, consistently paying on time and in full can demonstrate good payment habits, which may benefit your utility credit score. However, most utility companies don't charge interest or finance fees on unpaid balances, so paying extra isn't necessary unless you're aiming to reduce your balance quicker.