What Happens When You Miss A Payment?

Why Do Late Payments Affect Your Credit Score?

How Long Does A Late Payment Stay On Your Credit Report?

The Real Impact: How Missing Payments Affects Your Financial Future

Strategies To Recover From A Late Payment On A Credit Report

How To Avoid Future Late Payments

Building Credit After Payment Issues

Take Control Of Your Credit Journey With Arro

FAQs

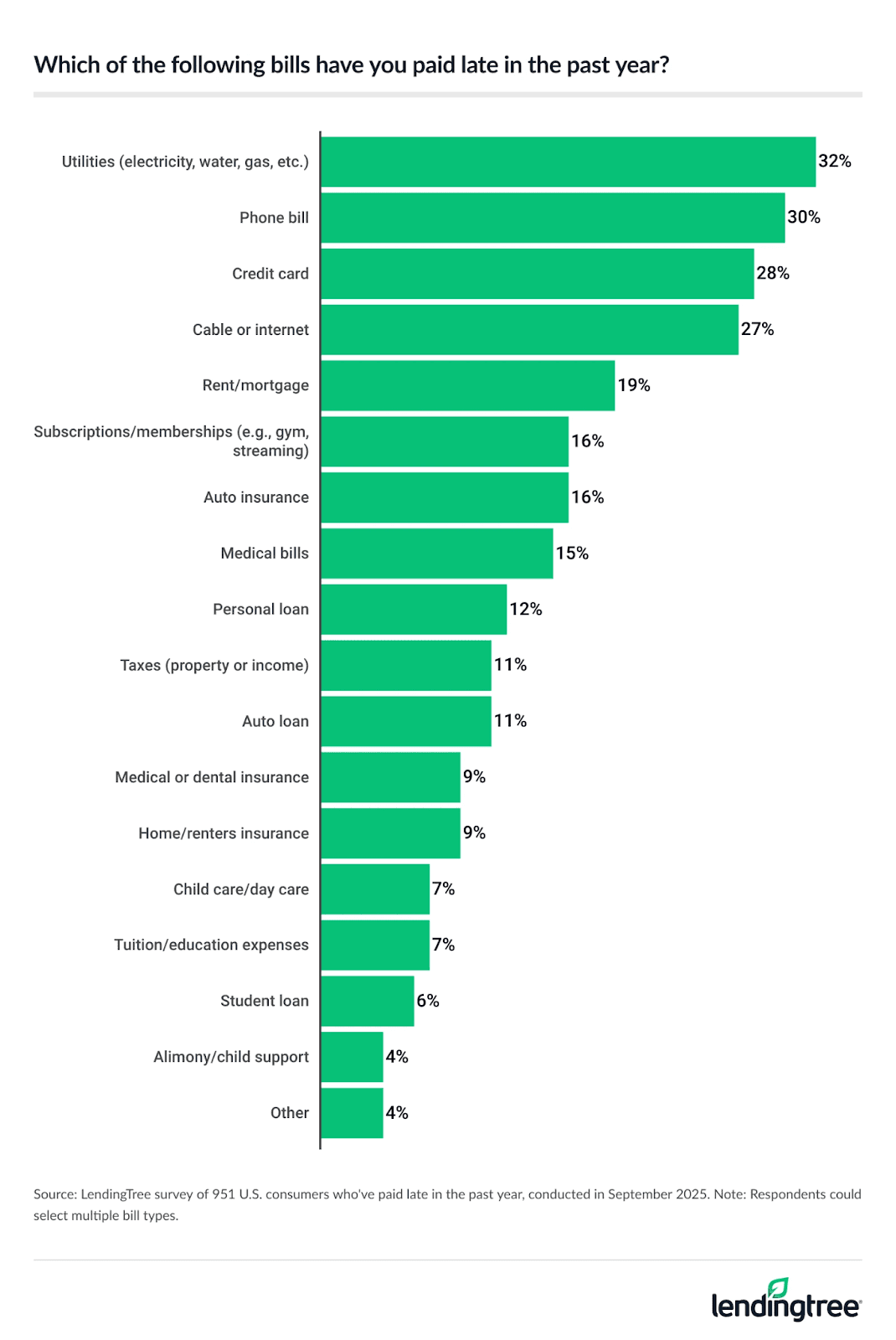

Life happens. Between work, family, and unexpected expenses, it's easy for a payment to slip through the cracks. You're not alone: one in three Americans (33%) paid a bill late in the past three months. Additionally, a recent survey reveals that 72% of Americans are struggling with their bills, with nearly half (48%) admitting to paying a bill late within the past year.

Late payments can significantly impact personal finances. Here’s a look at which bills U.S. consumers are most likely to pay late:

Source: Lending Tree

The financial landscape is challenging. When you miss a payment, consequences ripple through your financial life, affecting your credit score and your ability to secure future loans.

With the right knowledge and strategies, you can recover and rebuild your credit stronger than before. In this article, we'll break down what happens when you miss a payment, how long a late payment on your credit report affects your credit, and actionable steps to get back on track.

Key Takeaways

Late payments under 30 days typically won't be reported, but after 30 days, your late payment on your credit report can significantly impact your score.

Payment history accounts for 40% of VantageScore and 35% of FICO scores, making on-time payments critical for credit health.

A late payment on a credit report stays for seven years, but loses impact as you build positive payment history.

Recovery is possible through consistent on-time payments, AutoPay, and requesting goodwill adjustments from lenders.

Strong credit habits like emergency funds and payment reminders prevent future late payments.

What Happens When You Miss A Payment?

Missing a payment isn't always an immediate disaster, but understanding the timeline and consequences helps you act quickly. Here's what unfolds when you can't make a payment by the due date.

The First Few Days: Grace Period Territory

When you miss your due date by just a few days, you're usually still in safe territory. Most creditors charge a late fee that appears on your next statement, but they won't immediately report the late payment to credit bureaus. This grace period is your window of opportunity to make things right without lasting damage to your credit.

What typically happens:

Your credit card issuer charges a late fee (often $25 to $40)

You may receive reminder emails or texts

Your account remains in good standing with credit bureaus

The key here is speed. Receiving the payment within the first couple of weeks can prevent the situation from escalating, even if you still owe the late fee.

At Arro, we understand that life happens, so we offer a unique 5-day grace period after your due date. Pay within those 5 days, and we’ll refund your late fee – no other lender does this. While we always recommend staying on track with your payments, we’ve got your back when you need just a little extra time.

The 30-Day Mark: When Things Get Serious

Once you're 30 days past due, the stakes change dramatically. This is when creditors typically report your late payment on your credit report to the three major credit bureaus (Equifax, Experian, and TransUnion). This reporting can trigger a cascade of consequences that affect your finances for years.

At this stage, you may experience:

A significant drop in your credit score

The late payment appears on all three credit reports

Potential penalty APR on your credit card (sometimes as high as 29.99%)

Loss of promotional interest rates or introductory offers

Understanding ‘how long does a missed payment affect credit score?’ becomes crucial at this point. The impact will be most severe initially, but it gradually lessens as you demonstrate responsible payment behavior.

Beyond 60 And 90 Days: Escalating Consequences

The longer a payment remains unpaid, the worse the situation becomes. Payments that are 60 or 90 days late are reported separately and carry a heavier weight in credit scoring models. Some reports indicate that a 90-day late payment can hurt your credit score more than a 30-day late payment.

At this stage:

Your credit score continues to decline

The account may be flagged for default

Collection agencies may get involved

You risk having the account closed by the creditor

Approximately 28% of adults expect their financial situation to be worse in a year, suggesting many households are concerned about meeting financial obligations. This makes understanding and preventing late payments even more critical in today's economic climate.

Why Do Late Payments Affect Your Credit Score?

Your credit score is a snapshot of your reliability as a borrower. When lenders look at your score, they're essentially asking: "Can we trust this person to pay us back?" A late payment on a credit report sends a clear signal that you may have trouble managing debt, which makes lenders nervous about the risk they're taking.

Understanding How Long Late Payments Affect Credit Score

The duration and severity of impact depend on several factors:

Your starting credit score: Someone with an excellent credit score (750+) may see a more dramatic drop from a single late payment than someone with a fair score (600 to 650). This seems counterintuitive, but it's because higher scores have more room to fall, and the late payment represents a bigger departure from established responsible behavior.

How late the payment was: A payment that's 30 days late impacts your score differently than one that's 60 or 90 days late. The longer the delinquency, the more severe the consequences.

Your overall credit history: If you have a long history of on-time payments and this is your first slip-up, the impact may be less severe than if you have multiple late payments on your record. Lenders understand that everyone makes mistakes occasionally.

The impact of a late payment on a credit report isn't permanent or unchangeable. As time passes and you continue making on-time payments, your score gradually recovers. Most scoring models place greater emphasis on recent payment behavior, meaning your most recent actions matter more than past mistakes.

How Long Does A Late Payment Stay On Your Credit Report?

Here's the truth: a late payment on a credit report can stick around for up to seven years from the date of the delinquency. Yes, seven years. But before you panic, understand that this doesn't mean seven years of credit score devastation. The impact of that late payment diminishes significantly over time.

The Seven-Year Timeline: What It Really Means

It's important to distinguish between how long it remains visible and how long it actively damages your score. The late payment will appear on your credit report for seven years, but its influence on your score decreases considerably as the months and years pass.

Here's how the timeline typically works:

Year 1: The impact is most severe immediately after the late payment is reported

Years 2 to 3: The negative effect begins to moderate, especially if you've maintained consistent on-time payments since

Years 4 to 7: The late payment becomes "stale" in the eyes of credit scoring models, having minimal impact on your score, though it's still visible to lenders reviewing your full credit report

Lenders and credit scoring models pay far more attention to your recent payment history than to issues that occurred years ago. This is why consistent, responsible behavior after a late payment is so crucial. You're essentially building new evidence of creditworthiness that outweighs the old mistake.

Can You Remove A Late Payment Earlier?

In most cases, accurate late payments will remain on your report for the full seven-year period. However, there are a few scenarios where you might get a late payment removed earlier:

If it's inaccurate: Errors do happen. If a late payment was reported in error, you have the right to dispute it with the credit bureaus.

Goodwill adjustments: If this is your first late payment and you have an otherwise excellent payment history, some creditors may remove the late payment as a courtesy (we'll cover this strategy in detail later).

Pay-for-delete agreements: In some cases, with collection accounts, you may be able to negotiate removal in exchange for payment, though this is becoming less common.

Understanding how long late payments affect a credit score helps you set realistic expectations for your credit recovery timeline. While the late payment may linger on your report for years, its practical impact on your ability to get approved for credit diminishes much sooner if you stay on track with your payments going forward.

The Real Impact: How Missing Payments Affects Your Financial Future

A late payment on a credit report sends ripples through your entire financial life. Understanding these broader consequences helps you grasp why promptly preventing and addressing late payments is crucial to your long-term financial health.

Your Credit Score: The Immediate Hit

The most immediate and obvious consequence is the drop in your credit score. The exact point loss depends on several factors, but it can be substantial. Someone with a previously excellent score might see a drop of 100 points or more from a single 30-day late payment, while someone with an already challenged credit history might experience a smaller numerical decline.

Difficulty Getting Approved For New Credit

When you apply for new credit, lenders review your entire credit report. A late payment on your credit report, even if it's a few years old, raises red flags. Lenders may view you as a higher-risk borrower, which can result in:

Outright denials for credit applications

Approval, but with lower credit limits

Requirement for higher down payments on loans

Need for a cosigner to secure approval

Loss of eligibility for premium credit products with the best rewards

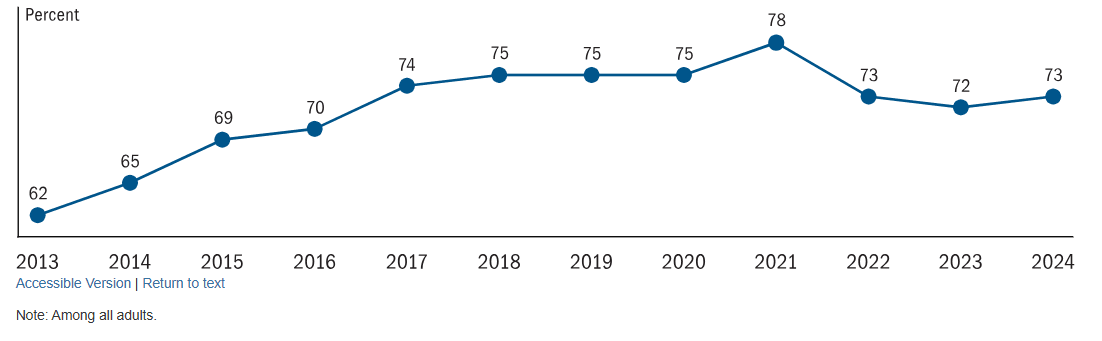

Source: The Fed

This is particularly challenging given that 73% of adults reported "doing okay" financially or "living comfortably," down from 78% in 2021, indicating that economic pressures are real and many people need access to credit to manage expenses.

The Cumulative Effect On Your Financial Options

The consequences extend beyond just credit cards and loans:

Housing: Landlords often check credit reports. A history of late payments might make it harder to rent an apartment or require a larger security deposit.

Employment: While less common, some employers in certain industries check credit reports as part of the hiring process, particularly for positions involving financial responsibility.

Insurance rates: In many states, insurers use credit-based insurance scores to set premiums. Poor credit can lead to higher rates on auto and homeowners insurance.

Utility deposits: Utility companies may require larger deposits from customers with late payments on their credit reports.

A late payment on a credit report affects far more than just your ability to borrow money. It touches nearly every aspect of your financial life, which is why addressing payment issues quickly and building strong payment habits is so essential for your overall financial well-being.

Strategies To Recover From A Late Payment On A Credit Report

With the right strategies and consistent effort, you can bounce back from a late payment and rebuild your credit stronger than before. Let's explore the most effective approaches to recovery.

Act Immediately: Make The Payment As Soon As Possible

The very first step is the most obvious but also the most critical: make the payment right away. The longer a payment remains outstanding, the greater the damage. Even if you're already past the 30-day mark and the late payment has been reported, paying it immediately stops the clock from ticking toward 60 or 90 days late, which would cause even more severe damage.

Why immediate action matters:

Prevents the late payment from becoming more delinquent

Shows the lender you're taking responsibility

Stops additional late fees from accumulating

Demonstrates to credit bureaus that you're addressing the issue

If you can't make the full payment right away, contact your lender. Many are willing to work with customers who communicate proactively about financial difficulties.

For Arro Cardholders: Take Action On Your Overdue Balance

If you're an Arro cardholder with an overdue balance, taking action now is essential to protect your credit and restore your account to good standing. Here's what you need to know:

Clear your overdue balance with Arro to get your credit on track. Even if you've fallen behind, addressing it quickly minimizes the long-term impact on your credit score.

You don't need to pay the full balance; only the overdue portion is due. Focus on bringing your account current by paying the past-due amount. This stops additional late fees and prevents further credit damage.

Get in good standing with your credit this year. Starting fresh with on-time payments from now on helps you rebuild a positive payment history. Every month you stay current adds strength to your credit profile.

If you're having trouble making your payment, reach out to support@arrofinance.com. The sooner you communicate, the more options we can explore together.

Set Up Automatic Payments For The Future

One of the most effective ways to prevent future late payments while you're rebuilding is to set up automatic payments. Most credit cards and loan servicers offer AutoPay options that can be customized to your needs.

Autopay options typically include:

Minimum payment due

Fixed amount of your choosing

Full statement balance

Pro tip: If you're concerned about overdrafts, set up AutoPay for the minimum payment, then make additional manual payments throughout the month to pay down your balance faster. This ensures you never miss a payment while giving you flexibility to pay more when you can.

Build New Positive Payment History

Every month of on-time payments adds positive information to your credit report, gradually outweighing that late payment. Credit scoring models place the most emphasis on recent payment history, so as you stack up months and years of on-time payments, the impact of that earlier late payment on your credit report diminishes.

Recovery isn't instant, but it is inevitable if you stay consistent. Many people see noticeable improvement in their credit scores within 6 to 12 months of establishing a positive payment pattern, even with a late payment still on their report.

How To Avoid Future Late Payments

Prevention is always easier than recovery. While we've covered how to bounce back from a late payment on a credit report, the best strategy is to never have to deal with one in the first place. Here are practical, actionable steps to ensure you never miss a payment again.

Automate Everything You Can

We've mentioned this before, but it bears repeating: automation is your best ally for on-time payments. In today's digital world, almost every bill can be set up for automatic payment.

What to automate:

Credit card minimum payments (you can always pay more manually)

Student loan payments

Auto loan or mortgage payments

Rent payments

Utility bills

Insurance premiums

Always monitor your accounts, even with AutoPay enabled. You want to catch any unauthorized charges or billing errors before they drain your account.

Create A Payment Calendar And Reminders

For bills that can't be automated or for those who prefer more hands-on control, a payment calendar is essential. Use whatever system works best for you: a physical planner, your phone's calendar app, or a specialized budgeting app.

Set up your reminder system:

Add all payment due dates to your calendar

Set reminders 5 to 7 days before each due date

Set a second reminder 1 to 2 days before as a backup

Include the payment amount and account information in the calendar entry

Many apps like Google Calendar, Apple Calendar, or budgeting apps like YNAB or Mint can send you push notifications, emails, or text messages to remind you when payments are coming due. The key is finding a system you'll actually use consistently.

Build An Emergency Fund

Life's unexpected expenses are often what trigger late payments in the first place.

Start small and build:

Begin with a goal of $500 to $1,000

Gradually work toward 3 to 6 months of expenses

Keep this money in a separate savings account

Don't touch it except for true emergencies

An emergency fund acts as a buffer against life's surprises, such as car repairs, medical bills, or temporary job loss. With this cushion, an unexpected expense doesn't automatically translate into missed payments or credit damage.

Also read:

Building Credit After Payment Issues

Recovering from a late payment on a credit report is about actively building your credit back up. Even if you have some dings on your credit report, you can still take positive steps to strengthen your credit profile and improve your financial standing.

Understanding The Path Forward

First, let's set realistic expectations. Rebuilding credit isn't an overnight process, but it also doesn't take as long as you might fear. Most people who commit to responsible credit habits see meaningful improvements within 6 to 12 months, with continued progress over the following years.

The key is consistency. Credit scoring models reward sustained responsible behavior, so your goal is to manage your credit accounts steadily and reliably over time.

Keep Existing Accounts Open And Active

One mistake people make after a late payment is closing credit accounts out of frustration or shame. Resist this impulse. Keeping accounts open and in good standing actually helps your credit in several ways.

How to keep accounts healthy:

Make small purchases on cards you don't use regularly

Pay the balance in full each month (use AutoPay!)

Keep cards active so issuers don't close them for inactivity

Never carry a balance on a card just to ‘build credit’, that's a myth that costs you money in interest

If you're worried about overspending on a particular card, put it in a drawer or freeze it in a block of ice (yes, some people actually do this), but don't close the account.

Be Strategic About New Credit Applications

When you're working on credit recovery, the temptation might be to open several new accounts to build a more positive history. Resist this urge. Each new credit application results in a hard inquiry on your credit report, which can temporarily lower your score.

Best practices for new credit:

Wait at least 6 months after a late payment before applying for new credit

Only apply for credit you genuinely need

Space out applications by several months

Consider using prequalification tools that don't impact your score

Be selective; one or two strategic new accounts are better than many

Remember, lenders want to see that you can manage existing credit responsibly before they're eager to extend more. Focus on perfect payment history on your current accounts before seeking new ones.

Take Control Of Your Credit Journey With Arro

Here's what you now know: late payments stay on your credit report for up to seven years, but their impact fades significantly as you build positive payment history. Payment history makes up the largest portion of your credit score, making consistent on-time payments your most powerful tool for credit health. Recovery from a late payment is absolutely possible through automation, strategic credit-building, and patience.

Most importantly, you understand how long a missed payment affects your credit score in practical terms. While the mark remains visible, its influence on your borrowing power diminishes within months if you take the right steps.

Why Choose Arro?

At Arro, we believe building credit shouldn't be confusing, expensive, or out of reach. That's why we've created a credit card that supports you in learning, earning, and building credit, all seamlessly integrated within a single app.

What makes Arro different:

No hard credit checks, no deposit: We've removed the traditional barriers that keep people from accessing credit-building tools.

1% cashback on gas & groceries: Build your credit while getting rewarded for everyday spending.

Artie, your personal AI Money Coach: Get 24/7 answers to your questions, celebrate wins, and receive smart financial guidance tailored to you.

Credit education built in: Learn credit basics through bite-sized lessons that make financial knowledge accessible and actionable.

Automatic payment tracking: Never miss a payment with built-in tools that help you stay on top of your credit obligations.

Thousands of people are already building stronger credit with Arro, and having fun doing it. Our community has completed hundreds of thousands of lessons, earned millions of Arro Points, and seen their credit scores climb an average of 40+ points. You're not just getting a credit card; you're joining a movement of people taking control of their financial futures.

Ready To Start Your Journey? Your credit journey doesn't have to be perfect. It just has to keep moving forward. Let's build that future together.

FAQs

Will My Credit Card Company Warn Me Before Reporting A Late Payment?

Most creditors send payment reminders via email, text, or app notifications before your payment is due. However, once you're 30 days past due, they can report to credit bureaus without additional warning. The best protection is setting up AutoPay and payment alerts in your account settings to catch issues before they escalate.

Can A Late Payment Affect My Other Credit Cards Even If They're With Different Companies?

Yes, indirectly. While the late payment only reports on the account where it occurred, the resulting credit score drop can trigger existing card issuers to review your account and potentially lower your credit limit or increase your interest rate through a practice called "universal default." This is less common now, but still happens with some issuers.

If I Pay Right Before The 30-Day Mark, Will It Still Be Reported?

Generally no. If you make your payment before hitting 30 days late, most creditors won't report it to the bureaus. However, you'll likely still owe late fees, and the payment won't count toward your grace period. The key is getting current before that 30-day threshold to avoid credit reporting consequences.

Does Closing A Credit Card With A Late Payment Remove It From My Report?

No. Closing an account doesn't remove its payment history from your credit report. The late payment will remain visible for seven years, whether the account stays open or closed. In fact, keeping the account open may actually help by maintaining your available credit and length of credit history.

Can I Negotiate My Interest Rate After Making Late Payments?

It's challenging but possible. After reestablishing six months of perfect payment history, you can contact your issuer to request a rate reduction. Some cardholders succeed by explaining their improved financial situation and threatening to transfer balances to competitor cards with better rates. Your leverage depends on your payment track record and credit score improvement.