What Actually Impacts Your Credit Score

Do Subscriptions Build Credit?

Which Bills Can Help Your Credit (And How They Work)

The Truth About Everyday Bills

How To Use Small Bills In A Smart Credit Strategy

Bringing It All Together

FAQs

Have you been paying your bills on time? Great job! But did you know that, in doing so, you may be missing out on an opportunity to build your credit? Many people don’t realize that certain everyday bills can impact their credit score if they’re reported to the credit bureaus.

According to the Pew Research Center, around 83% of adults in the US use streaming services

Most of the services we use every day, Netflix, Spotify, Disney+, don’t automatically show up on your credit report, which leads many people to ask the same question over and over:

The answer is yes… sometimes… but also no… kind of.

Yeah. It’s complicated.

In this article, we’ll unpack, in normal-people language, which small bills help your credit, which don’t, and how to use your subscriptions smarter if you want to build real credit history.

Let’s get into it.

Key Takeaways

Most subscriptions don’t affect your credit unless they’re reported.

Using a credit card is the simplest way to turn subscriptions into real credit activity.

Optional tools like Experian Boost can help, but only in certain situations.

Utilities and rent can help your score, but not automatically.

The question “Do subscriptions build credit?” has a yes-and-no answer.

Smart strategy > hacks. Consistent on-time payments matter most.

What Actually Impacts Your Credit Score

Before we talk about streaming, small bills, or reporting tools, here’s the truth: Your credit score comes from just a few things. And they’re all pretty predictable:

Payment history (35%) – Did you pay on time?

Amounts owed (30%) – How much of your credit line are you using?

Length of credit history (15%) – how long you’ve had accounts

New credit (10%) – recent applications

Credit mix (10%) – types of credit you use

That’s it. No mystery. And this is where the question “Do subscriptions build credit?” gets tricky. Subscriptions might help, but only if the credit bureaus actually see the payments. And most of the time, they don’t.

Do Subscriptions Build Credit?

Short version? No, not by default.

Netflix does not report your payments. Spotify does not report your payments. Even your gym doesn’t report your payments. But there are two ways subscriptions can indirectly help:

1. If You Pay With A Credit Card

Using a credit card creates a real, reportable trail. Even if Spotify never reports a thing, your credit card does. Every month, your card issuer sends the bureaus:

How much credit did you use

Whether you paid on time

Your balance

How long have you had the card

That’s why many people put 1–3 small subscriptions (like Spotify + iCloud) on a card: predictable, low-cost, and easy to pay off. It’s the simplest way to turn everyday bills into real credit history.

Final note: The subscription itself doesn’t build credit; your credit card payment does.

2. If You Use A Reporting Tool

There are third-party services that let you add specific bills, such as streaming subscriptions, phone payments, or utilities, to your credit file. They work by scanning your bank account for recurring charges and sending that information to participating credit bureaus.

These tools can give beginners a slight nudge, especially if you don’t have much credit history yet. But the impact varies a lot, and not all lenders use the same data, so results aren’t guaranteed. Some months you might see movement, and some months you might not.

Final note: Bill-reporting services can help a little, but they’re not a replacement for building credit through real tradelines that report consistently every month.

That’s why the question “do subscriptions build credit” keeps trending; it’s a half-true, half-misunderstood idea. So let’s break down what really counts.

Which Bills Can Help Your Credit (And How They Work)

Here’s the part most people wish someone had explained earlier in life.

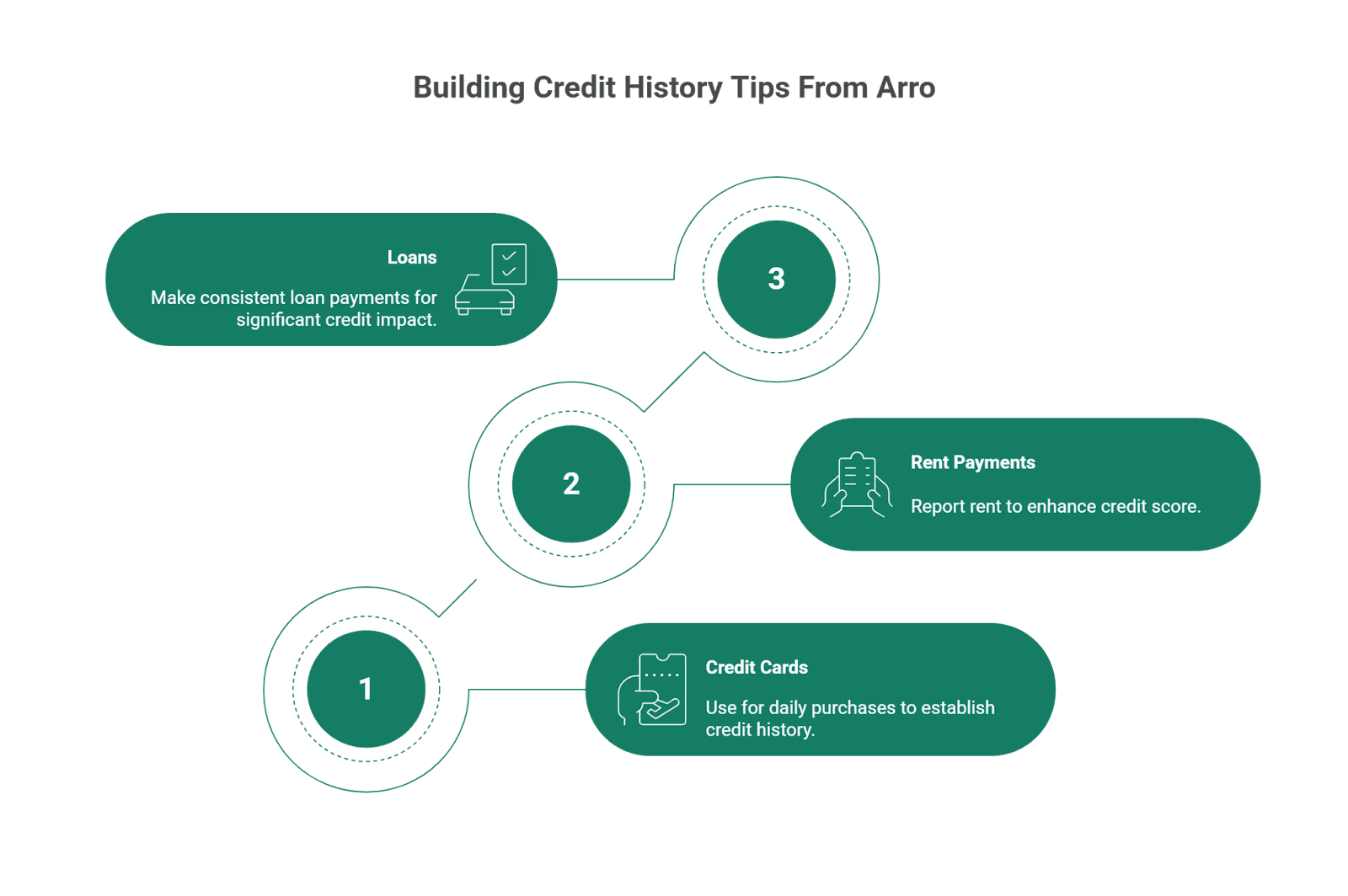

1. Credit Cards (Your #1 Credit Builder)

Any time you use a credit card, whether it’s for groceries, gas, or a Crunchyroll binge, the card issuer reports your activity. According to TransUnion, around 84% of credit-active Gen Z consumers (ages 22-24) prefer it because it’s the most reliable way to generate a monthly payment history.

Credit cards matter because they’re designed to be reported every single month, and small purchases still count.

2. Rent Payments

Rent can help your credit if it’s reported. The Wall Street Journal notes that more than 100 million Americans rent, yet only a tiny percentage of landlords automatically report payments.

You can add rent history if:

Your landlord uses a reporting service.

You sign up for a third-party reporting tool.

Rent is powerful, but only if someone actually sends your payment history to the bureaus.

3. Loans (Student, Auto, Personal)

Loan payments are automatically reported, always. This includes car payments, student loans, and personal loans. These create strong tradelines because they show long-term payment reliability.

According to the New York Times, 43 million Americans hold student loans, making them one of the most common sources of early credit history.

Loans always count and carry more weight than subscription reporting.

The Truth About Everyday Bills

A lot of people assume their everyday subscriptions are secretly helping their credit in the background, and honestly, it feels like they should, right? You pay them every month, you never miss a beat. It seems only fair that your credit score would give you a little high-five for that consistency. But the reality doesn’t quite work that way, and it’s why so many people end up asking, “Do subscriptions build credit?” in the first place.

There are plenty of bills that never show up on your credit report at all. Your go-to streaming apps, Hulu, Disney+, and Spotify, don’t report your payments. Gym memberships don’t report. Food delivery passes like Uber One, or DashPass, don’t report. Amazon Prime doesn’t report. Insurance premiums don’t report either. Even Buy Now Pay Later payments stay completely invisible unless the lender decides to report them, which isn’t common. You could be perfect with these bills for years, and your credit score would have no idea.

Then we get into bill-reporting tools, which is where the internet gets tangled. These services scan your bank account for predictable monthly charges, things like streaming subscriptions, phone bills, utilities, and add whatever they recognize to your credit file. And since Nielsen says the average American has four or more streaming subscriptions, these services usually find something. But even when they do, the impact is still pretty light. They’re helpful as a small boost, sure, just not something to rely on as your main credit-building plan.

How To Use Small Bills In A Smart Credit Strategy

Small bills might feel insignificant on their own, but used the right way, they can make your credit-building routine feel smoother and way less intimidating. Think of this as a simple starter plan, nothing extreme, nothing stressful, just a few easy habits that stack up over time.

1. Put 1–3 Predictable Subscriptions On Your Credit Card

Pick the bills you barely think about, Spotify, Amazon Prime, Netflix, whatever you know hits the same number every month. These tiny, steady charges help you build a clean payment history without letting things spiral. You’re not suddenly putting your whole budget on a card; you’re just giving yourself a small, reliable way to show consistency. Small, predictable bills take the pressure off and keep the process manageable.

2. Turn On Auto Pay For Your Credit Card

AutoPay isn’t fancy, but it’s one of the easiest guardrails you can set up. It keeps you from accidentally missing a due date, which matters a lot because late payments are one of the most common reasons credit scores drop. Even covering just the minimum automatically creates a buffer while you pay the rest manually. Stability always beats scrambling; it’s about protecting your progress.

3. Keep Your Card Balance Low

Hint: keep your credit card balance at 30% or less of your total available credit limit. You don’t need to use much of your credit limit for the account to help your score. In fact, keeping your usage on the lower side looks healthier to lenders because it shows you’re not relying heavily on credit to get by. A few small charges plus a full monthly payoff keep everything predictable and straightforward. Low usage paired with on-time payments creates a steady upward path for your score.

4. Add Optional Reporting, If It’s Easy

Some landlords and utility providers offer reporting for free or with minimal effort on your part. If it’s already available and doesn’t add extra work, go for it. But don’t feel pressured to sign up for complicated systems or pay extra fees just to get those bills reported. If it fits smoothly into your life, great. If not, you’re not missing a deal-breaker.

5. Use A Tool That Guides You Along The Way

A lot of beginners get stuck not because they’re doing something wrong, but because credit feels like a mystery. Knowing what to do is one thing; remembering it, sticking to it, and not second-guessing yourself is the more challenging part. That’s why having a tool like Arro helps so much; it gives you structure, reminders, encouragement, and a clear sense of direction. You’re not left to figure everything out on your own. Good guidance makes the whole journey feel lighter and far less overwhelming.

Also Read:

Arro Credit Card: Increase Your Odds of Passing Tenant Credit Checks

Credit Builder Card: Your Complete Guide to Building Credit the Smart Way

Bringing It All Together

If there’s one message to take away, it’s this: most everyday bills, streaming services, subscriptions, and gym memberships don’t build credit on their own.

You don’t need hacks or TikTok loopholes. You just need simple habits, clear guidance, and a tool that actually supports your credit-building journey.

And that’s where Arro comes in.

At Arro, we believe building credit shouldn’t be confusing, expensive, or reserved for people who already have great credit. We built a card that helps you learn, earn, and grow, all inside a simple, friendly app. No hard credit checks, no deposits, and yes, you even get 1% cashback on gas and groceries.

You’ll also meet Artie, your AI Money Coach, who’s there 24/7 with tips, explanations, reminders, and plenty of encouragement. Every on-time payment, every lesson, every streak helps you unlock higher limits and better credit health.

Thousands of people are already building stronger credit with Arro and actually enjoying the process.

Ready to start your own journey? See how easy credit building can feel when you have the right support.

FAQs

1. Do I need to carry a balance on my credit card to build credit?

Nope, that’s a common myth. You never have to carry a balance or pay interest to build credit. Paying your card in full every month still builds payment history, which is the most significant part of your score. Think consistency, not debt, that’s what really counts.

2. Will closing a streaming service or subscription hurt my credit score?

Canceling a subscription doesn’t affect your credit score. Those services don’t report to the credit bureaus, so changing or deleting them won’t move your score up or down. The only thing that matters is how you pay the credit card or account tied to it.

3. Can free trials or temporary subscriptions affect my credit?

Free trials don’t influence your credit score, even if you enter a payment method. The only time they matter is if the charge goes through on a credit card and you forget to pay the card on time. It’s the missed credit card payment, not the trial, that would hurt.

4. If my roommate pays me back for shared bills, does that help my credit?

Unfortunately, no. Splitting bills is great for budgeting, but credit scores only look at the account holder’s payment history. If a bill is under your name, only your payments count. If it’s under theirs, only they get the credit. Credit files aren’t “shareable.”

5. Does switching banks or debit cards affect my credit score?

Switching banks or debit cards won’t affect your credit score because neither is part of your credit report. The only thing to watch out for is making sure your automatic payments transfer correctly. A missed payment on a credit account, not the bank change, can cause issues.